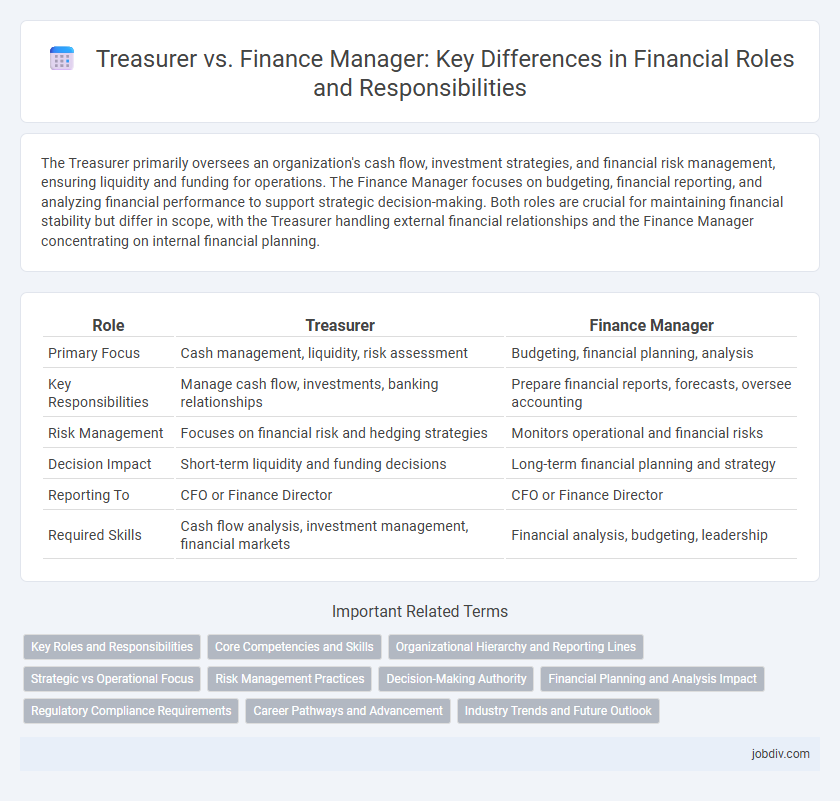

The Treasurer primarily oversees an organization's cash flow, investment strategies, and financial risk management, ensuring liquidity and funding for operations. The Finance Manager focuses on budgeting, financial reporting, and analyzing financial performance to support strategic decision-making. Both roles are crucial for maintaining financial stability but differ in scope, with the Treasurer handling external financial relationships and the Finance Manager concentrating on internal financial planning.

Table of Comparison

| Role | Treasurer | Finance Manager |

|---|---|---|

| Primary Focus | Cash management, liquidity, risk assessment | Budgeting, financial planning, analysis |

| Key Responsibilities | Manage cash flow, investments, banking relationships | Prepare financial reports, forecasts, oversee accounting |

| Risk Management | Focuses on financial risk and hedging strategies | Monitors operational and financial risks |

| Decision Impact | Short-term liquidity and funding decisions | Long-term financial planning and strategy |

| Reporting To | CFO or Finance Director | CFO or Finance Director |

| Required Skills | Cash flow analysis, investment management, financial markets | Financial analysis, budgeting, leadership |

Key Roles and Responsibilities

The Treasurer primarily manages an organization's liquidity, investments, and risk related to cash flow and capital structure, ensuring optimal cash availability and funding strategies. The Finance Manager oversees budgeting, financial reporting, and analysis, driving financial planning and internal controls to support business decisions. Both roles collaborate closely to maintain financial stability, but the Treasurer's focus lies in external financing and risk management, while the Finance Manager emphasizes internal finance operations and performance monitoring.

Core Competencies and Skills

A Treasurer specializes in cash flow management, risk assessment, and investment strategies to ensure optimal liquidity and financial stability, focusing on capital structure and funding. In contrast, a Finance Manager oversees budgeting, financial reporting, and performance analysis, emphasizing cost control and financial planning. Both roles require strong analytical skills, expertise in financial software, and knowledge of regulatory compliance, but Treasurers demand deeper proficiency in treasury functions and market instruments.

Organizational Hierarchy and Reporting Lines

The Treasurer typically occupies a senior position within the organizational hierarchy, responsible for managing the company's liquidity, investments, and risk management strategies, often reporting directly to the CFO or CEO. The Finance Manager usually operates at a mid-level management tier, overseeing day-to-day financial operations, budgeting, and internal financial controls, and reports to the Treasurer or Finance Director. Clear delineation of reporting lines ensures effective financial governance and strategic alignment in corporate finance structures.

Strategic vs Operational Focus

Treasurers primarily handle strategic financial planning, managing liquidity, investments, and risk to ensure long-term financial stability and value creation. Finance Managers focus on operational tasks such as budgeting, financial reporting, and cost control to maintain efficient day-to-day financial management. The Treasurer's role aligns with high-level capital structure decisions, while the Finance Manager supports internal financial processes and compliance.

Risk Management Practices

Treasurers focus on liquidity risk and currency exposure, implementing hedging strategies to protect cash flow and investments. Finance Managers oversee broader financial risk, including credit risk, market risk, and operational risk, by developing risk assessment frameworks and internal controls. Both roles collaborate to ensure comprehensive enterprise risk management aligned with corporate financial goals.

Decision-Making Authority

A Treasurer typically holds decision-making authority over corporate liquidity, investment strategies, and risk management policies, ensuring optimal cash flow and financial stability. Finance Managers focus on budgeting, financial reporting, and expense control, driving decisions that affect operational cost efficiency and financial planning. The Treasurer's strategic decisions impact long-term capital structure, while the Finance Manager's choices influence day-to-day financial performance.

Financial Planning and Analysis Impact

A Treasurer primarily manages cash flow, risk assessment, and liquidity to ensure organizational financial stability, while a Finance Manager concentrates on financial planning and analysis (FP&A) by forecasting budgets, analyzing financial data, and guiding strategic investment decisions. Effective FP&A led by Finance Managers drives profitability through detailed variance analysis and scenario planning, directly impacting resource allocation and performance metrics. Treasurers support these efforts by optimizing capital structure and managing funding costs, creating a financial environment conducive to meeting the company's long-term financial goals.

Regulatory Compliance Requirements

Treasurers primarily ensure that a company's cash management and investment activities comply with financial regulations such as SEC rules, Sarbanes-Oxley Act, and anti-money laundering laws to minimize legal risks. Finance Managers focus on broader financial reporting and internal controls, aligning compliance with GAAP, IFRS standards, and tax codes to support accurate financial disclosures. Both roles require ongoing monitoring of regulatory changes and implementation of controls to uphold corporate governance and avoid penalties.

Career Pathways and Advancement

Treasurers typically focus on cash management, investment strategies, and risk assessment, preparing them for senior roles like Chief Financial Officer (CFO) or Director of Treasury. Finance Managers oversee budgeting, financial reporting, and strategic planning, positioning themselves for advancement into finance director or corporate controller positions. Both roles require strong analytical skills and offer distinct pathways to executive leadership within financial departments.

Industry Trends and Future Outlook

Treasurers increasingly leverage advanced analytics and blockchain technology to enhance cash flow management and risk mitigation, reflecting a shift towards strategic financial stewardship. Finance managers are adopting integrated financial planning software and AI-driven forecasting tools to improve budgeting accuracy and operational efficiency. Industry trends indicate growing collaboration between treasurers and finance managers to drive agile decision-making and resilient financial strategies amid evolving market conditions.

Treasurer vs Finance Manager Infographic

jobdiv.com

jobdiv.com