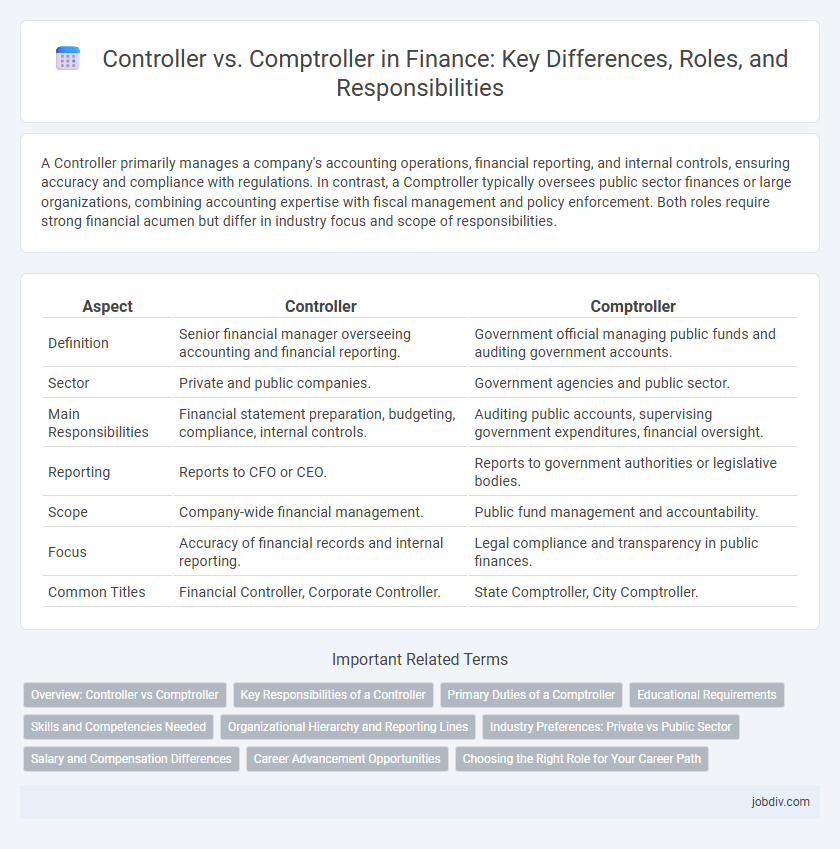

A Controller primarily manages a company's accounting operations, financial reporting, and internal controls, ensuring accuracy and compliance with regulations. In contrast, a Comptroller typically oversees public sector finances or large organizations, combining accounting expertise with fiscal management and policy enforcement. Both roles require strong financial acumen but differ in industry focus and scope of responsibilities.

Table of Comparison

| Aspect | Controller | Comptroller |

|---|---|---|

| Definition | Senior financial manager overseeing accounting and financial reporting. | Government official managing public funds and auditing government accounts. |

| Sector | Private and public companies. | Government agencies and public sector. |

| Main Responsibilities | Financial statement preparation, budgeting, compliance, internal controls. | Auditing public accounts, supervising government expenditures, financial oversight. |

| Reporting | Reports to CFO or CEO. | Reports to government authorities or legislative bodies. |

| Scope | Company-wide financial management. | Public fund management and accountability. |

| Focus | Accuracy of financial records and internal reporting. | Legal compliance and transparency in public finances. |

| Common Titles | Financial Controller, Corporate Controller. | State Comptroller, City Comptroller. |

Overview: Controller vs Comptroller

A Controller oversees the financial reporting, budgeting, and accounting operations within private corporations, ensuring compliance with accounting standards and internal controls. A Comptroller typically serves in government agencies or nonprofit organizations, managing public funds, auditing, and fiscal policy implementation. Both roles require expertise in financial management, but Controllers focus on corporate financial strategy while Comptrollers emphasize regulatory compliance and governmental accountability.

Key Responsibilities of a Controller

A Controller oversees a company's financial reporting, budgeting, and internal controls to ensure accuracy and regulatory compliance. They manage accounting teams, prepare financial statements, and analyze financial data to support strategic decision-making. Controllers also coordinate audits and implement financial policies to optimize cost control and reporting efficiency.

Primary Duties of a Comptroller

The comptroller primarily oversees financial reporting, budgeting, and internal controls to ensure compliance with regulations and accurate financial management. They are responsible for auditing financial statements, managing risk assessment, and supervising accounting processes within public or private organizations. Their role includes ensuring transparency and accountability in fiscal operations to support strategic financial planning and governance.

Educational Requirements

Controllers typically require a bachelor's degree in accounting, finance, or business administration, with many employers preferring a Certified Public Accountant (CPA) certification. Comptrollers often hold similar degrees but may have additional qualifications related to government finance or public administration, reflecting their focus on public sector accountability. Both roles benefit from advanced degrees such as an MBA or a master's in finance to enhance expertise and career advancement opportunities.

Skills and Competencies Needed

Controllers require strong expertise in financial reporting, budgeting, and regulatory compliance, with advanced skills in accounting principles and software proficiency. Comptrollers need comprehensive knowledge of auditing, risk management, and internal controls, emphasizing governmental or nonprofit sector regulations and strategic oversight capabilities. Both roles demand analytical thinking, leadership, and effective communication to manage financial operations and guide organizational decision-making.

Organizational Hierarchy and Reporting Lines

In organizational hierarchy, the controller typically reports directly to the chief financial officer (CFO) and oversees financial reporting, budgeting, and internal controls. The comptroller often holds a similar role but is more common in government or non-profit sectors, reporting to higher administrative authorities such as city managers or executive directors. Both positions manage accounting functions, but the controller's reporting lines are primarily within corporate finance, while the comptroller's role includes compliance with public sector regulations.

Industry Preferences: Private vs Public Sector

Controllers predominantly manage financial reporting and internal controls within private sector companies, ensuring compliance with corporate governance and shareholder requirements. Comptrollers are more common in the public sector, overseeing government funds, budgets, and audits to ensure accountability and regulatory adherence. Industry preferences reflect these roles, with private firms valuing controllers for profitability and efficiency, while public institutions rely on comptrollers for transparency and public accountability.

Salary and Compensation Differences

Controllers typically earn between $85,000 and $130,000 annually, reflecting their focus on company financial management and reporting. Comptrollers, often positioned in government or non-profit sectors, have salaries ranging from $70,000 to $110,000, with compensation influenced by public funding and regional budgets. Salary differences arise from sectors served, organizational size, and specific responsibilities tied to financial oversight and compliance.

Career Advancement Opportunities

Controllers typically oversee financial reporting, budgeting, and internal controls, providing a solid foundation for advancing into senior finance roles such as CFO or VP of Finance. Comptrollers, often found in government or nonprofit sectors, manage regulatory compliance and fiduciary responsibilities, positioning them for leadership in public administration or finance departments. Both roles offer distinct career advancement paths driven by industry demands and organizational structure.

Choosing the Right Role for Your Career Path

Selecting between a Controller and a Comptroller role depends on your career goals and industry focus, with Controllers typically managing corporate financial operations and Comptrollers often serving in government or nonprofit sectors overseeing public funds. Controllers engage in budgeting, financial reporting, and internal controls to drive corporate strategy, while Comptrollers focus on compliance, audit functions, and fiscal accountability in public administration. Understanding the distinct responsibilities, sector demands, and required certifications, such as CPA for Controllers or CGFM for Comptrollers, is crucial to aligning your skills and ambitions with the right finance leadership position.

Controller vs Comptroller Infographic

jobdiv.com

jobdiv.com