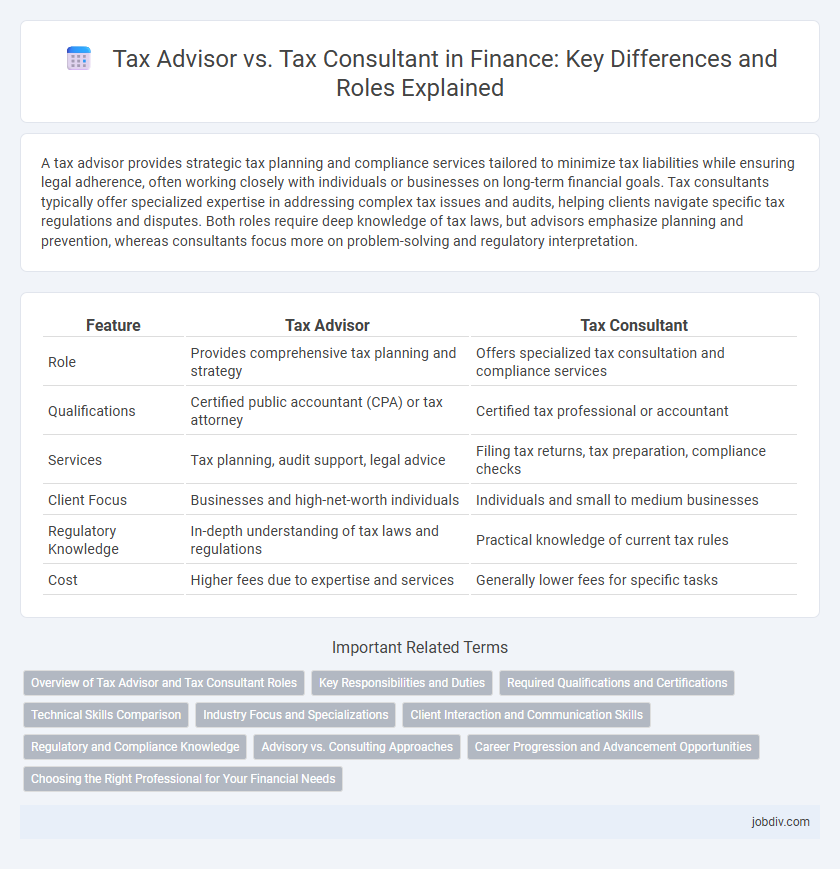

A tax advisor provides strategic tax planning and compliance services tailored to minimize tax liabilities while ensuring legal adherence, often working closely with individuals or businesses on long-term financial goals. Tax consultants typically offer specialized expertise in addressing complex tax issues and audits, helping clients navigate specific tax regulations and disputes. Both roles require deep knowledge of tax laws, but advisors emphasize planning and prevention, whereas consultants focus more on problem-solving and regulatory interpretation.

Table of Comparison

| Feature | Tax Advisor | Tax Consultant |

|---|---|---|

| Role | Provides comprehensive tax planning and strategy | Offers specialized tax consultation and compliance services |

| Qualifications | Certified public accountant (CPA) or tax attorney | Certified tax professional or accountant |

| Services | Tax planning, audit support, legal advice | Filing tax returns, tax preparation, compliance checks |

| Client Focus | Businesses and high-net-worth individuals | Individuals and small to medium businesses |

| Regulatory Knowledge | In-depth understanding of tax laws and regulations | Practical knowledge of current tax rules |

| Cost | Higher fees due to expertise and services | Generally lower fees for specific tasks |

Overview of Tax Advisor and Tax Consultant Roles

Tax advisors specialize in providing strategic tax planning, compliance guidance, and representation before tax authorities for individuals and businesses, ensuring optimal tax savings and legal adherence. Tax consultants primarily focus on detailed tax return preparation, assessing financial records, and offering recommendations on tax liabilities and credits to maximize client benefits. Both roles require strong knowledge of tax laws and regulations but differ in scope, with advisors emphasizing strategy and consultants focusing on execution and compliance.

Key Responsibilities and Duties

Tax advisors primarily focus on offering strategic tax planning, compliance guidance, and minimizing tax liabilities for individuals and businesses by interpreting tax laws and regulations. Tax consultants specialize in providing detailed tax return preparation, audit support, and resolving tax disputes with tax authorities to ensure accurate reporting and adherence to tax codes. Both roles require expertise in tax legislation, but tax advisors emphasize proactive tax strategy, while tax consultants concentrate on practical tax problem-solving and filings.

Required Qualifications and Certifications

Tax advisors typically require formal qualifications such as a Certified Public Accountant (CPA) license or a Chartered Tax Advisor (CTA) certification, ensuring expertise in tax laws and regulations. Tax consultants may hold similar credentials but often have broader financial or business qualifications, such as an MBA with a focus on taxation or certification from recognized bodies like the Enrolled Agent (EA) program. Both roles demand continuous professional education to stay updated with evolving tax codes and compliance standards.

Technical Skills Comparison

Tax advisors typically possess advanced technical skills in tax law, regulatory compliance, and strategic tax planning, often holding certifications such as CPA or EA. Tax consultants focus on practical application of tax regulations, specializing in areas like tax returns preparation, audit support, and specific industry tax issues. Both roles require detailed knowledge of tax codes, but advisors tend to engage in higher-level financial analysis and long-term tax strategy development.

Industry Focus and Specializations

Tax advisors often specialize in comprehensive tax planning and compliance for individuals and businesses across diverse industries, leveraging deep expertise in regulatory frameworks and strategic tax reduction. Tax consultants typically focus on specific sectors, such as real estate, healthcare, or international taxation, providing tailored advice on complex transactions and industry-specific tax incentives. Both roles require a thorough understanding of evolving tax laws, but tax consultants emphasize niche market knowledge to optimize tax positions within particular industries.

Client Interaction and Communication Skills

Tax advisors often maintain ongoing client relationships, providing personalized tax planning and continuous support tailored to individual financial situations. Tax consultants typically engage in specific projects or compliance matters, focusing on delivering expert advice based on in-depth analysis rather than prolonged client interaction. Effective communication skills are critical for both roles, with tax advisors emphasizing clarity and trust-building in frequent consultations, while tax consultants prioritize concise, technical explanations suited to project-based engagements.

Regulatory and Compliance Knowledge

Tax advisors possess extensive regulatory and compliance knowledge, enabling them to guide clients through complex tax laws and ensure adherence to government requirements. Tax consultants focus on providing strategic tax planning and optimization while maintaining compliance with current tax regulations. Both roles require up-to-date expertise in tax codes, but tax advisors typically emphasize regulatory interpretation and legal compliance more heavily.

Advisory vs. Consulting Approaches

Tax advisors primarily provide strategic guidance on tax planning and compliance, tailoring solutions to optimize financial outcomes within legal frameworks. Tax consultants focus on analyzing specific tax issues, offering detailed assessments and actionable recommendations for immediate problems. The advisory approach emphasizes long-term tax strategy and risk management, whereas the consulting approach delivers targeted, problem-solving expertise for particular tax challenges.

Career Progression and Advancement Opportunities

Tax advisors often begin their careers by obtaining certifications such as CPA or Enrolled Agent, enabling them to specialize in complex tax planning and compliance, which opens pathways to senior advisory roles or leadership positions within accounting firms. Tax consultants typically gain expertise through diverse client engagements and may advance by developing niche specialties like international tax or transfer pricing, leading to opportunities in consulting firms or corporate tax departments with strategic responsibilities. Both career paths benefit from continuous education and professional networking to progress toward executive roles such as tax director or compliance officer.

Choosing the Right Professional for Your Financial Needs

Tax advisors and tax consultants both specialize in optimizing tax obligations, but tax advisors typically provide strategic financial planning and long-term tax efficiency, while tax consultants often focus on compliance and specific tax issues. Selecting the right professional depends on your financial complexity and goals; tax advisors are ideal for comprehensive tax strategies, whereas tax consultants excel in handling audits, filings, and regulatory requirements. Understanding the distinction ensures personalized service that aligns with your financial needs and maximizes tax benefits.

Tax Advisor vs Tax Consultant Infographic

jobdiv.com

jobdiv.com