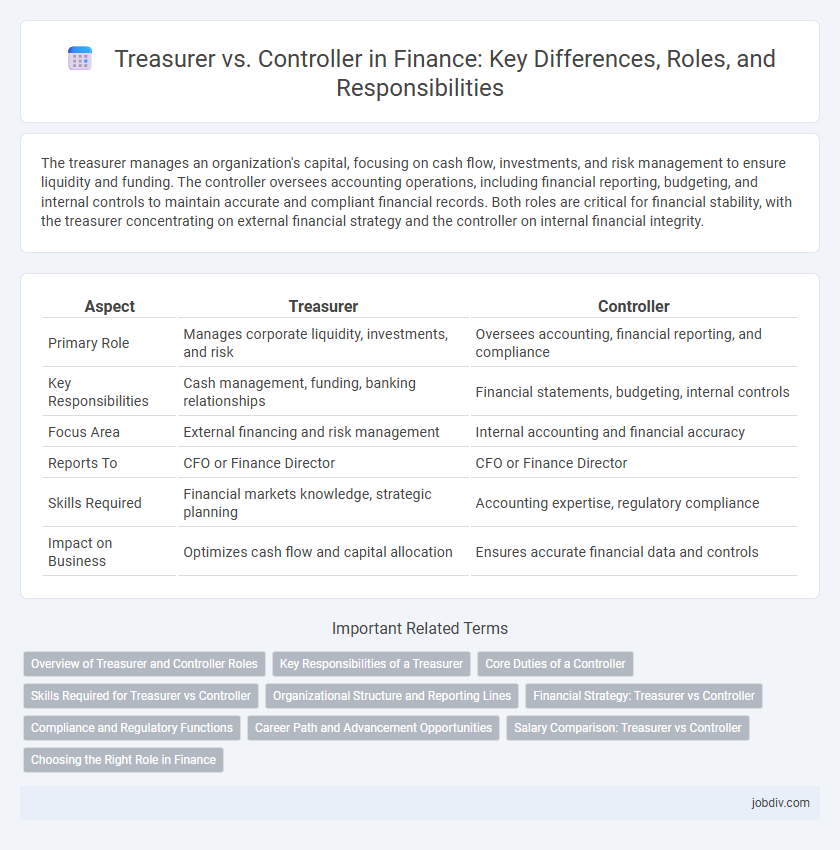

The treasurer manages an organization's capital, focusing on cash flow, investments, and risk management to ensure liquidity and funding. The controller oversees accounting operations, including financial reporting, budgeting, and internal controls to maintain accurate and compliant financial records. Both roles are critical for financial stability, with the treasurer concentrating on external financial strategy and the controller on internal financial integrity.

Table of Comparison

| Aspect | Treasurer | Controller |

|---|---|---|

| Primary Role | Manages corporate liquidity, investments, and risk | Oversees accounting, financial reporting, and compliance |

| Key Responsibilities | Cash management, funding, banking relationships | Financial statements, budgeting, internal controls |

| Focus Area | External financing and risk management | Internal accounting and financial accuracy |

| Reports To | CFO or Finance Director | CFO or Finance Director |

| Skills Required | Financial markets knowledge, strategic planning | Accounting expertise, regulatory compliance |

| Impact on Business | Optimizes cash flow and capital allocation | Ensures accurate financial data and controls |

Overview of Treasurer and Controller Roles

The Treasurer manages an organization's liquidity, funding, and financial risk, overseeing cash flow, investments, and debt issuance to ensure optimal capital structure. The Controller is responsible for accurate financial reporting, internal controls, budgeting, and compliance, maintaining the integrity of accounting processes and financial statements. Both roles are critical for sustaining financial health, with the Treasurer focusing on external financial strategy and the Controller concentrating on internal financial management.

Key Responsibilities of a Treasurer

A Treasurer manages an organization's cash flow, investment strategies, and risk assessment to maintain financial stability and liquidity. They oversee banking relationships, secure funding through debt or equity, and ensure compliance with financial regulations. This role also involves forecasting financial needs and optimizing capital structure to support strategic objectives.

Core Duties of a Controller

The Controller oversees the company's accounting operations, including managing financial statements, ensuring accurate record-keeping, and maintaining compliance with regulatory standards. Responsibilities also involve budgeting, internal auditing, and supervising accounts payable and receivable processes. This role focuses on delivering precise financial reporting and supporting strategic decision-making through detailed analysis of financial data.

Skills Required for Treasurer vs Controller

Treasurers require strong skills in cash management, risk assessment, and investment strategies to optimize liquidity and funding. Controllers must excel in financial reporting, regulatory compliance, and internal controls to ensure accurate accounting and audit readiness. Both roles demand proficiency in financial analysis, but treasurers focus more on external financial interactions, while controllers prioritize internal financial integrity.

Organizational Structure and Reporting Lines

In corporate finance, the Treasurer typically oversees cash management, funding strategies, and risk management, reporting directly to the CFO or CEO. The Controller manages accounting operations, financial reporting, and compliance, usually positioned under the CFO with a focus on internal controls and financial accuracy. Organizational structures often place the Treasurer and Controller as parallel roles with distinct responsibilities, ensuring clear segregation of financial strategy and accounting functions.

Financial Strategy: Treasurer vs Controller

The Treasurer focuses on financial strategy by managing liquidity, capital structure, and investment decisions to ensure optimal cash flow and risk mitigation. The Controller oversees accounting integrity, budget compliance, and financial reporting to maintain accurate records and support strategic planning. Together, they align financial operations with corporate objectives to enhance overall fiscal stability and growth.

Compliance and Regulatory Functions

The Treasurer is responsible for managing the company's liquidity, investments, and risk management, ensuring compliance with financial regulations such as SEC rules and anti-money laundering laws. The Controller oversees the accuracy of financial reporting, internal controls, and adherence to GAAP and Sarbanes-Oxley Act requirements. Both roles collaborate to maintain regulatory compliance, safeguard assets, and provide transparent financial disclosures to stakeholders.

Career Path and Advancement Opportunities

Treasurers typically advance into executive roles such as Chief Financial Officer by focusing on cash management, risk assessment, and investment strategies, while controllers often progress toward senior accounting or finance leadership positions by mastering financial reporting, compliance, and internal controls. Career growth for treasurers involves developing expertise in capital markets and liquidity management, whereas controllers enhance their prospects through proficiency in auditing, regulatory standards, and budgeting. Both paths offer opportunities for leadership in corporate finance but diverge in skill specialization and strategic influence within an organization.

Salary Comparison: Treasurer vs Controller

Treasurers typically earn an average salary between $95,000 and $150,000 annually, reflecting their strategic role in cash management and investment decisions. Controllers usually command slightly higher compensation, ranging from $100,000 to $160,000 annually, due to their responsibilities in overseeing accounting operations and financial reporting. Salary levels for both roles vary significantly based on company size, industry, and geographic location.

Choosing the Right Role in Finance

Selecting the right finance role depends on organizational needs and skill sets, as Treasurers focus on cash flow management, investment strategies, and liquidity optimization, while Controllers emphasize financial reporting, internal controls, and regulatory compliance. Companies prioritizing strategic cash management and risk mitigation benefit from a Treasurer's expertise, whereas those requiring precise accounting practices and audit readiness rely on Controllers. Understanding these distinctions ensures effective financial leadership aligned with corporate goals and operational demands.

Treasurer vs Controller Infographic

jobdiv.com

jobdiv.com