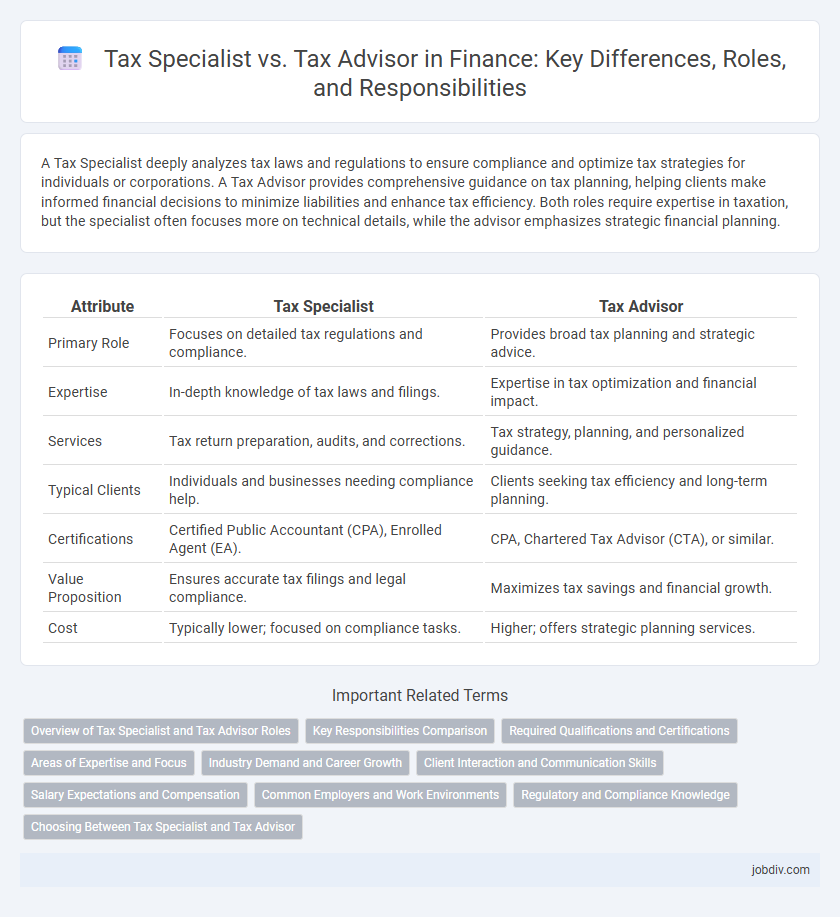

A Tax Specialist deeply analyzes tax laws and regulations to ensure compliance and optimize tax strategies for individuals or corporations. A Tax Advisor provides comprehensive guidance on tax planning, helping clients make informed financial decisions to minimize liabilities and enhance tax efficiency. Both roles require expertise in taxation, but the specialist often focuses more on technical details, while the advisor emphasizes strategic financial planning.

Table of Comparison

| Attribute | Tax Specialist | Tax Advisor |

|---|---|---|

| Primary Role | Focuses on detailed tax regulations and compliance. | Provides broad tax planning and strategic advice. |

| Expertise | In-depth knowledge of tax laws and filings. | Expertise in tax optimization and financial impact. |

| Services | Tax return preparation, audits, and corrections. | Tax strategy, planning, and personalized guidance. |

| Typical Clients | Individuals and businesses needing compliance help. | Clients seeking tax efficiency and long-term planning. |

| Certifications | Certified Public Accountant (CPA), Enrolled Agent (EA). | CPA, Chartered Tax Advisor (CTA), or similar. |

| Value Proposition | Ensures accurate tax filings and legal compliance. | Maximizes tax savings and financial growth. |

| Cost | Typically lower; focused on compliance tasks. | Higher; offers strategic planning services. |

Overview of Tax Specialist and Tax Advisor Roles

Tax Specialists focus on the technical aspects of tax law compliance, preparing and reviewing tax returns, and ensuring accurate application of tax codes to maximize deductions and minimize liabilities. Tax Advisors provide strategic tax planning and consulting services, offering personalized advice on tax-efficient structuring, investment decisions, and business transactions to optimize overall tax outcomes. Both roles require in-depth knowledge of tax regulations, but specialists emphasize execution while advisors prioritize long-term financial strategy.

Key Responsibilities Comparison

Tax Specialists primarily focus on preparing, reviewing, and filing tax returns while ensuring compliance with tax laws and regulations. Tax Advisors provide strategic tax planning, offer guidance on tax-saving opportunities, and assist clients with complex financial decisions to minimize tax liabilities. Both roles require up-to-date knowledge of tax codes, but Tax Advisors typically engage in broader financial consulting beyond routine tax preparation.

Required Qualifications and Certifications

Tax Specialists typically require a strong foundation in accounting or finance, with certifications such as Certified Public Accountant (CPA) or Certified Tax Specialist (CTS) enhancing their expertise in tax preparation and compliance. Tax Advisors, on the other hand, often hold advanced qualifications like Chartered Tax Adviser (CTA) or Enrolled Agent (EA), emphasizing strategic tax planning and advisory services. Both roles benefit from continuous professional development and up-to-date knowledge of tax laws, but the certifications reflect their distinct focus on execution versus consultation.

Areas of Expertise and Focus

Tax Specialists possess in-depth knowledge of complex tax codes, regulations, and compliance requirements, specializing in areas such as corporate tax, international tax, and tax audit defense. Tax Advisors concentrate on broader financial planning, offering guidance on tax strategies, retirement planning, and investment-related tax implications to optimize clients' overall tax efficiency. Both roles provide critical support, but Tax Specialists focus more on technical accuracy and compliance, while Tax Advisors emphasize strategic tax planning and personalized financial advice.

Industry Demand and Career Growth

Tax specialists and tax advisors both hold critical roles in finance, yet demand for tax specialists is rising sharply due to increasingly complex regulatory frameworks across industries. Career growth for tax advisors often centers on advisory and consultancy roles within multinational corporations, while tax specialists frequently advance into compliance and audit leadership positions. Industry data from the Bureau of Labor Statistics projects a 7% growth rate for tax-related professions through 2031, with tax specialists experiencing higher demand in sectors like manufacturing, financial services, and technology.

Client Interaction and Communication Skills

Tax Specialists demonstrate in-depth expertise in complex tax regulations and communicate detailed technical information clearly to clients, focusing on compliance and precise documentation. Tax Advisors emphasize a strategic approach, tailoring tax planning advice to clients' financial goals through personalized consultations and proactive communication. Both roles demand exceptional client interaction skills, but Advisors prioritize relationship-building and ongoing dialogue to optimize tax outcomes.

Salary Expectations and Compensation

Tax specialists typically earn an average salary ranging from $60,000 to $90,000 annually, reflecting their focused expertise in compliance and tax regulations, while tax advisors often command higher compensation, between $80,000 and $120,000, due to their broader role in strategic tax planning and client consulting. Variations in salary depend on factors such as geographic location, level of experience, and industry sector, with tax advisors in major financial hubs generally seeing the most competitive compensation packages. Bonus structures and additional benefits frequently supplement base salaries, especially for senior tax advisors who manage complex portfolios and provide high-level financial guidance.

Common Employers and Work Environments

Tax Specialists and Tax Advisors frequently find employment within accounting firms, corporate finance departments, government tax agencies, and consulting firms. Both professionals often work in office settings, utilizing specialized tax software and staying updated on tax laws to support compliance and strategic tax planning. Large multinational corporations and public accounting firms represent common employers, offering opportunities to handle complex tax issues across various jurisdictions.

Regulatory and Compliance Knowledge

Tax Specialists possess deep expertise in regulatory frameworks and ensure strict compliance with evolving tax laws, minimizing legal risks for clients. Tax Advisors combine regulatory knowledge with strategic planning to optimize tax liabilities while maintaining adherence to compliance standards. Understanding nuances in tax codes and regulatory updates is essential for both roles to provide accurate and lawful tax solutions.

Choosing Between Tax Specialist and Tax Advisor

Choosing between a tax specialist and a tax advisor depends on the complexity of your financial situation and specific tax needs. Tax specialists possess in-depth knowledge of tax laws and are ideal for handling intricate tax issues, audits, and compliance requirements, while tax advisors provide broader financial planning and tax strategy advice for individuals and businesses. Evaluating whether you need focused expertise or comprehensive tax planning will guide the decision toward the right professional.

Tax Specialist vs Tax Advisor Infographic

jobdiv.com

jobdiv.com