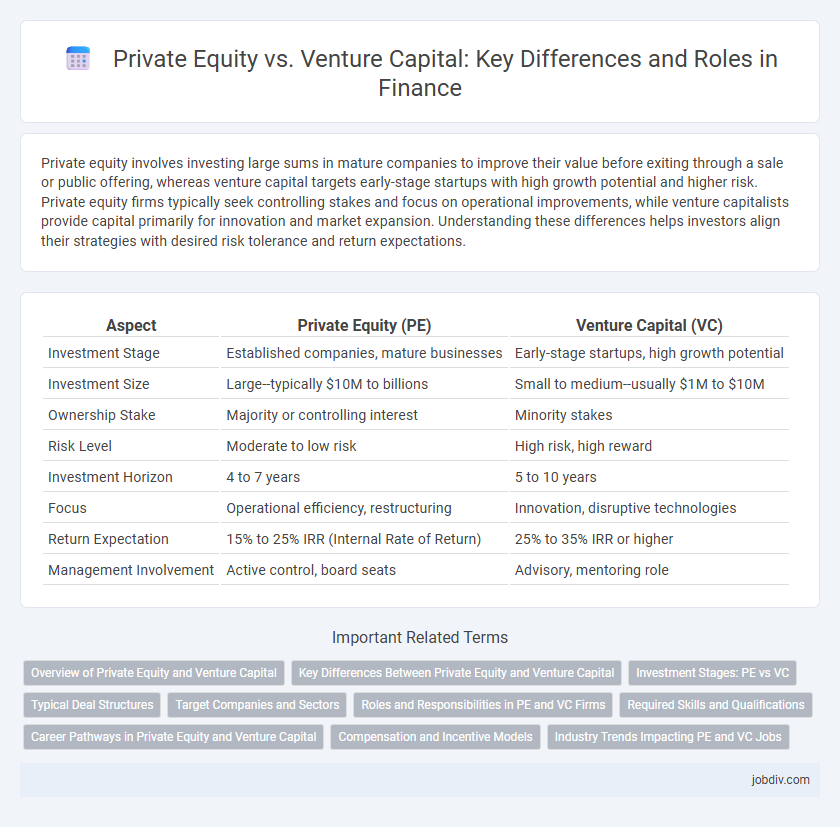

Private equity involves investing large sums in mature companies to improve their value before exiting through a sale or public offering, whereas venture capital targets early-stage startups with high growth potential and higher risk. Private equity firms typically seek controlling stakes and focus on operational improvements, while venture capitalists provide capital primarily for innovation and market expansion. Understanding these differences helps investors align their strategies with desired risk tolerance and return expectations.

Table of Comparison

| Aspect | Private Equity (PE) | Venture Capital (VC) |

|---|---|---|

| Investment Stage | Established companies, mature businesses | Early-stage startups, high growth potential |

| Investment Size | Large--typically $10M to billions | Small to medium--usually $1M to $10M |

| Ownership Stake | Majority or controlling interest | Minority stakes |

| Risk Level | Moderate to low risk | High risk, high reward |

| Investment Horizon | 4 to 7 years | 5 to 10 years |

| Focus | Operational efficiency, restructuring | Innovation, disruptive technologies |

| Return Expectation | 15% to 25% IRR (Internal Rate of Return) | 25% to 35% IRR or higher |

| Management Involvement | Active control, board seats | Advisory, mentoring role |

Overview of Private Equity and Venture Capital

Private equity involves investing in established companies through buyouts, aiming to improve operations and increase value before exiting, typically over a longer investment horizon. Venture capital focuses on early-stage startups with high growth potential, providing capital and mentorship to fuel innovation and market entry. Both asset classes play distinct roles in financing but differ in risk profiles, investment stages, and expected returns.

Key Differences Between Private Equity and Venture Capital

Private equity involves investing in mature companies through buyouts or significant ownership stakes, aiming to improve operations and increase value before exiting, typically over a longer horizon. Venture capital focuses on early-stage startups with high growth potential, providing funding in exchange for equity while accepting higher risks and the possibility of rapid returns. Key differences include investment stage, risk profile, ownership structure, and exit strategies.

Investment Stages: PE vs VC

Private Equity (PE) typically invests in established companies during later stages such as growth, buyouts, or recapitalizations, aiming for operational improvements and market expansion. Venture Capital (VC) targets early-stage startups and high-growth potential firms, focusing on seed, Series A, or Series B funding rounds to accelerate product development and market entry. The distinct investment stages reflect PE's emphasis on maturity and stability versus VC's risk tolerance for innovation and scalability.

Typical Deal Structures

Private equity deal structures often involve majority ownership stakes through leveraged buyouts, enabling significant operational control and strategic influence. Venture capital deals typically feature minority equity investments with preferred shares, emphasizing high-growth potential and exit strategies such as initial public offerings or acquisitions. Both structures utilize term sheets outlining valuation, governance rights, and liquidation preferences to align investor and company interests.

Target Companies and Sectors

Private equity primarily targets mature companies with stable cash flows in sectors such as manufacturing, healthcare, and consumer goods, aiming for operational improvements and long-term value creation. Venture capital focuses on early-stage startups in high-growth sectors like technology, biotechnology, and fintech, emphasizing innovation and scalability. The differing risk profiles influence investment strategies, with private equity favoring established markets and venture capital pursuing disruptive market opportunities.

Roles and Responsibilities in PE and VC Firms

Private equity firms primarily focus on acquiring mature companies, restructuring operations, and driving long-term value creation through strategic management and financial engineering. Venture capital firms specialize in funding early-stage startups, providing not only capital but also mentorship, market access, and guidance to accelerate growth and innovation. Role distinctions include PE professionals managing buyouts and operational improvements, while VC professionals emphasize deal sourcing, portfolio company support, and market trend analysis.

Required Skills and Qualifications

Private equity professionals require strong financial modeling, portfolio management, and negotiation skills, often backed by MBAs or CFA certifications, reflecting their focus on mature companies and complex transactions. Venture capital experts emphasize entrepreneurial insight, market evaluation, and networking abilities, typically possessing backgrounds in technology, startups, or business development. Both fields demand analytical acumen and due diligence expertise, but private equity prioritizes operational experience while venture capital values risk assessment and innovation analysis.

Career Pathways in Private Equity and Venture Capital

Career pathways in private equity typically involve roles in financial analysis, deal sourcing, and portfolio management, emphasizing leveraged buyouts and restructuring of established companies. Venture capital careers focus on identifying high-growth startups, conducting market research, and providing strategic guidance to early-stage companies. Both sectors demand strong financial modeling skills, but private equity professionals often advance through associate to partner levels within firms managing large funds, while venture capitalists may progress through analyst to general partner roles centered on innovation and emerging markets.

Compensation and Incentive Models

Private equity compensation typically includes a significant base salary combined with carried interest, aligning incentives through profit-sharing on portfolio company exits. Venture capital models emphasize carried interest as well but often reward early-stage risk-taking with milestone-based bonuses tied to startup growth metrics. Both sectors use carried interest to motivate long-term value creation, yet venture capital places greater emphasis on incentivizing innovation and rapid scalability.

Industry Trends Impacting PE and VC Jobs

Private Equity and Venture Capital sectors are experiencing dynamic shifts due to increased digital transformation and ESG investment priorities, driving demand for specialized talent in financial modeling and sustainability analysis. The rise of AI and data analytics is reshaping recruitment, with firms seeking candidates adept in technology integration to enhance deal sourcing and portfolio management. Market volatility and regulatory changes further influence job stability, compelling professionals to adapt skills for strategic risk management and compliance within these competitive investment landscapes.

Private Equity vs Venture Capital Infographic

jobdiv.com

jobdiv.com