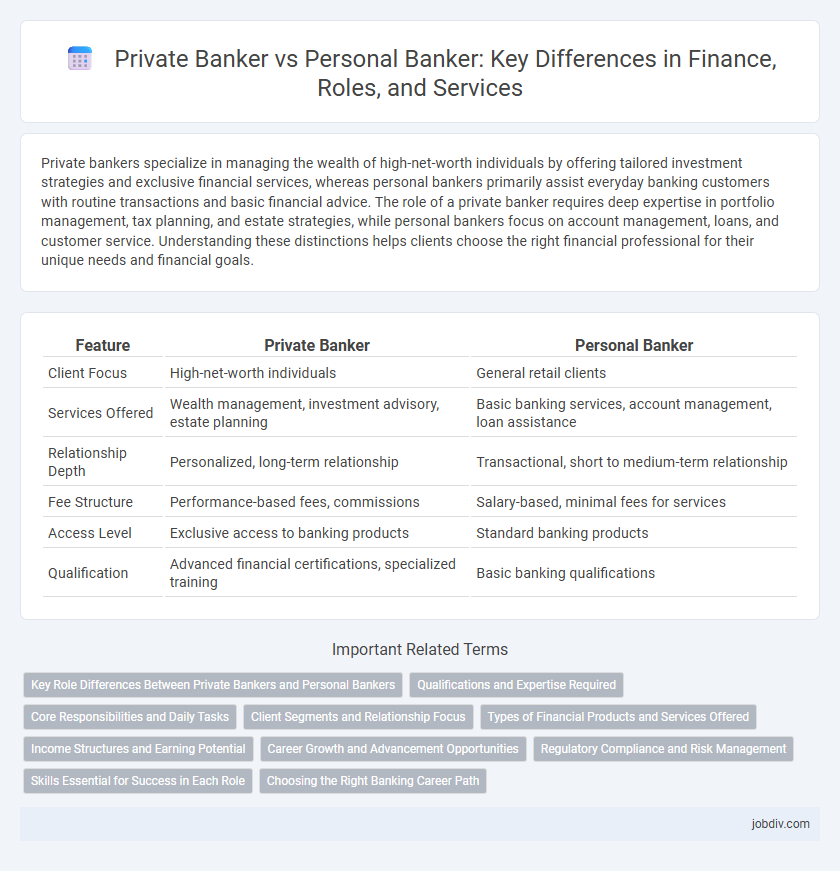

Private bankers specialize in managing the wealth of high-net-worth individuals by offering tailored investment strategies and exclusive financial services, whereas personal bankers primarily assist everyday banking customers with routine transactions and basic financial advice. The role of a private banker requires deep expertise in portfolio management, tax planning, and estate strategies, while personal bankers focus on account management, loans, and customer service. Understanding these distinctions helps clients choose the right financial professional for their unique needs and financial goals.

Table of Comparison

| Feature | Private Banker | Personal Banker |

|---|---|---|

| Client Focus | High-net-worth individuals | General retail clients |

| Services Offered | Wealth management, investment advisory, estate planning | Basic banking services, account management, loan assistance |

| Relationship Depth | Personalized, long-term relationship | Transactional, short to medium-term relationship |

| Fee Structure | Performance-based fees, commissions | Salary-based, minimal fees for services |

| Access Level | Exclusive access to banking products | Standard banking products |

| Qualification | Advanced financial certifications, specialized training | Basic banking qualifications |

Key Role Differences Between Private Bankers and Personal Bankers

Private bankers primarily manage high-net-worth clients' complex financial portfolios, offering tailored wealth management, investment advice, and estate planning services. Personal bankers focus on everyday banking needs such as account management, loan processing, and retail financial products for individual customers. The key role difference lies in private bankers' specialization in personalized wealth growth and preservation, whereas personal bankers provide general banking support and transactional services.

Qualifications and Expertise Required

Private bankers typically hold advanced degrees in finance, economics, or business administration, along with certifications such as CFA or CFP, showcasing expertise in wealth management, investment strategies, and tax planning for high-net-worth clients. Personal bankers generally require a bachelor's degree in finance, business, or related fields, with a focus on retail banking products, customer service, and basic financial advising skills. The specialization of private bankers in complex financial portfolios contrasts with personal bankers' proficiency in everyday banking services and credit products.

Core Responsibilities and Daily Tasks

Private bankers manage high-net-worth clients' wealth by offering personalized financial strategies, including investment management, estate planning, and tax optimization. Personal bankers focus on retail banking services such as account management, loan processing, and customer support for everyday banking needs. Both roles require strong client relationship skills, but private bankers handle complex financial portfolios while personal bankers address routine transactions.

Client Segments and Relationship Focus

Private bankers primarily serve high-net-worth individuals and ultra-high-net-worth clients, offering personalized wealth management, investment advice, and estate planning tailored to complex financial needs. Personal bankers focus on retail clients and small business customers, providing transactional services, basic financial products, and routine account management to support everyday banking needs. The relationship focus of private bankers is deeply advisory and strategic, while personal bankers emphasize operational support and customer service.

Types of Financial Products and Services Offered

Private bankers primarily offer customized wealth management solutions, including investment advisory, estate planning, tax optimization, and exclusive access to alternative investments for high-net-worth clients. Personal bankers focus on retail banking services such as checking and savings accounts, personal loans, mortgages, and credit cards tailored to everyday banking needs. The distinction in financial products reflects the target clientele, with private bankers addressing complex, high-value asset management and personal bankers supporting routine financial transactions.

Income Structures and Earning Potential

Private bankers typically earn higher base salaries complemented by performance-based bonuses linked to managing high-net-worth clients and securing substantial asset inflows. Personal bankers often have a lower fixed salary but rely on commission structures tied to product sales and client acquisitions within retail banking. Income potential for private bankers generally surpasses that of personal bankers due to greater asset management responsibilities and access to wealthier clientele, resulting in more lucrative incentive opportunities.

Career Growth and Advancement Opportunities

Private bankers typically experience faster career progression by managing high-net-worth clients and handling complex financial portfolios, which enhances their expertise in wealth management and investment strategies. Personal bankers often focus on retail banking services with opportunities concentrated in branch management or sales leadership roles, providing a solid foundation in customer service and basic financial products. The specialized skill set of private bankers often leads to higher earning potential and executive-level positions compared to the broader, service-oriented trajectory of personal bankers.

Regulatory Compliance and Risk Management

Private bankers typically cater to high-net-worth individuals, requiring stringent adherence to regulatory compliance rules such as anti-money laundering (AML) and know your customer (KYC) policies to mitigate financial risks. Personal bankers manage routine banking services for retail clients but must also follow regulatory guidelines to ensure proper risk management and fraud prevention. Both roles demand continuous monitoring and reporting to regulatory authorities to maintain financial integrity and protect client assets.

Skills Essential for Success in Each Role

Private bankers require advanced financial acumen, strong relationship management skills, and expertise in wealth management strategies to cater to high-net-worth clients. Personal bankers must excel in customer service, sales proficiency, and knowledge of retail banking products to effectively handle everyday client needs and drive branch growth. Both roles demand excellent communication abilities and problem-solving skills, but the private banker role emphasizes investment advisory expertise while the personal banker focuses on transactional efficiency.

Choosing the Right Banking Career Path

Private bankers manage high-net-worth clients' complex financial portfolios, specializing in wealth management, investment strategies, and tailored financial planning. Personal bankers focus on retail banking services such as account management, loans, and everyday financial products for individual customers. Choosing the right banking career path depends on your interest in relationship management, client asset size, and specialization in financial advisory or transactional services.

Private Banker vs Personal Banker Infographic

jobdiv.com

jobdiv.com