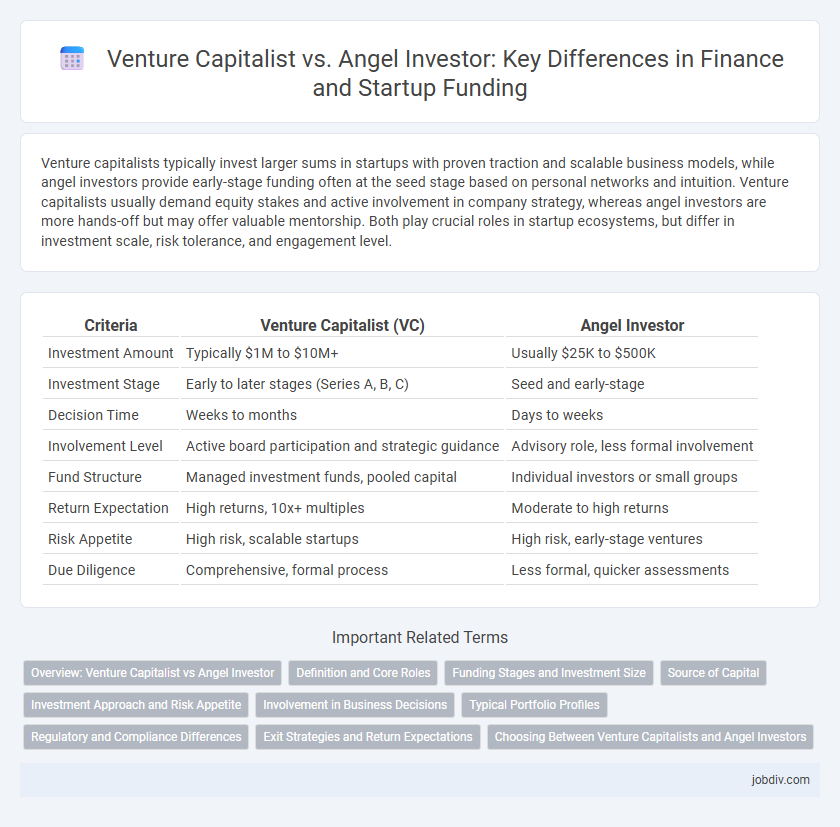

Venture capitalists typically invest larger sums in startups with proven traction and scalable business models, while angel investors provide early-stage funding often at the seed stage based on personal networks and intuition. Venture capitalists usually demand equity stakes and active involvement in company strategy, whereas angel investors are more hands-off but may offer valuable mentorship. Both play crucial roles in startup ecosystems, but differ in investment scale, risk tolerance, and engagement level.

Table of Comparison

| Criteria | Venture Capitalist (VC) | Angel Investor |

|---|---|---|

| Investment Amount | Typically $1M to $10M+ | Usually $25K to $500K |

| Investment Stage | Early to later stages (Series A, B, C) | Seed and early-stage |

| Decision Time | Weeks to months | Days to weeks |

| Involvement Level | Active board participation and strategic guidance | Advisory role, less formal involvement |

| Fund Structure | Managed investment funds, pooled capital | Individual investors or small groups |

| Return Expectation | High returns, 10x+ multiples | Moderate to high returns |

| Risk Appetite | High risk, scalable startups | High risk, early-stage ventures |

| Due Diligence | Comprehensive, formal process | Less formal, quicker assessments |

Overview: Venture Capitalist vs Angel Investor

Venture capitalists are professional investors managing pooled funds from institutions and high-net-worth individuals to invest in high-growth startups, typically requiring equity stakes and board involvement. Angel investors are affluent individuals who provide early-stage capital, often during the seed or pre-seed phase, offering mentorship and flexible investment terms. Both play crucial roles in startup financing, differing mainly in investment scale, involvement level, and risk tolerance.

Definition and Core Roles

Venture capitalists are professional investors who manage pooled funds from institutions and high-net-worth individuals to invest larger amounts in high-growth startups, typically during later funding stages. Angel investors are affluent individuals who provide early-stage capital, often contributing personal funds and mentorship to emerging companies in their initial development phases. Both play crucial roles in startup ecosystems by supplying necessary financial resources and strategic guidance, but differ primarily in investment scale, timing, and source of funds.

Funding Stages and Investment Size

Venture capitalists typically invest in later funding stages such as Series A, B, and beyond, providing large capital amounts ranging from $1 million to hundreds of millions of dollars. Angel investors usually fund early-stage startups or seed rounds with smaller investments, often between $25,000 and $100,000. The scale and timing of funding differ significantly, with venture capitalists aiming for rapid growth and scalability while angel investors focus on initial business validation.

Source of Capital

Venture capitalists typically raise capital from institutional investors, such as pension funds, endowments, and wealthy individuals, pooling large amounts of money to invest in startups and growing companies. Angel investors use their personal funds or resources to provide early-stage capital, often investing smaller amounts compared to venture capital firms. The source of capital influences investment size, risk tolerance, and involvement in company growth and governance.

Investment Approach and Risk Appetite

Venture capitalists typically invest larger sums of money in startups with proven business models, seeking scalable opportunities and aiming for significant equity stakes in exchange for substantial influence over company operations. Angel investors often contribute smaller amounts during the early stages, showing a higher risk appetite by funding unproven ideas with potential for high growth, motivated by personal interest or industry expertise rather than immediate financial returns. Both investors differ in investment approach, as venture capitalists prioritize structured due diligence and exit strategies, while angel investors rely more on intuition and long-term mentorship roles.

Involvement in Business Decisions

Venture capitalists typically require a significant equity stake and actively participate in strategic business decisions, often holding board seats to influence company direction and governance. Angel investors usually provide early-stage funding with a more hands-off approach, offering advice and mentorship without demanding substantial control over daily operations. The level of involvement in business decisions varies greatly, with venture capitalists driving growth strategies and angel investors supporting entrepreneurial vision.

Typical Portfolio Profiles

Venture capitalists typically hold diversified portfolios consisting of multiple high-growth startups, often investing larger sums in later funding rounds to maximize returns. Angel investors usually maintain smaller, more concentrated portfolios, focusing on early-stage companies where they provide seed capital and mentorship. The investment horizon for venture capitalists tends to be longer, while angels often seek quicker exits through initial growth phases.

Regulatory and Compliance Differences

Venture capitalists typically operate within structured funds subject to stricter regulatory oversight by entities like the SEC, ensuring compliance with investment limits, disclosure requirements, and fiduciary duties. Angel investors, often accredited individuals investing personal funds, face fewer regulatory constraints but must still adhere to securities laws, such as those governing private placements under Regulation D. Understanding these regulatory distinctions is crucial for startup founders when seeking capital, as it affects reporting obligations, investment timelines, and potential legal liabilities.

Exit Strategies and Return Expectations

Venture capitalists typically pursue high-return exit strategies such as initial public offerings (IPOs) or acquisitions within 5 to 7 years, aiming for exponential returns to satisfy limited partners. Angel investors often seek earlier, more flexible exit options including buyouts or secondary sales, expecting moderate to high returns but with longer holding periods. Both investors emphasize scalable growth in startups, yet venture capitalists depend on structured exit timelines, while angels tolerate diverse exit paths aligned with portfolio diversification.

Choosing Between Venture Capitalists and Angel Investors

Choosing between venture capitalists and angel investors depends on the startup's funding needs and growth stage, with venture capitalists typically providing larger capital sums suited for rapid scaling. Angel investors, often high-net-worth individuals, offer smaller investments and mentorship during early-stage development, facilitating initial product validation and market entry. Evaluating factors such as control dilution, funding speed, and network access is crucial for optimizing financial strategy and achieving long-term business objectives.

Venture Capitalist vs Angel Investor Infographic

jobdiv.com

jobdiv.com