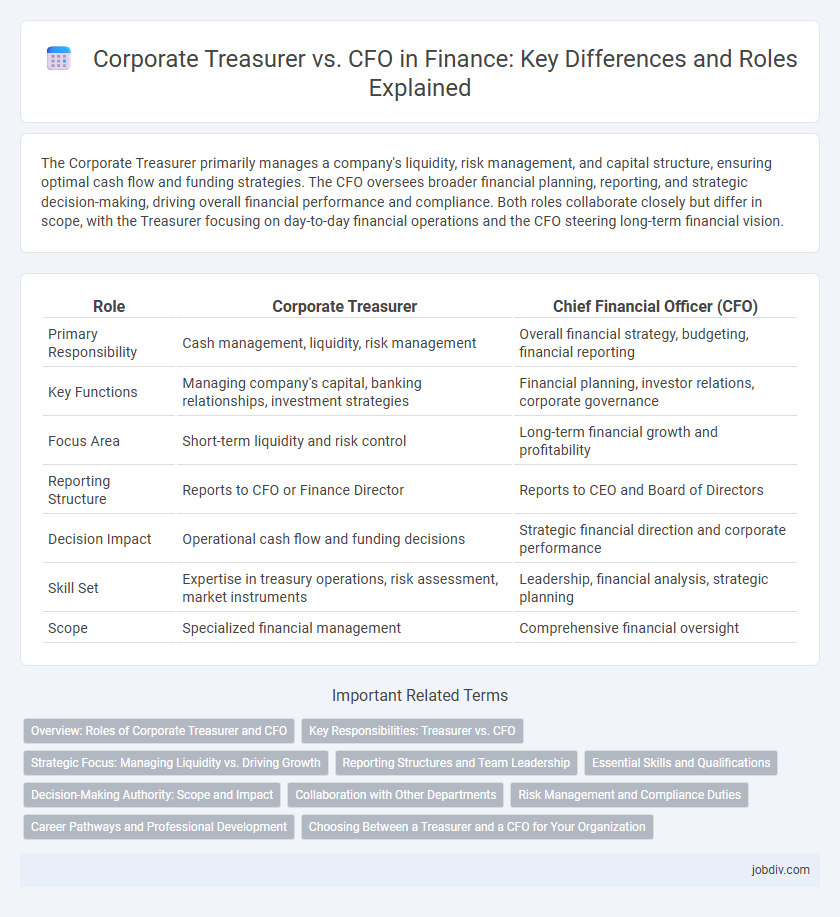

The Corporate Treasurer primarily manages a company's liquidity, risk management, and capital structure, ensuring optimal cash flow and funding strategies. The CFO oversees broader financial planning, reporting, and strategic decision-making, driving overall financial performance and compliance. Both roles collaborate closely but differ in scope, with the Treasurer focusing on day-to-day financial operations and the CFO steering long-term financial vision.

Table of Comparison

| Role | Corporate Treasurer | Chief Financial Officer (CFO) |

|---|---|---|

| Primary Responsibility | Cash management, liquidity, risk management | Overall financial strategy, budgeting, financial reporting |

| Key Functions | Managing company's capital, banking relationships, investment strategies | Financial planning, investor relations, corporate governance |

| Focus Area | Short-term liquidity and risk control | Long-term financial growth and profitability |

| Reporting Structure | Reports to CFO or Finance Director | Reports to CEO and Board of Directors |

| Decision Impact | Operational cash flow and funding decisions | Strategic financial direction and corporate performance |

| Skill Set | Expertise in treasury operations, risk assessment, market instruments | Leadership, financial analysis, strategic planning |

| Scope | Specialized financial management | Comprehensive financial oversight |

Overview: Roles of Corporate Treasurer and CFO

The Corporate Treasurer manages an organization's liquidity, risk, and capital structure to ensure financial stability and operational efficiency. The CFO oversees all financial operations, including strategic planning, financial reporting, and investor relations, driving overall corporate financial performance. Both roles collaborate closely to align financial strategies with company goals, but the CFO holds broader responsibility for financial leadership and corporate governance.

Key Responsibilities: Treasurer vs. CFO

The Corporate Treasurer manages an organization's liquidity, cash flow, risk exposure, and capital structure, focusing on short-term financial stability and funding strategies. The CFO oversees broader financial planning, reporting, budgeting, and strategic financial management to drive long-term growth and shareholder value. While the Treasurer handles operational financial risks and banking relationships, the CFO aligns financial goals with overall corporate strategy and investor relations.

Strategic Focus: Managing Liquidity vs. Driving Growth

The Corporate Treasurer concentrates on managing liquidity, ensuring the company maintains optimal cash flow and mitigates financial risks through effective cash management and funding strategies. The CFO drives growth by developing long-term financial plans, optimizing capital structure, and making strategic investment decisions that support business expansion. Both roles require a deep understanding of financial markets, but the treasurer emphasizes operational cash efficiency, while the CFO focuses on maximizing shareholder value and sustainable growth.

Reporting Structures and Team Leadership

The Corporate Treasurer typically reports to the CFO and manages specialized teams focused on cash management, risk mitigation, and liquidity planning. The CFO oversees broader financial reporting, strategy, and overall team leadership across departments such as accounting, auditing, and investor relations. Clear reporting structures ensure efficient communication and aligned decision-making between the Treasurer's operational focus and the CFO's strategic financial management.

Essential Skills and Qualifications

Corporate Treasurers require expertise in cash management, risk assessment, and regulatory compliance, often holding certifications like Certified Treasury Professional (CTP). CFOs must possess advanced financial acumen, leadership skills, and strategic planning abilities, typically supported by qualifications such as CPA or MBA. Both roles demand strong analytical capabilities and experience with financial reporting, but CFOs oversee broader organizational finance while Treasurers concentrate on liquidity and investment management.

Decision-Making Authority: Scope and Impact

Corporate Treasurers primarily manage liquidity, risk, and capital structure decisions, focusing on short-term financial operations and cash flow optimization. CFOs hold broader decision-making authority, encompassing strategic financial planning, budgeting, investor relations, and overall corporate financial policy. The CFO's decisions impact long-term corporate growth and shareholder value, while Treasurers ensure operational financial stability and regulatory compliance.

Collaboration with Other Departments

Corporate Treasurers work closely with finance, legal, and risk management teams to optimize cash flow, manage liquidity, and ensure regulatory compliance. CFOs collaborate with marketing, operations, and HR departments to align financial strategies with business growth objectives and performance metrics. Effective collaboration between the Corporate Treasurer and CFO ensures integrated financial planning, risk mitigation, and strategic decision-making across all departments.

Risk Management and Compliance Duties

The Corporate Treasurer primarily manages liquidity risk, cash flow forecasting, and financial risk exposures, ensuring the company maintains adequate funding and hedges against market volatility. The CFO oversees broader compliance duties, including regulatory reporting, internal controls, and aligning risk management strategies with corporate governance policies. Both roles collaborate to safeguard the organization's financial stability while adhering to legal and regulatory frameworks.

Career Pathways and Professional Development

Corporate Treasurers typically advance through roles in cash management, risk assessment, and financial analysis, gaining expertise in liquidity management and corporate finance strategies. CFOs often have broader experience, encompassing strategic planning, financial reporting, and investor relations, with career progression frequently including roles like Controller or Finance Director. Professional development for both roles emphasizes certifications such as CPA, CFA, or CTP to enhance financial expertise and leadership skills necessary for executive decision-making.

Choosing Between a Treasurer and a CFO for Your Organization

Choosing between a Corporate Treasurer and a CFO depends on the organization's size, financial complexity, and strategic needs. A Treasurer focuses on cash management, risk assessment, and maintaining liquidity, while the CFO oversees broader financial strategy, reporting, and investor relations. Smaller firms may benefit from a Treasurer's operational focus, whereas larger enterprises require a CFO's comprehensive financial leadership for optimal growth and compliance.

Corporate Treasurer vs CFO Infographic

jobdiv.com

jobdiv.com