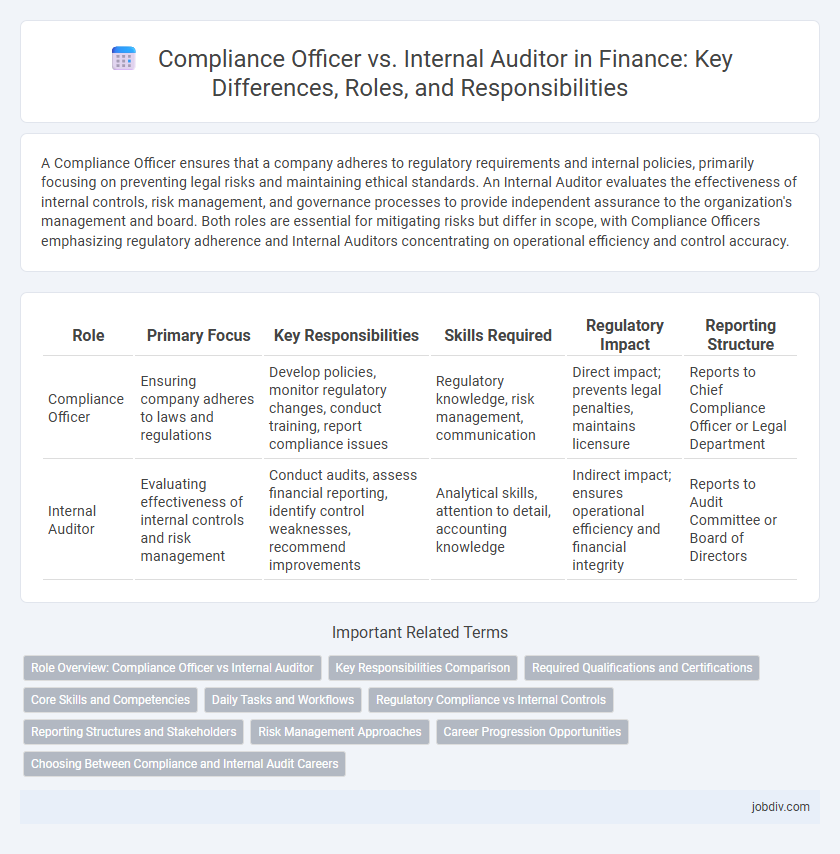

A Compliance Officer ensures that a company adheres to regulatory requirements and internal policies, primarily focusing on preventing legal risks and maintaining ethical standards. An Internal Auditor evaluates the effectiveness of internal controls, risk management, and governance processes to provide independent assurance to the organization's management and board. Both roles are essential for mitigating risks but differ in scope, with Compliance Officers emphasizing regulatory adherence and Internal Auditors concentrating on operational efficiency and control accuracy.

Table of Comparison

| Role | Primary Focus | Key Responsibilities | Skills Required | Regulatory Impact | Reporting Structure |

|---|---|---|---|---|---|

| Compliance Officer | Ensuring company adheres to laws and regulations | Develop policies, monitor regulatory changes, conduct training, report compliance issues | Regulatory knowledge, risk management, communication | Direct impact; prevents legal penalties, maintains licensure | Reports to Chief Compliance Officer or Legal Department |

| Internal Auditor | Evaluating effectiveness of internal controls and risk management | Conduct audits, assess financial reporting, identify control weaknesses, recommend improvements | Analytical skills, attention to detail, accounting knowledge | Indirect impact; ensures operational efficiency and financial integrity | Reports to Audit Committee or Board of Directors |

Role Overview: Compliance Officer vs Internal Auditor

Compliance Officers ensure an organization adheres to legal standards and internal policies by monitoring regulatory changes and implementing compliance programs. Internal Auditors evaluate the effectiveness of internal controls, risk management, and governance processes through systematic audits and reporting. Both roles are crucial for risk mitigation but differ in focus: Compliance Officers prevent violations, while Internal Auditors provide independent assurance on operational integrity.

Key Responsibilities Comparison

Compliance Officers develop, implement, and monitor policies to ensure adherence to regulatory standards and prevent legal risks within financial institutions. Internal Auditors evaluate the effectiveness of internal controls, risk management, and governance processes by conducting independent assessments and audits. Both roles collaborate to enhance organizational compliance and operational integrity but focus on policy enforcement versus assessment and reporting.

Required Qualifications and Certifications

Compliance Officers typically require qualifications such as a bachelor's degree in finance, law, or business administration, often complemented by certifications like Certified Regulatory Compliance Manager (CRCM) or Certified Compliance and Ethics Professional (CCEP). Internal Auditors generally hold a bachelor's degree in accounting, finance, or business and frequently obtain the Certified Internal Auditor (CIA) credential or Certified Public Accountant (CPA) certification to demonstrate expertise in audit processes and financial controls. Both roles demand strong knowledge of regulatory frameworks, risk management, and organizational policies to ensure adherence to legal and ethical standards.

Core Skills and Competencies

Compliance Officers specialize in regulatory knowledge, risk assessment, and ensuring adherence to legal standards, emphasizing skills in policy development, regulatory reporting, and ethical decision-making. Internal Auditors excel in analytical thinking, internal controls evaluation, process improvement, and detailed financial auditing to identify operational weaknesses and prevent fraud. Both roles require strong communication, critical thinking, and problem-solving abilities, but Compliance Officers focus more on external regulations while Internal Auditors prioritize internal risk management and control assurance.

Daily Tasks and Workflows

Compliance Officers monitor adherence to regulations by conducting regular risk assessments, updating policies, and training staff to prevent legal breaches. Internal Auditors perform systematic evaluations of financial records and operational processes to detect discrepancies and ensure accuracy. Both roles collaborate to safeguard organizational integrity but focus on prevention versus verification within daily workflows.

Regulatory Compliance vs Internal Controls

Compliance Officers ensure adherence to regulatory compliance by monitoring external laws, industry standards, and company policies to mitigate legal risks. Internal Auditors focus on evaluating internal controls and operational processes to guarantee accuracy, efficiency, and fraud prevention within the organization. Together, these roles enhance overall risk management by addressing compliance from both external regulatory frameworks and internal governance mechanisms.

Reporting Structures and Stakeholders

Compliance Officers typically report to the Chief Compliance Officer or directly to the Board of Directors, ensuring adherence to regulatory requirements and minimizing legal risks. Internal Auditors usually report to the Audit Committee or Chief Audit Executive, providing independent assessments of internal controls and risk management processes. Key stakeholders for Compliance Officers include regulatory agencies and executive management, while Internal Auditors primarily engage with the Audit Committee and senior management to enhance organizational governance.

Risk Management Approaches

Compliance Officers implement risk management by ensuring adherence to laws, regulations, and internal policies to prevent legal penalties and financial losses. Internal Auditors assess and improve the effectiveness of risk management processes by conducting independent evaluations and identifying control weaknesses. Both roles collaborate to enhance organizational resilience through proactive risk identification and mitigation strategies.

Career Progression Opportunities

Compliance Officers often advance to senior risk management or regulatory affairs roles, leveraging their expertise in legal frameworks and organizational policies. Internal Auditors typically progress into senior audit management, chief audit executive positions, or broader finance leadership roles due to their deep understanding of internal controls and risk assessment. Both career paths offer opportunities for cross-functional leadership, with Compliance Officers focusing on regulatory compliance and Internal Auditors driving governance and operational efficiency.

Choosing Between Compliance and Internal Audit Careers

Choosing between careers as a Compliance Officer and Internal Auditor involves evaluating distinct but complementary roles in risk management and regulatory adherence. Compliance Officers primarily focus on ensuring that organizations comply with laws, regulations, and internal policies, while Internal Auditors assess the effectiveness of internal controls, risk management, and governance processes. Professionals should consider their strengths in policy interpretation and enforcement versus analytical evaluation and reporting to align career paths with organizational needs and personal skills.

Compliance Officer vs Internal Auditor Infographic

jobdiv.com

jobdiv.com