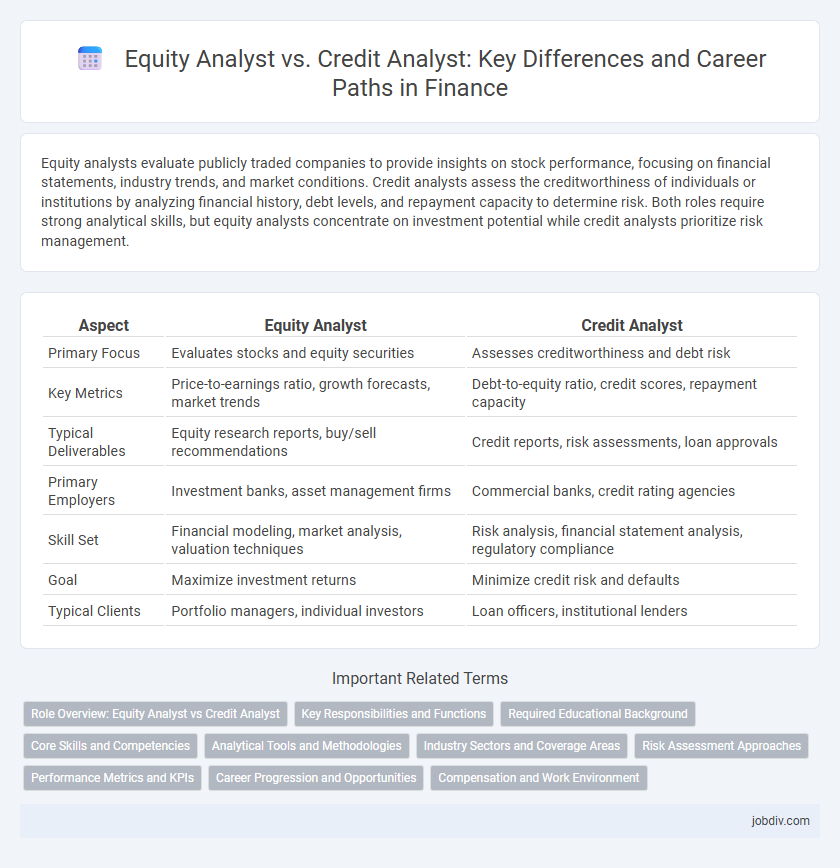

Equity analysts evaluate publicly traded companies to provide insights on stock performance, focusing on financial statements, industry trends, and market conditions. Credit analysts assess the creditworthiness of individuals or institutions by analyzing financial history, debt levels, and repayment capacity to determine risk. Both roles require strong analytical skills, but equity analysts concentrate on investment potential while credit analysts prioritize risk management.

Table of Comparison

| Aspect | Equity Analyst | Credit Analyst |

|---|---|---|

| Primary Focus | Evaluates stocks and equity securities | Assesses creditworthiness and debt risk |

| Key Metrics | Price-to-earnings ratio, growth forecasts, market trends | Debt-to-equity ratio, credit scores, repayment capacity |

| Typical Deliverables | Equity research reports, buy/sell recommendations | Credit reports, risk assessments, loan approvals |

| Primary Employers | Investment banks, asset management firms | Commercial banks, credit rating agencies |

| Skill Set | Financial modeling, market analysis, valuation techniques | Risk analysis, financial statement analysis, regulatory compliance |

| Goal | Maximize investment returns | Minimize credit risk and defaults |

| Typical Clients | Portfolio managers, individual investors | Loan officers, institutional lenders |

Role Overview: Equity Analyst vs Credit Analyst

Equity analysts evaluate publicly traded companies to provide investment recommendations based on financial statements, market trends, and industry dynamics, focusing on stock price movements and growth potential. Credit analysts assess the creditworthiness of individuals or organizations by analyzing financial data, repayment history, and economic conditions to determine risk levels and lending terms. Both roles require strong analytical skills but differ in objectives: equity analysts prioritize investment return maximization, while credit analysts emphasize risk mitigation and debt management.

Key Responsibilities and Functions

Equity analysts primarily focus on evaluating public company stocks by analyzing financial statements, market trends, and competitive positioning to provide investment recommendations. Credit analysts assess the creditworthiness of individuals or corporations by evaluating financial data, payment history, and economic conditions to determine risk levels and lending terms. Both roles require strong financial modeling skills, but equity analysts emphasize growth potential and valuation, while credit analysts prioritize risk assessment and debt repayment capacity.

Required Educational Background

Equity analysts typically require a strong foundation in finance, economics, or accounting, often holding a bachelor's degree in these fields, with many pursuing advanced certifications like the Chartered Financial Analyst (CFA) designation. Credit analysts usually possess degrees in finance, business administration, or economics, focusing on credit risk assessment, financial statement analysis, and lending principles, with certifications such as Credit Risk Certification (CRC) enhancing their expertise. Both roles demand quantitative skills and analytical proficiency but diverge in specialized training aligned with equity valuation or credit risk management.

Core Skills and Competencies

Equity analysts excel in financial modeling, market research, and valuation techniques to assess stock performance and company growth potential. Credit analysts focus on credit risk assessment, analyzing borrowers' financial statements, and evaluating repayment capacity to determine creditworthiness. Both roles require strong analytical skills, attention to detail, and proficiency in financial statement analysis, but equity analysts emphasize market trends while credit analysts prioritize risk management and debt analysis.

Analytical Tools and Methodologies

Equity analysts primarily utilize discounted cash flow (DCF) models, price-earnings (P/E) ratios, and market sentiment analysis to evaluate stock valuations and forecast company growth potential. Credit analysts rely on credit scoring models, debt-service coverage ratios (DSCR), and liquidity assessments to determine borrower creditworthiness and default risk. Both roles leverage financial statements and ratio analysis but apply distinct methodologies tailored to equity performance versus credit risk evaluation.

Industry Sectors and Coverage Areas

Equity analysts primarily focus on industry sectors such as technology, healthcare, consumer goods, and energy, evaluating company performance to guide stock investment decisions. Credit analysts concentrate on assessing credit risk across sectors like banking, real estate, manufacturing, and utilities, examining debt instruments and borrower creditworthiness. Both roles require sector-specific expertise, but equity analysts emphasize market trends and earnings forecasts, while credit analysts prioritize credit ratings and financial stability within their coverage areas.

Risk Assessment Approaches

Equity analysts evaluate risk by examining market volatility, company earnings, growth potential, and industry trends to forecast stock price movements and investment returns. Credit analysts assess risk through in-depth analysis of a borrower's creditworthiness, including cash flow stability, debt levels, repayment history, and macroeconomic factors influencing default probability. Both roles utilize quantitative models and qualitative judgment but differ in focus: equity analysts prioritize market and operational risks, whereas credit analysts emphasize credit risk and financial solvency.

Performance Metrics and KPIs

Equity analysts primarily evaluate stock performance using metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) to assess company value and growth potential. Credit analysts focus on creditworthiness indicators including debt-to-equity ratio, interest coverage ratio, and credit score trends to determine a borrower's ability to meet financial obligations. Both roles utilize key performance indicators (KPIs) like default rates for credit analysts and analyst rating accuracy for equity analysts to measure the effectiveness of their financial assessments.

Career Progression and Opportunities

Equity analysts often progress into portfolio management or investment banking roles due to their deep focus on company performance and market trends, while credit analysts typically advance towards risk management or corporate lending positions, leveraging their expertise in creditworthiness assessment. Equity analysts develop strong skills in valuation and growth forecasting, opening opportunities in asset management and equity research leadership. Credit analysts gain in-depth knowledge of debt instruments and regulatory frameworks, which can lead to senior roles in credit risk strategy and financial consulting.

Compensation and Work Environment

Equity analysts typically earn higher average salaries, often ranging from $70,000 to $120,000 annually, reflecting the pressure to forecast market movements and make investment recommendations. Credit analysts, earning between $60,000 and $95,000, focus on assessing credit risk and financial stability of borrowers, working primarily in corporate finance or banking environments. Equity analysts often experience high-stress, fast-paced trading floors, whereas credit analysts enjoy more structured hours within risk management departments, contributing to a more balanced work environment.

Equity Analyst vs Credit Analyst Infographic

jobdiv.com

jobdiv.com