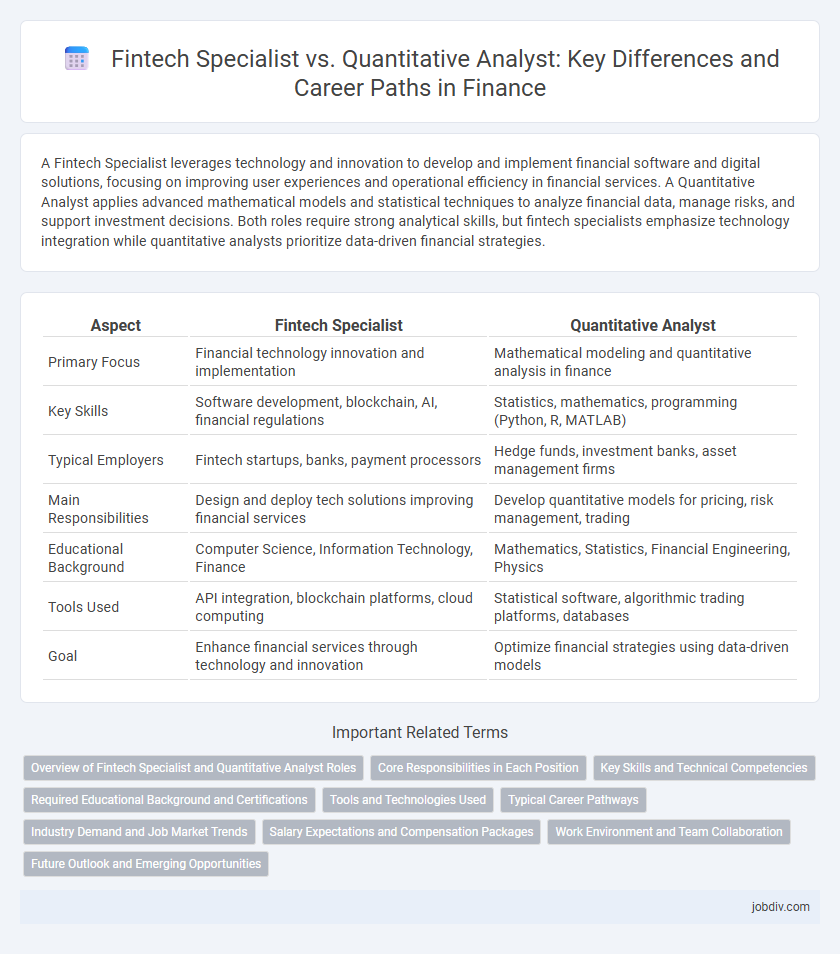

A Fintech Specialist leverages technology and innovation to develop and implement financial software and digital solutions, focusing on improving user experiences and operational efficiency in financial services. A Quantitative Analyst applies advanced mathematical models and statistical techniques to analyze financial data, manage risks, and support investment decisions. Both roles require strong analytical skills, but fintech specialists emphasize technology integration while quantitative analysts prioritize data-driven financial strategies.

Table of Comparison

| Aspect | Fintech Specialist | Quantitative Analyst |

|---|---|---|

| Primary Focus | Financial technology innovation and implementation | Mathematical modeling and quantitative analysis in finance |

| Key Skills | Software development, blockchain, AI, financial regulations | Statistics, mathematics, programming (Python, R, MATLAB) |

| Typical Employers | Fintech startups, banks, payment processors | Hedge funds, investment banks, asset management firms |

| Main Responsibilities | Design and deploy tech solutions improving financial services | Develop quantitative models for pricing, risk management, trading |

| Educational Background | Computer Science, Information Technology, Finance | Mathematics, Statistics, Financial Engineering, Physics |

| Tools Used | API integration, blockchain platforms, cloud computing | Statistical software, algorithmic trading platforms, databases |

| Goal | Enhance financial services through technology and innovation | Optimize financial strategies using data-driven models |

Overview of Fintech Specialist and Quantitative Analyst Roles

Fintech Specialists develop innovative financial technologies that enhance digital banking, payment systems, and blockchain applications, leveraging expertise in software development and user experience. Quantitative Analysts apply mathematical models, statistical techniques, and data analysis to interpret market trends, optimize trading strategies, and manage financial risks. Both roles drive value in finance by integrating technology with data-driven decision-making to improve operational efficiency and competitive advantage.

Core Responsibilities in Each Position

Fintech Specialists drive innovation by developing digital financial products, enhancing blockchain applications, and optimizing automated payment systems to improve customer experience. Quantitative Analysts apply advanced mathematical models, statistical techniques, and data analytics to assess market risks, price derivatives, and support algorithmic trading strategies. Their core responsibilities distinctly emphasize technology-driven product development for Fintech Specialists versus quantitative modeling and financial data analysis for Quantitative Analysts.

Key Skills and Technical Competencies

Fintech Specialists excel in blockchain technology, API integrations, and digital payment systems, leveraging strong programming skills in languages like Python and JavaScript to innovate financial services. Quantitative Analysts specialize in statistical modeling, risk management, and algorithmic trading, utilizing advanced proficiency in mathematical software such as MATLAB, R, and Python for data-driven decision-making. Both roles require robust analytical abilities, but Fintech Specialists focus more on technology development and product implementation, whereas Quantitative Analysts emphasize quantitative research and financial modeling.

Required Educational Background and Certifications

Fintech Specialists typically require a strong foundation in finance, computer science, or information technology, often holding degrees in Finance, Computer Science, or Business Administration, with certifications like CFA, FRM, or Certified FinTech Professional enhancing their credentials. Quantitative Analysts generally hold advanced degrees in quantitative disciplines such as Mathematics, Statistics, Physics, or Financial Engineering, supplemented by certifications like CFA, CQF (Certificate in Quantitative Finance), or PRM (Professional Risk Manager) that emphasize their expertise in mathematical modeling and data analysis. Both roles demand proficiency in programming languages, but Quantitative Analysts require deeper statistical and algorithmic expertise, while Fintech Specialists focus more on technology-driven financial innovation.

Tools and Technologies Used

Fintech specialists primarily leverage blockchain platforms, API integrations, and cloud-based financial software such as AWS and Azure to develop innovative digital banking solutions and payment systems. Quantitative analysts utilize statistical programming languages and tools like Python, R, MATLAB, and advanced algorithms implemented through machine learning frameworks to build predictive financial models and risk management systems. Both roles heavily rely on big data analytics and high-performance computing, but fintech specialists emphasize user experience and system scalability while quantitative analysts focus on mathematical precision and data-driven decision making.

Typical Career Pathways

Fintech specialists typically begin their careers in software development or product management within financial technology firms, advancing to roles in innovation strategy or fintech project leadership. Quantitative analysts often start with strong backgrounds in mathematics, statistics, or physics, entering financial institutions as junior quants before progressing to senior quantitative researcher or portfolio manager positions. Both career paths demand continuous skill development in data analytics, programming, and financial modeling to adapt to evolving market technologies.

Industry Demand and Job Market Trends

Fintech specialists experience growing demand driven by the rapid expansion of digital banking, blockchain technology, and AI-driven financial services reshaping the industry. Quantitative analysts remain crucial in hedge funds, asset management, and risk analytics, with their expertise in mathematical modeling and data analysis facilitating sophisticated investment strategies. Job market trends indicate fintech roles are proliferating in startups and traditional financial institutions adapting to digital transformation, while quantitative analysts sustain steady opportunities primarily in established finance hubs with a focus on algorithmic trading and quantitative research.

Salary Expectations and Compensation Packages

Fintech specialists typically command salaries ranging from $90,000 to $140,000 annually, with compensation packages often including performance bonuses and equity stakes in startups. Quantitative analysts generally earn between $110,000 and $180,000 per year, bolstered by substantial bonuses tied to trading performance and profit generation. Both roles offer competitive benefits, but quantitative analysts usually receive higher variable compensation due to the direct impact of their models on financial outcomes.

Work Environment and Team Collaboration

Fintech Specialists typically work in dynamic startup environments or innovative financial institutions where cross-functional collaboration with software developers, product managers, and marketing teams is essential to create user-centric financial solutions. Quantitative Analysts operate mainly within established banks, hedge funds, or investment firms, collaborating closely with traders, risk managers, and IT professionals to develop data-driven models for asset pricing and risk assessment. Both roles demand strong teamwork but differ in pace and focus, with Fintech Specialists emphasizing agile project cycles and innovation, while Quantitative Analysts prioritize precision and robust data analysis in high-stakes trading environments.

Future Outlook and Emerging Opportunities

Fintech Specialists are positioned to capitalize on the rapid expansion of digital banking, blockchain technologies, and AI-driven financial services, driving innovation in customer experience and regulatory compliance. Quantitative Analysts continue to see growing demand in algorithmic trading, risk management, and predictive modeling, especially with advancements in machine learning and big data analytics reshaping financial markets. Emerging opportunities for both roles include the integration of decentralized finance (DeFi) platforms, enhanced cybersecurity measures, and the development of sustainable finance models leveraging technology.

Fintech Specialist vs Quantitative Analyst Infographic

jobdiv.com

jobdiv.com