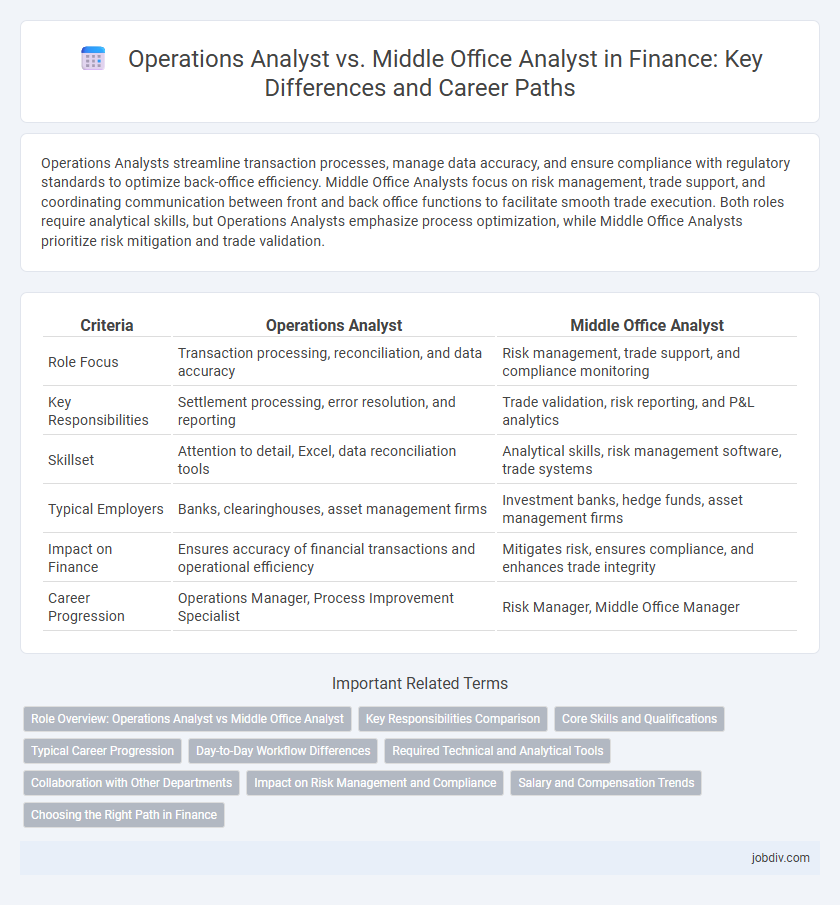

Operations Analysts streamline transaction processes, manage data accuracy, and ensure compliance with regulatory standards to optimize back-office efficiency. Middle Office Analysts focus on risk management, trade support, and coordinating communication between front and back office functions to facilitate smooth trade execution. Both roles require analytical skills, but Operations Analysts emphasize process optimization, while Middle Office Analysts prioritize risk mitigation and trade validation.

Table of Comparison

| Criteria | Operations Analyst | Middle Office Analyst |

|---|---|---|

| Role Focus | Transaction processing, reconciliation, and data accuracy | Risk management, trade support, and compliance monitoring |

| Key Responsibilities | Settlement processing, error resolution, and reporting | Trade validation, risk reporting, and P&L analytics |

| Skillset | Attention to detail, Excel, data reconciliation tools | Analytical skills, risk management software, trade systems |

| Typical Employers | Banks, clearinghouses, asset management firms | Investment banks, hedge funds, asset management firms |

| Impact on Finance | Ensures accuracy of financial transactions and operational efficiency | Mitigates risk, ensures compliance, and enhances trade integrity |

| Career Progression | Operations Manager, Process Improvement Specialist | Risk Manager, Middle Office Manager |

Role Overview: Operations Analyst vs Middle Office Analyst

Operations Analysts in finance focus on streamlining back-office processes such as trade settlements, reconciliations, and data management to ensure operational efficiency and reduce risk exposure. Middle Office Analysts bridge the gap between front-office trading activities and back-office operations by monitoring risk, validating trade data, and supporting compliance with regulatory standards. Both roles require strong analytical skills, but Operations Analysts emphasize process optimization while Middle Office Analysts prioritize risk assessment and control functions.

Key Responsibilities Comparison

Operations Analysts focus on transaction processing, reconciliation, and ensuring data accuracy across financial systems, emphasizing efficiency and error reduction in trade lifecycle management. Middle Office Analysts primarily handle risk assessment, trade support, and compliance monitoring by bridging front office activities with back office operations to ensure regulatory adherence and accurate reporting. Both roles require strong analytical skills but differ in scope, with Operations Analysts targeting operational integrity and Middle Office Analysts concentrating on risk and control frameworks within financial institutions.

Core Skills and Qualifications

Operations Analysts excel in data analysis, process improvement, and risk management, requiring strong proficiency in Excel, SQL, and financial software such as Bloomberg Terminal. Middle Office Analysts specialize in trade support, position management, and regulatory compliance, demanding expertise in trade lifecycle knowledge, reconciliation processes, and risk assessment tools. Both roles value analytical skills, attention to detail, and effective communication, but differ in focus areas and technical requirements specific to front-to-back office coordination.

Typical Career Progression

Operations Analysts typically advance into roles such as Senior Operations Analyst, Operations Manager, or Business Process Consultant, leveraging their expertise in transaction processing and workflow optimization. Middle Office Analysts often progress toward positions like Middle Office Manager, Risk Analyst, or Treasury Analyst, focusing on risk management, trade support, and regulatory compliance. Both career paths can lead to specialized roles in finance operations, risk assessment, or project management within investment banks and financial institutions.

Day-to-Day Workflow Differences

Operations Analysts handle trade settlements, reconciliations, and data management to ensure accurate transaction processing, while Middle Office Analysts focus on risk assessment, trade support, and compliance monitoring. Operations Analysts work closely with back-office teams to streamline transaction lifecycles, whereas Middle Office Analysts liaise between front-office and back-office to manage operational risks and validate trade details. The day-to-day workflow of Operations Analysts is more execution-focused, contrasting with the analytical and verification tasks predominant in the Middle Office Analyst role.

Required Technical and Analytical Tools

Operations Analysts require proficiency in SQL, Excel VBA, and ERP systems to optimize transaction processing and data management, while Middle Office Analysts emphasize skills in risk management software, Bloomberg Terminal, and advanced Excel modeling to support trade validation and compliance. Both roles demand strong analytical tools knowledge, but Operations Analysts focus more on workflow automation and data integrity, whereas Middle Office Analysts prioritize trade reconciliation and regulatory reporting accuracy. Expertise in Python and data visualization tools like Tableau is increasingly valuable across both positions for enhanced financial analysis and reporting.

Collaboration with Other Departments

Operations Analysts collaborate closely with risk management, IT, and trading desks to ensure seamless transaction processing and accurate data flow, enhancing operational efficiency and mitigating errors. Middle Office Analysts work alongside front office teams and compliance departments to monitor trade settlements and validate trade confirmations, ensuring adherence to regulatory standards and internal controls. Both roles require strong interdepartmental communication to maintain workflow continuity and support strategic decision-making.

Impact on Risk Management and Compliance

Operations Analysts play a critical role in risk management by ensuring accurate transaction processing and identifying discrepancies that could indicate operational risks, thereby supporting compliance with regulatory standards. Middle Office Analysts focus on validating trade data, monitoring risk exposure, and performing risk analytics to detect market or credit risk, directly influencing compliance reporting and adherence to internal risk policies. Both roles enhance overall financial institution stability by mitigating operational errors and ensuring regulatory compliance through meticulous data oversight.

Salary and Compensation Trends

Operations Analysts in finance generally command salaries ranging from $65,000 to $90,000 annually, with bonuses averaging 10-15% of base pay, reflecting their role in transaction processing and operational efficiency. Middle Office Analysts typically earn higher compensation, between $75,000 and $110,000 per year, supported by bonuses often exceeding 15%, attributable to their involvement in risk management and trade support functions. Salary trends indicate growing premiums for Middle Office Analysts due to increased regulatory demands and the need for advanced analytical skills in managing complex financial products.

Choosing the Right Path in Finance

Operations Analysts specialize in streamlining back-office processes, ensuring efficient trade settlements and risk management to support trading desks. Middle Office Analysts focus on monitoring trade compliance, risk assessment, and P&L analysis, acting as a bridge between front office and back office functions. Choosing the right path depends on your interest in process optimization and data accuracy versus risk evaluation and regulatory adherence within financial institutions.

Operations Analyst vs Middle Office Analyst Infographic

jobdiv.com

jobdiv.com