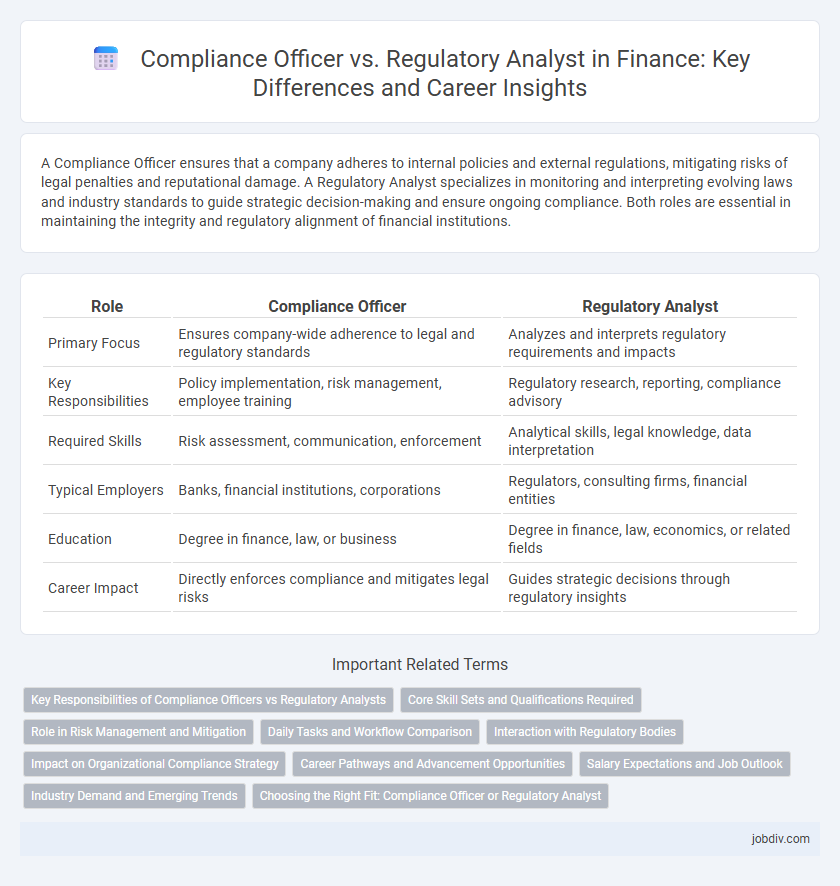

A Compliance Officer ensures that a company adheres to internal policies and external regulations, mitigating risks of legal penalties and reputational damage. A Regulatory Analyst specializes in monitoring and interpreting evolving laws and industry standards to guide strategic decision-making and ensure ongoing compliance. Both roles are essential in maintaining the integrity and regulatory alignment of financial institutions.

Table of Comparison

| Role | Compliance Officer | Regulatory Analyst |

|---|---|---|

| Primary Focus | Ensures company-wide adherence to legal and regulatory standards | Analyzes and interprets regulatory requirements and impacts |

| Key Responsibilities | Policy implementation, risk management, employee training | Regulatory research, reporting, compliance advisory |

| Required Skills | Risk assessment, communication, enforcement | Analytical skills, legal knowledge, data interpretation |

| Typical Employers | Banks, financial institutions, corporations | Regulators, consulting firms, financial entities |

| Education | Degree in finance, law, or business | Degree in finance, law, economics, or related fields |

| Career Impact | Directly enforces compliance and mitigates legal risks | Guides strategic decisions through regulatory insights |

Key Responsibilities of Compliance Officers vs Regulatory Analysts

Compliance Officers enforce internal policies and regulatory requirements to mitigate financial risks and ensure organizational adherence to laws such as AML and GDPR. Regulatory Analysts monitor legislative changes, assess their impact on business operations, and prepare detailed reports to guide strategic compliance decisions. Both roles require expertise in risk management, but Compliance Officers focus on implementation and enforcement, while Regulatory Analysts prioritize research and regulatory forecasting.

Core Skill Sets and Qualifications Required

Compliance Officers require strong knowledge of regulatory frameworks such as the Dodd-Frank Act and GDPR, along with skills in risk assessment, internal auditing, and policy implementation. Regulatory Analysts must possess expertise in analyzing complex financial regulations, interpreting legal documents, and conducting regulatory impact assessments, often requiring advanced degrees in finance, law, or economics. Both roles demand excellent analytical abilities, attention to detail, and proficiency in compliance software and data analytics tools to ensure adherence to evolving financial laws.

Role in Risk Management and Mitigation

Compliance Officers enforce internal policies and regulatory requirements to ensure organizational adherence, reducing legal and financial risks. Regulatory Analysts monitor evolving regulations and analyze their impact, enabling proactive risk identification and strategic mitigation planning. Both roles collaborate to create a comprehensive risk management framework that upholds regulatory compliance and minimizes potential liabilities.

Daily Tasks and Workflow Comparison

Compliance Officers conduct daily audits to ensure adherence to internal policies and regulatory standards, managing risk assessments and employee training programs. Regulatory Analysts focus on monitoring changes in financial regulations, analyzing the impact on organizational policies, and preparing detailed compliance reports for senior management. Both roles require collaboration with legal teams and regulatory bodies to maintain up-to-date compliance frameworks and mitigate potential violations.

Interaction with Regulatory Bodies

Compliance Officers maintain direct communication with regulatory bodies to ensure organizational adherence to laws and promptly address compliance issues. Regulatory Analysts interpret complex regulatory frameworks and convey critical updates to internal teams, often liaising with regulators to clarify guidelines and facilitate audits. Both roles require strong collaboration with government agencies to manage risks and uphold financial regulations effectively.

Impact on Organizational Compliance Strategy

A Compliance Officer ensures adherence to internal policies and external regulations, directly shaping the organizational compliance framework to mitigate risks and avoid legal penalties. A Regulatory Analyst interprets evolving regulatory requirements and analyzes their implications, enabling proactive adjustments in compliance strategies to maintain alignment with industry standards. Together, they form a critical synergy that strengthens regulatory oversight and enhances the effectiveness of compliance programs.

Career Pathways and Advancement Opportunities

Compliance Officers typically advance by gaining expertise in regulatory frameworks and risk management, often moving into senior compliance or chief compliance officer roles within financial institutions. Regulatory Analysts can progress into specialized roles such as regulatory affairs manager or policy advisor, leveraging their deep understanding of legislative requirements and impact assessments. Both career paths benefit from continuous professional development and certifications like CAMS or FRM to unlock higher-level leadership positions in finance compliance and regulatory strategy.

Salary Expectations and Job Outlook

Compliance Officers in finance typically earn a median salary ranging from $70,000 to $110,000 annually, with faster job growth driven by increasing regulatory scrutiny and corporate governance demands. Regulatory Analysts usually have a slightly lower salary bracket, averaging between $60,000 and $95,000, but benefit from steady job prospects due to ongoing changes in financial legislation and compliance requirements. Both roles offer strong career opportunities, with Compliance Officers often commanding higher pay due to broader responsibilities and leadership roles in risk management.

Industry Demand and Emerging Trends

Compliance Officers are increasingly sought after in financial institutions due to rising regulatory scrutiny and the need for robust risk management frameworks, with industry demand growing by 8% annually according to the U.S. Bureau of Labor Statistics. Regulatory Analysts are also gaining prominence, especially in fintech and cryptocurrency sectors where evolving regulations require continuous monitoring and analysis. Emerging trends highlight the integration of AI-driven compliance tools, enhancing the capabilities of both roles to address complex regulatory landscapes efficiently.

Choosing the Right Fit: Compliance Officer or Regulatory Analyst

Compliance Officers ensure an organization adheres to financial laws and internal policies, focusing on risk mitigation and maintaining ethical standards. Regulatory Analysts specialize in interpreting and analyzing regulatory changes to advise businesses on compliance strategies and regulatory impact. Selecting the right fit depends on whether a company needs proactive policy enforcement or detailed regulatory insight to navigate complex financial regulations.

Compliance Officer vs Regulatory Analyst Infographic

jobdiv.com

jobdiv.com