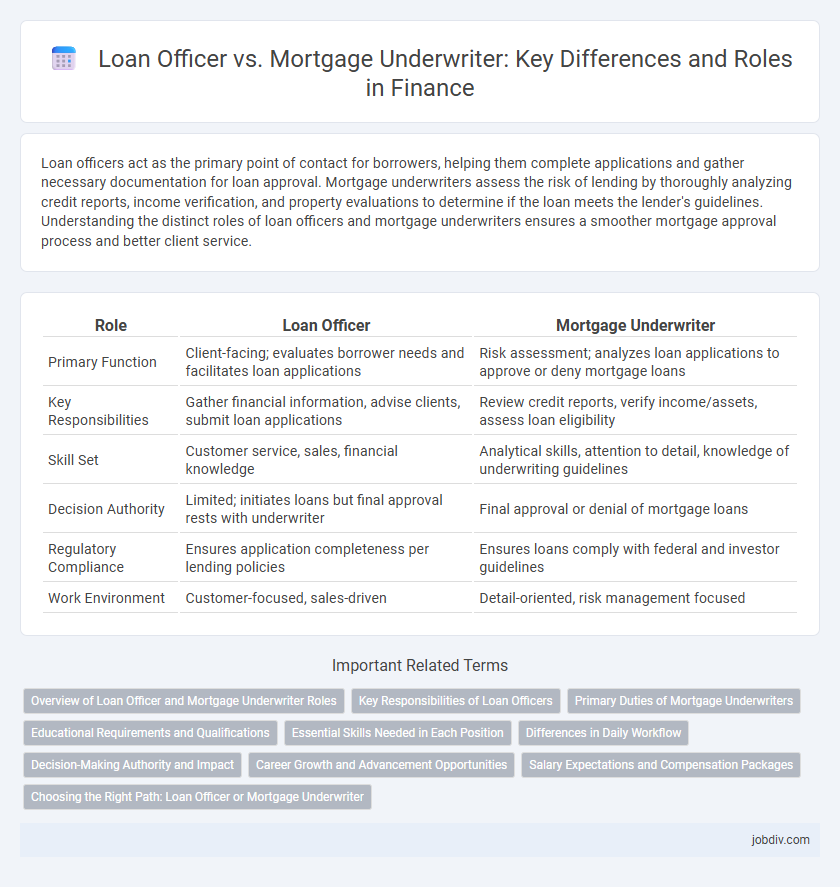

Loan officers act as the primary point of contact for borrowers, helping them complete applications and gather necessary documentation for loan approval. Mortgage underwriters assess the risk of lending by thoroughly analyzing credit reports, income verification, and property evaluations to determine if the loan meets the lender's guidelines. Understanding the distinct roles of loan officers and mortgage underwriters ensures a smoother mortgage approval process and better client service.

Table of Comparison

| Role | Loan Officer | Mortgage Underwriter |

|---|---|---|

| Primary Function | Client-facing; evaluates borrower needs and facilitates loan applications | Risk assessment; analyzes loan applications to approve or deny mortgage loans |

| Key Responsibilities | Gather financial information, advise clients, submit loan applications | Review credit reports, verify income/assets, assess loan eligibility |

| Skill Set | Customer service, sales, financial knowledge | Analytical skills, attention to detail, knowledge of underwriting guidelines |

| Decision Authority | Limited; initiates loans but final approval rests with underwriter | Final approval or denial of mortgage loans |

| Regulatory Compliance | Ensures application completeness per lending policies | Ensures loans comply with federal and investor guidelines |

| Work Environment | Customer-focused, sales-driven | Detail-oriented, risk management focused |

Overview of Loan Officer and Mortgage Underwriter Roles

Loan officers evaluate, authorize, or recommend approval of loan applications, acting as the primary client-facing representatives who assess financial information and guide borrowers through the loan process. Mortgage underwriters analyze loan applications in detail to determine risk and compliance, using credit, income, and asset documentation to ensure loans meet lender and regulatory standards. Both roles are critical in the lending process, with loan officers managing customer interaction and mortgage underwriters providing thorough risk assessment.

Key Responsibilities of Loan Officers

Loan officers evaluate borrowers' financial status by reviewing credit histories, income, and employment to determine loan eligibility. They guide clients through the application process, recommending appropriate loan products tailored to individual needs. Their role emphasizes customer interaction and initial risk assessment before the mortgage underwriter conducts in-depth loan verification.

Primary Duties of Mortgage Underwriters

Mortgage underwriters evaluate loan applications by analyzing credit reports, income statements, and property appraisals to assess borrower risk and ensure compliance with lending guidelines. They verify the accuracy of documentation and determine loan approval, modification, or denial based on detailed risk assessment criteria. Their primary responsibilities include validating financial information, assessing creditworthiness, and supporting lenders in making informed, compliant mortgage decisions.

Educational Requirements and Qualifications

Loan officers typically require a bachelor's degree in finance, business, or economics, along with strong interpersonal skills and knowledge of lending regulations. Mortgage underwriters often hold degrees in finance or accounting and must demonstrate expertise in risk assessment, credit analysis, and regulatory compliance. Certifications such as Certified Mortgage Underwriter (CMU) or knowledge of automated underwriting systems can enhance qualifications for mortgage underwriters.

Essential Skills Needed in Each Position

Loan officers require strong interpersonal skills, financial analysis capabilities, and in-depth knowledge of loan products to evaluate clients' financial situations and guide them through loan applications. Mortgage underwriters need exceptional attention to detail, risk assessment expertise, and proficiency in interpreting credit reports, income documentation, and property appraisals to determine loan eligibility. Both roles demand critical decision-making abilities and compliance with regulatory standards in the mortgage lending process.

Differences in Daily Workflow

Loan officers primarily engage with clients, assessing their financial needs, explaining loan options, and gathering necessary documentation during the application process. Mortgage underwriters analyze credit reports, verify income, and evaluate risk factors to determine loan eligibility and compliance with lending guidelines. While loan officers focus on client interaction and sales, underwriters concentrate on detailed risk assessment and decision-making within the financial institution.

Decision-Making Authority and Impact

Loan officers evaluate borrowers' financial information to approve or deny loan applications, directly influencing initial loan access and customer experience. Mortgage underwriters perform in-depth risk assessments and verify documentation to ensure regulatory compliance and mitigate default risks, impacting loan approval accuracy and institutional stability. Together, their decision-making authority balances customer acquisition with prudent risk management in the lending process.

Career Growth and Advancement Opportunities

Loan officers build client relationships and originate loans, gaining skills in sales and risk assessment that can lead to senior positions or branch management roles. Mortgage underwriters specialize in evaluating loan applications and financial documents, developing expertise critical for advancing to lead underwriter or compliance officer roles. Both career paths offer growth through certifications and experience, but loan officers often experience faster advancement due to client interaction and revenue-generating responsibilities.

Salary Expectations and Compensation Packages

Loan officers typically earn a base salary ranging from $45,000 to $70,000 annually, with commission and bonuses significantly boosting their total compensation, often surpassing $100,000 in high-performing markets. Mortgage underwriters, on the other hand, have a more stable salary range between $55,000 and $85,000, with fewer variable bonuses, reflecting their crucial role in risk assessment and loan approval. Compensation packages for loan officers emphasize sales incentives, whereas mortgage underwriters benefit from structured pay and job security in the finance sector.

Choosing the Right Path: Loan Officer or Mortgage Underwriter

Choosing the right path between a loan officer and a mortgage underwriter depends on your strengths and career goals within the finance industry. Loan officers excel in client-facing roles, evaluating borrower eligibility and guiding applicants through loan processes, while mortgage underwriters focus on risk assessment, scrutinizing loan applications to ensure compliance with lending standards. Understanding whether you prefer direct customer interaction or analytical review helps determine the best fit for a rewarding career in mortgage financing.

Loan Officer vs Mortgage Underwriter Infographic

jobdiv.com

jobdiv.com