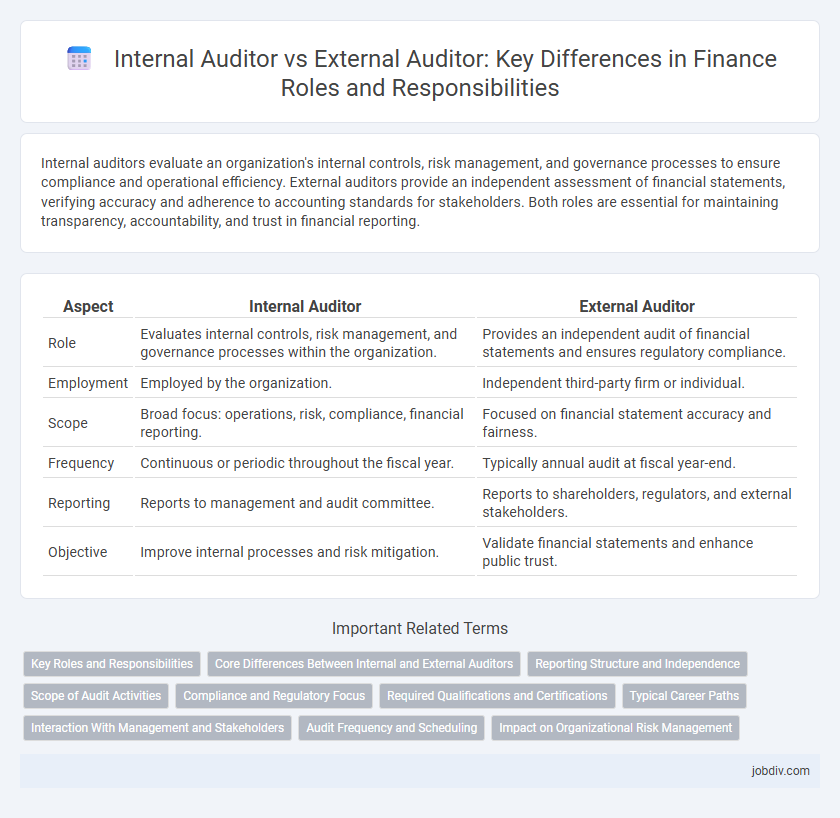

Internal auditors evaluate an organization's internal controls, risk management, and governance processes to ensure compliance and operational efficiency. External auditors provide an independent assessment of financial statements, verifying accuracy and adherence to accounting standards for stakeholders. Both roles are essential for maintaining transparency, accountability, and trust in financial reporting.

Table of Comparison

| Aspect | Internal Auditor | External Auditor |

|---|---|---|

| Role | Evaluates internal controls, risk management, and governance processes within the organization. | Provides an independent audit of financial statements and ensures regulatory compliance. |

| Employment | Employed by the organization. | Independent third-party firm or individual. |

| Scope | Broad focus: operations, risk, compliance, financial reporting. | Focused on financial statement accuracy and fairness. |

| Frequency | Continuous or periodic throughout the fiscal year. | Typically annual audit at fiscal year-end. |

| Reporting | Reports to management and audit committee. | Reports to shareholders, regulators, and external stakeholders. |

| Objective | Improve internal processes and risk mitigation. | Validate financial statements and enhance public trust. |

Key Roles and Responsibilities

Internal auditors evaluate and improve the effectiveness of risk management, control, and governance processes within an organization, conducting continuous audits and compliance assessments to enhance operational efficiency. External auditors provide independent verification of financial statements, ensuring accuracy and adherence to accounting standards and regulatory requirements for stakeholders such as investors and regulators. Both roles are critical in maintaining financial integrity, with internal auditors focusing on internal controls and processes, while external auditors emphasize external accountability and transparency.

Core Differences Between Internal and External Auditors

Internal auditors primarily focus on evaluating and improving an organization's internal controls, risk management, and governance processes to ensure operational efficiency and compliance, while external auditors provide an independent opinion on the accuracy and fairness of financial statements prepared by the company. Internal auditors are employed by the organization and conduct ongoing assessments throughout the year, whereas external auditors are independent third parties engaged periodically to validate financial reports for stakeholders and regulatory compliance. The core distinction lies in the scope and accountability: internal auditors support management in internal oversight, and external auditors serve shareholders and the public by ensuring transparency and reliability in financial disclosures.

Reporting Structure and Independence

Internal auditors report directly to the organization's audit committee or senior management, ensuring alignment with internal controls and risk management processes, while maintaining operational independence. External auditors, employed by an independent accounting firm, report to shareholders and regulatory bodies, emphasizing unbiased financial statement verification. The independence of external auditors is protected by strict regulatory frameworks, contrasting with internal auditors' embedded role within the company.

Scope of Audit Activities

Internal auditors focus on evaluating the effectiveness of internal controls, risk management, and governance processes within an organization, often covering operational, financial, and compliance areas. External auditors primarily assess the accuracy and fairness of an entity's financial statements and compliance with accounting standards to provide an independent opinion. The scope of internal auditing is continuous and broad, while external auditing is periodic and specifically geared toward financial statement verification for stakeholders.

Compliance and Regulatory Focus

Internal auditors primarily focus on ensuring an organization's compliance with internal policies and regulatory requirements to mitigate risks and improve operational efficiency. External auditors concentrate on assessing the accuracy of financial statements and verifying adherence to statutory regulations, providing an independent evaluation for stakeholders. Both roles are integral to maintaining robust governance frameworks and ensuring regulatory compliance across financial operations.

Required Qualifications and Certifications

Internal auditors commonly hold certifications such as Certified Internal Auditor (CIA) and Certified Information Systems Auditor (CISA), emphasizing expertise in risk management, control, and internal processes. External auditors typically require Certified Public Accountant (CPA) credentials, highlighting proficiency in financial reporting, compliance, and auditing standards. Both roles demand a strong foundation in accounting principles, but internal auditors focus more on operational audits whereas external auditors concentrate on financial statement verification.

Typical Career Paths

Internal auditors often begin their careers in accounting or finance departments, progressing towards roles such as audit manager or compliance officer within an organization. External auditors typically start at public accounting firms, advancing to senior auditor, audit manager, and eventually partner positions. Both paths require strong expertise in financial reporting, risk assessment, and regulatory compliance, but internal auditors focus on organizational controls while external auditors emphasize independent financial statement verification.

Interaction With Management and Stakeholders

Internal auditors maintain continuous interaction with management to improve internal controls and operational efficiency, providing ongoing feedback and risk assessments. External auditors engage primarily with top management and board committees, such as the audit committee, to ensure financial statement accuracy and compliance with regulations. Both roles require effective communication with stakeholders to uphold transparency and trust in financial reporting.

Audit Frequency and Scheduling

Internal auditors conduct audits continuously throughout the fiscal year with flexible scheduling aligned to organizational risk assessments and operational needs. External auditors perform audits annually or bi-annually, following a fixed schedule dictated by regulatory requirements and financial reporting deadlines. The difference in audit frequency and scheduling ensures internal audits provide ongoing assurance, while external audits offer independent, periodic validation of financial statements.

Impact on Organizational Risk Management

Internal auditors provide continuous, in-depth evaluations of internal controls and risk management processes, enabling organizations to identify and mitigate operational and compliance risks proactively. External auditors conduct independent assessments of financial statements, enhancing stakeholder confidence and detecting material misstatements or fraud risks that impact financial reporting integrity. The combined efforts of internal and external auditors strengthen overall organizational risk governance and promote a robust control environment.

Internal Auditor vs External Auditor Infographic

jobdiv.com

jobdiv.com