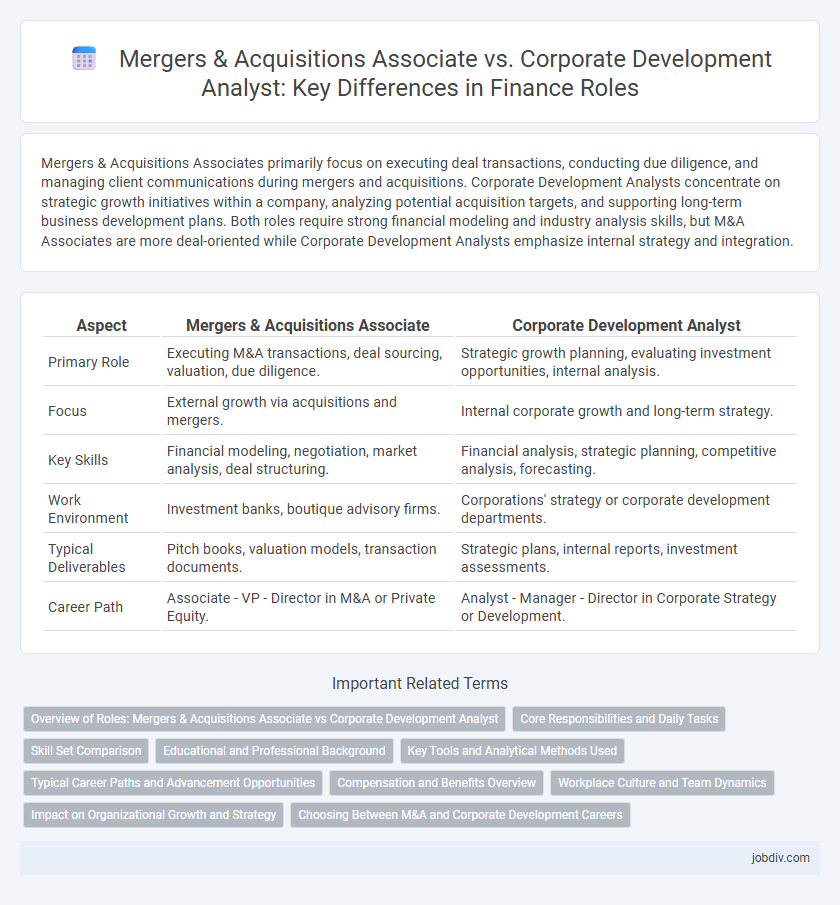

Mergers & Acquisitions Associates primarily focus on executing deal transactions, conducting due diligence, and managing client communications during mergers and acquisitions. Corporate Development Analysts concentrate on strategic growth initiatives within a company, analyzing potential acquisition targets, and supporting long-term business development plans. Both roles require strong financial modeling and industry analysis skills, but M&A Associates are more deal-oriented while Corporate Development Analysts emphasize internal strategy and integration.

Table of Comparison

| Aspect | Mergers & Acquisitions Associate | Corporate Development Analyst |

|---|---|---|

| Primary Role | Executing M&A transactions, deal sourcing, valuation, due diligence. | Strategic growth planning, evaluating investment opportunities, internal analysis. |

| Focus | External growth via acquisitions and mergers. | Internal corporate growth and long-term strategy. |

| Key Skills | Financial modeling, negotiation, market analysis, deal structuring. | Financial analysis, strategic planning, competitive analysis, forecasting. |

| Work Environment | Investment banks, boutique advisory firms. | Corporations' strategy or corporate development departments. |

| Typical Deliverables | Pitch books, valuation models, transaction documents. | Strategic plans, internal reports, investment assessments. |

| Career Path | Associate - VP - Director in M&A or Private Equity. | Analyst - Manager - Director in Corporate Strategy or Development. |

Overview of Roles: Mergers & Acquisitions Associate vs Corporate Development Analyst

Mergers & Acquisitions Associates primarily focus on deal execution, including financial modeling, due diligence, and coordinating with legal teams to facilitate transactions. Corporate Development Analysts concentrate on strategic growth initiatives within the company, performing market analysis, identifying acquisition targets, and supporting integration processes post-merger. Both roles require strong analytical skills but differ in their focus: M&A Associates work on external transaction processes, while Corporate Development Analysts drive internal strategic expansion.

Core Responsibilities and Daily Tasks

Mergers & Acquisitions Associates primarily focus on deal execution, including financial modeling, due diligence, and coordinating with legal teams to close transactions efficiently. Corporate Development Analysts concentrate on strategic growth initiatives by conducting market research, identifying acquisition targets, and supporting integration efforts post-merger. Both roles require strong analytical skills, but M&A Associates engage more deeply in transaction-specific activities, while Corporate Development Analysts emphasize long-term corporate strategy and internal project management.

Skill Set Comparison

Mergers & Acquisitions Associates specialize in financial modeling, valuation techniques, and deal execution skills with a strong emphasis on due diligence and negotiation strategies. Corporate Development Analysts focus on strategic analysis, market research, and integration planning to support long-term corporate growth initiatives. Both roles require proficiency in financial analysis and Excel, but M&A Associates typically need deeper expertise in transaction structuring while Corporate Development Analysts excel in cross-functional collaboration and strategic decision-making.

Educational and Professional Background

Mergers & Acquisitions Associates typically hold degrees in finance, economics, or business administration and often acquire certifications such as CFA or CPA, combined with investment banking or private equity experience. Corporate Development Analysts usually possess backgrounds in finance, accounting, or strategic management, with experience in corporate finance, strategic planning, or internal consulting within large corporations. Both roles demand strong analytical skills, financial modeling expertise, and a solid understanding of market dynamics, but M&A Associates often have more transaction-focused experience while Corporate Development Analysts emphasize strategic growth initiatives.

Key Tools and Analytical Methods Used

Mergers & Acquisitions Associates primarily utilize financial modeling, valuation techniques such as discounted cash flow (DCF) and precedent transactions, and due diligence tools to assess potential deals. Corporate Development Analysts focus on strategic analysis tools, including market research databases, scenario planning, and performance benchmarking software to support long-term growth initiatives. Both roles rely heavily on Excel, PowerPoint, and data visualization tools but differ in their emphasis on transaction execution versus internal strategic planning.

Typical Career Paths and Advancement Opportunities

Mergers & Acquisitions Associates typically progress from junior analyst roles to senior associate positions before advancing to vice president and director roles within investment banks or boutique advisory firms. Corporate Development Analysts often transition internally within their organizations, moving from analyst to manager and then to director or vice president roles, focusing on strategic growth initiatives and acquisitions. Both career paths offer advancement opportunities, but M&A roles emphasize deal execution expertise while corporate development prioritizes strategic planning and long-term organizational growth.

Compensation and Benefits Overview

Mergers & Acquisitions Associates typically receive higher base salaries and larger annual bonuses compared to Corporate Development Analysts, reflecting the intense deal-making environment and transaction-driven responsibilities. Corporate Development Analysts benefit from more stable compensation with attractive long-term incentives such as stock options and performance-based equity awards tied to company growth. Both roles often include comprehensive benefits packages covering health insurance, retirement plans, and professional development allowances, but the M&A path usually offers faster compensation growth linked to deal closures.

Workplace Culture and Team Dynamics

Mergers & Acquisitions Associates often operate in high-pressure environments with a focus on deal execution, fostering a culture of rapid decision-making and cross-functional collaboration. Corporate Development Analysts typically experience a more strategic and integrated workplace culture, emphasizing long-term planning and close alignment with executive teams. Team dynamics in M&A prioritize agility and responsiveness, while Corporate Development teams value sustained communication and internal partnership building.

Impact on Organizational Growth and Strategy

Mergers & Acquisitions Associates primarily drive organizational growth by identifying, evaluating, and executing acquisition opportunities that align with strategic expansion goals, directly influencing market positioning and competitive advantage. Corporate Development Analysts focus on internal strategic analysis and long-term planning, supporting growth through data-driven insights that optimize resource allocation and business portfolio management. Both roles critically shape corporate strategy, with M&A Associates leaning towards external growth opportunities and Corporate Development Analysts reinforcing internal strategic initiatives.

Choosing Between M&A and Corporate Development Careers

Mergers & Acquisitions Associates primarily work on executing transactions, including deal sourcing, due diligence, and financial modeling, often within investment banks or advisory firms. Corporate Development Analysts focus on strategic growth initiatives, internal company acquisitions, and integration processes, emphasizing long-term value creation within a corporation. Choosing between these careers depends on your preference for deal-driven, fast-paced environments versus strategic, operational roles that shape corporate growth trajectories.

Mergers & Acquisitions Associate vs Corporate Development Analyst Infographic

jobdiv.com

jobdiv.com