Corporate finance centers on managing a company's capital structure, budgeting, and financial planning to maximize shareholder value and ensure long-term growth. Investment banking specializes in raising capital through underwriting, mergers and acquisitions, and advisory services for corporations, institutions, and governments. Both fields drive financial strategy but differ in scope, with corporate finance focusing inward on operational efficiency and investment banking targeting external market transactions.

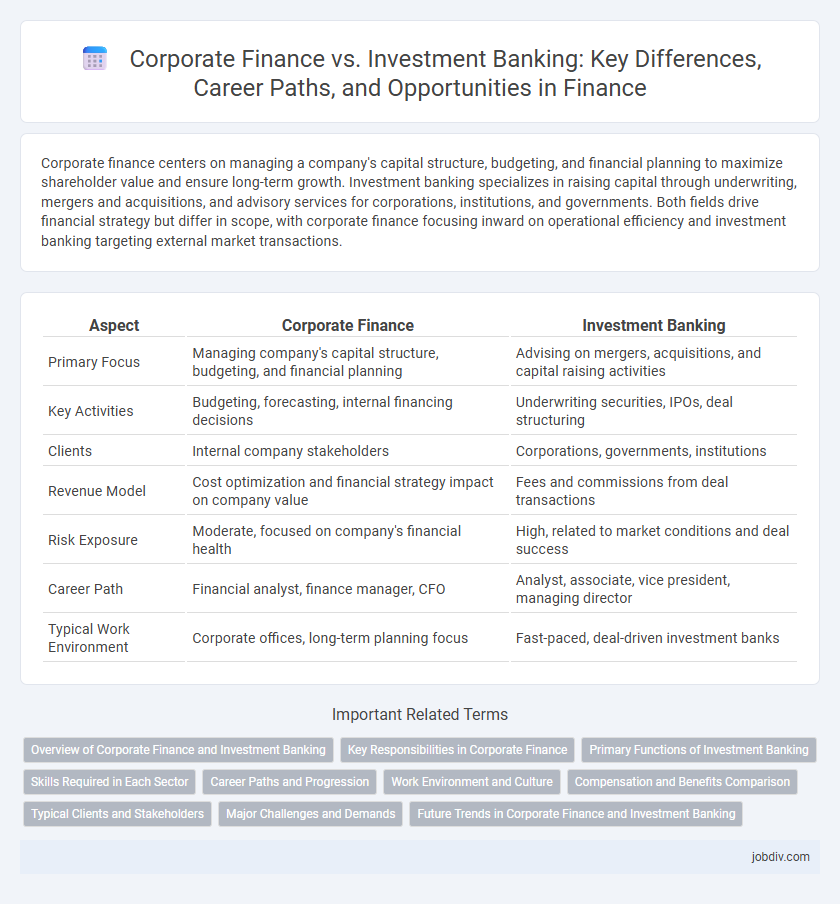

Table of Comparison

| Aspect | Corporate Finance | Investment Banking |

|---|---|---|

| Primary Focus | Managing company's capital structure, budgeting, and financial planning | Advising on mergers, acquisitions, and capital raising activities |

| Key Activities | Budgeting, forecasting, internal financing decisions | Underwriting securities, IPOs, deal structuring |

| Clients | Internal company stakeholders | Corporations, governments, institutions |

| Revenue Model | Cost optimization and financial strategy impact on company value | Fees and commissions from deal transactions |

| Risk Exposure | Moderate, focused on company's financial health | High, related to market conditions and deal success |

| Career Path | Financial analyst, finance manager, CFO | Analyst, associate, vice president, managing director |

| Typical Work Environment | Corporate offices, long-term planning focus | Fast-paced, deal-driven investment banks |

Overview of Corporate Finance and Investment Banking

Corporate finance centers on managing a company's capital structure, budgeting, and financial strategy to maximize shareholder value, involving activities like capital raising, mergers and acquisitions, and financial risk management. Investment banking specializes in underwriting securities, facilitating mergers and acquisitions, and providing advisory services for corporate clients seeking to raise funds or restructure assets. Both fields require expertise in financial analysis, valuation, and market dynamics but serve distinct roles in corporate financial management and capital markets.

Key Responsibilities in Corporate Finance

Corporate finance primarily focuses on managing a company's capital structure, budgeting, financial planning, and investment decisions to maximize shareholder value. Key responsibilities include evaluating funding options, analyzing financial risks, overseeing mergers and acquisitions, and ensuring effective cash flow management. Financial reporting and compliance with regulatory standards also play critical roles in corporate finance functions.

Primary Functions of Investment Banking

Investment banking primarily focuses on raising capital for corporations through underwriting and issuing securities such as stocks and bonds, facilitating mergers and acquisitions, and providing advisory services for complex financial transactions. These banks act as intermediaries between issuers of securities and the investing public, ensuring efficient capital markets and liquidity. Corporate finance, in contrast, involves managing a company's internal financial activities, including budgeting, capital structuring, and investment decisions.

Skills Required in Each Sector

Corporate finance professionals require strong analytical skills, proficiency in financial modeling, and expertise in budgeting and forecasting to manage a company's capital structure and optimize financial performance. Investment banking demands advanced valuation techniques, deal structuring abilities, and exceptional communication skills to facilitate mergers, acquisitions, and capital raising. Both sectors prioritize attention to detail and a deep understanding of financial markets but differ in their emphasis on strategic planning versus transaction execution.

Career Paths and Progression

Corporate finance careers typically focus on managing a company's capital structure, budgeting, and financial planning, offering progression from financial analyst to CFO. Investment banking career paths emphasize deal-making, mergers and acquisitions, and capital raising, often starting as analysts and moving up to associate, vice president, and managing director roles. Professionals in investment banking experience faster progression but face longer hours, while corporate finance roles provide more stability with steady advancement opportunities.

Work Environment and Culture

Corporate finance teams often work within a structured, collaborative environment emphasizing long-term financial planning, budgeting, and strategic decision-making to enhance company value. Investment banking cultures are typically fast-paced and high-pressure, driven by deal-making, client interactions, and rigorous deadlines, demanding strong resilience and adaptability. Both sectors value analytical skills, but corporate finance prioritizes internal alignment while investment banking centers around external market dynamics and transaction execution.

Compensation and Benefits Comparison

Corporate finance professionals typically receive stable salaries with moderate bonuses tied to company performance, while investment bankers often earn significantly higher base salaries complemented by substantial bonuses linked to deal closures and trading profits. Benefits in corporate finance tend to emphasize work-life balance perks and long-term incentives like stock options or retirement plans, contrasting with the more performance-driven incentives and commission structures prevalent in investment banking. Career progression in investment banking often leads to exponentially higher compensation, but at the cost of longer hours and higher pressure compared to the more predictable compensation trajectory in corporate finance.

Typical Clients and Stakeholders

Corporate finance primarily serves internal clients such as company executives, board members, and shareholders focused on managing capital structure, budgeting, and financial planning. Investment banking typically works with external clients including corporations, governments, and institutional investors to facilitate mergers and acquisitions, underwriting, and capital raising. Key stakeholders in corporate finance include CFOs and financial controllers, while investment banking involves bankers, analysts, and dealmakers committed to client advisory and execution.

Major Challenges and Demands

Corporate finance faces major challenges in managing capital structure, optimizing cash flow, and navigating regulatory compliance to ensure sustainable growth and shareholder value. Investment banking demands high analytical precision in valuation, risk assessment, and deal execution under intense market volatility and competitive pressure. Both sectors require advanced financial modeling skills, strategic decision-making, and adaptability to rapid economic changes.

Future Trends in Corporate Finance and Investment Banking

Future trends in corporate finance emphasize the integration of artificial intelligence and blockchain technology to enhance financial decision-making and transparency. Investment banking is increasingly adopting sustainable finance practices and advanced data analytics to optimize deal structures and manage risks. Both sectors are expected to leverage digital transformation to improve client services and operational efficiency.

Corporate Finance vs Investment Banking Infographic

jobdiv.com

jobdiv.com