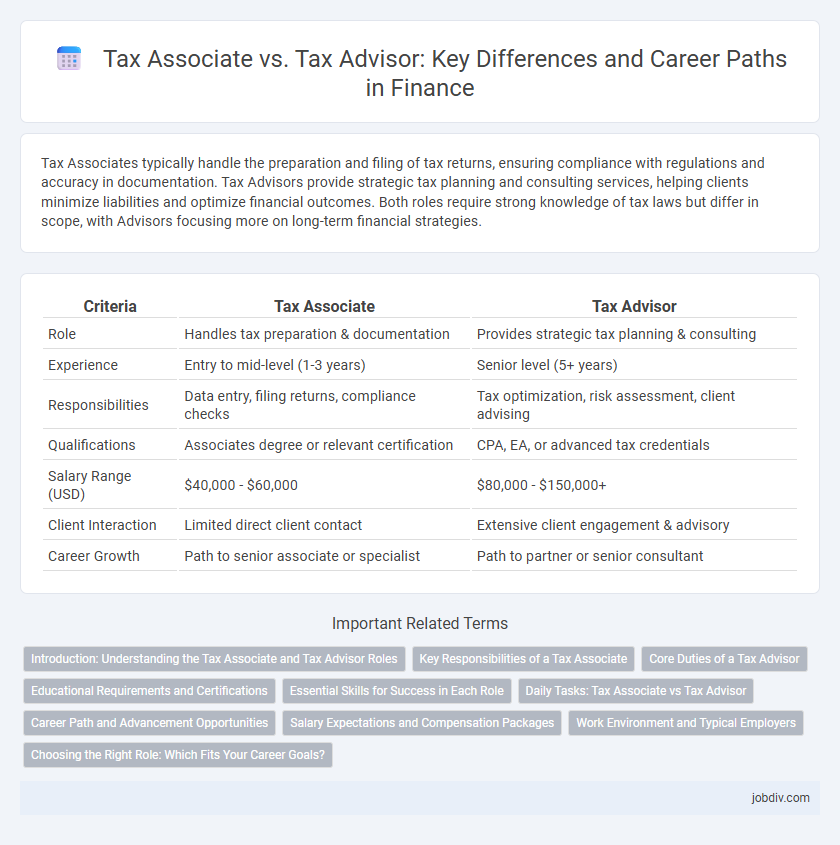

Tax Associates typically handle the preparation and filing of tax returns, ensuring compliance with regulations and accuracy in documentation. Tax Advisors provide strategic tax planning and consulting services, helping clients minimize liabilities and optimize financial outcomes. Both roles require strong knowledge of tax laws but differ in scope, with Advisors focusing more on long-term financial strategies.

Table of Comparison

| Criteria | Tax Associate | Tax Advisor |

|---|---|---|

| Role | Handles tax preparation & documentation | Provides strategic tax planning & consulting |

| Experience | Entry to mid-level (1-3 years) | Senior level (5+ years) |

| Responsibilities | Data entry, filing returns, compliance checks | Tax optimization, risk assessment, client advising |

| Qualifications | Associates degree or relevant certification | CPA, EA, or advanced tax credentials |

| Salary Range (USD) | $40,000 - $60,000 | $80,000 - $150,000+ |

| Client Interaction | Limited direct client contact | Extensive client engagement & advisory |

| Career Growth | Path to senior associate or specialist | Path to partner or senior consultant |

Introduction: Understanding the Tax Associate and Tax Advisor Roles

Tax Associates typically handle foundational tax preparation, data entry, and compliance tasks under supervision, supporting tax filing processes for individuals and businesses. Tax Advisors provide strategic guidance on tax planning, risk management, and regulatory interpretations, helping clients minimize liabilities and optimize financial outcomes. Both roles require proficiency in tax laws and software but differ in responsibility scope and client engagement levels.

Key Responsibilities of a Tax Associate

A Tax Associate primarily handles the preparation and review of tax returns, ensuring compliance with federal, state, and local tax regulations. They conduct detailed tax research and assist in identifying tax deductions and credits to optimize client tax liabilities. The role involves organizing financial documents and supporting senior tax professionals during audits and client consultations.

Core Duties of a Tax Advisor

Tax Advisors specialize in providing expert guidance on tax planning, compliance, and strategy to optimize clients' tax liabilities while ensuring adherence to regulatory requirements. Their core duties include analyzing complex tax laws, preparing detailed tax reports, advising on tax-efficient investments, and representing clients during tax audits or disputes. Unlike Tax Associates who primarily handle routine tax return preparation, Tax Advisors play a strategic role in financial decision-making and long-term tax management.

Educational Requirements and Certifications

Tax Associates typically require a bachelor's degree in accounting, finance, or a related field, with entry-level certification such as the Enrolled Agent (EA) or Certified Public Accountant (CPA) exam in progress. Tax Advisors usually hold advanced certifications like the CPA or Chartered Tax Professional (CTP), alongside extensive experience and specialized education in tax law and planning. Both roles benefit from ongoing continuing professional education (CPE) to stay current with evolving tax regulations and compliance standards.

Essential Skills for Success in Each Role

Tax Associates excel in foundational skills such as data analysis, tax preparation, and regulatory compliance, ensuring accuracy in filing and adherence to legal standards. Tax Advisors demonstrate advanced expertise in strategic tax planning, complex problem-solving, and client communication to optimize financial outcomes and minimize liabilities. Mastery of tax software, critical thinking, and up-to-date knowledge of tax laws are essential for both roles to succeed in the dynamic finance sector.

Daily Tasks: Tax Associate vs Tax Advisor

Tax Associates focus on preparing and reviewing tax returns, ensuring compliance with current tax laws, and conducting data entry and reconciliation of financial records. Tax Advisors analyze complex tax situations, provide strategic tax planning, advise on tax-saving opportunities, and assist clients with regulatory interpretations and tax dispute resolutions. Both roles require strong knowledge of tax codes, but Advisors emphasize consultative tasks while Associates handle transactional and compliance duties.

Career Path and Advancement Opportunities

Tax Associates typically start their careers handling compliance and preparation tasks, gaining foundational knowledge in tax laws and regulations. Tax Advisors often have advanced experience or certifications, enabling them to provide strategic tax planning and consulting services to clients. Career advancement for Tax Associates generally leads to roles such as Senior Tax Associate or Tax Advisor, while Tax Advisors may progress to senior consultancy positions, tax management, or specialized advisory roles within accounting firms or corporations.

Salary Expectations and Compensation Packages

Tax Associates typically earn an annual salary ranging from $45,000 to $65,000, with entry-level positions offering lower compensation and potential for bonuses based on firm performance. Tax Advisors command higher salaries, often between $70,000 and $120,000, reflecting their advanced expertise, client advisory roles, and experience in complex tax planning. Compensation packages for Tax Advisors frequently include performance bonuses, profit-sharing, and enhanced benefits such as stock options or retirement contributions, surpassing those available to Tax Associates.

Work Environment and Typical Employers

Tax Associates typically work in structured office settings within accounting firms, corporate tax departments, or government agencies, handling compliance and preparation tasks. Tax Advisors often operate in more client-facing environments such as consultancy firms, private practices, or financial advisory companies, providing strategic tax planning and personalized advice. Both roles may require collaboration with diverse teams, but Tax Advisors generally engage more frequently with high-net-worth individuals or businesses seeking tailored tax solutions.

Choosing the Right Role: Which Fits Your Career Goals?

Tax Associates typically handle detailed tax preparation and compliance tasks, ideal for individuals seeking hands-on experience in tax regulations and client data management. Tax Advisors focus on strategic tax planning and consulting, suited for those aiming to influence financial decisions and optimize tax strategies for businesses or high-net-worth individuals. Choosing the right role depends on whether your career goals emphasize technical tax expertise and operational duties or advisory skills and long-term financial impact.

Tax Associate vs Tax Advisor Infographic

jobdiv.com

jobdiv.com