A tax consultant offers strategic advice on tax planning and compliance to minimize liabilities, often working with complex financial scenarios and providing personalized guidance. In contrast, a tax accountant focuses primarily on preparing and filing tax returns, ensuring accuracy and adherence to tax laws. Both professionals play crucial roles in effective tax management but serve different functions within the financial landscape.

Table of Comparison

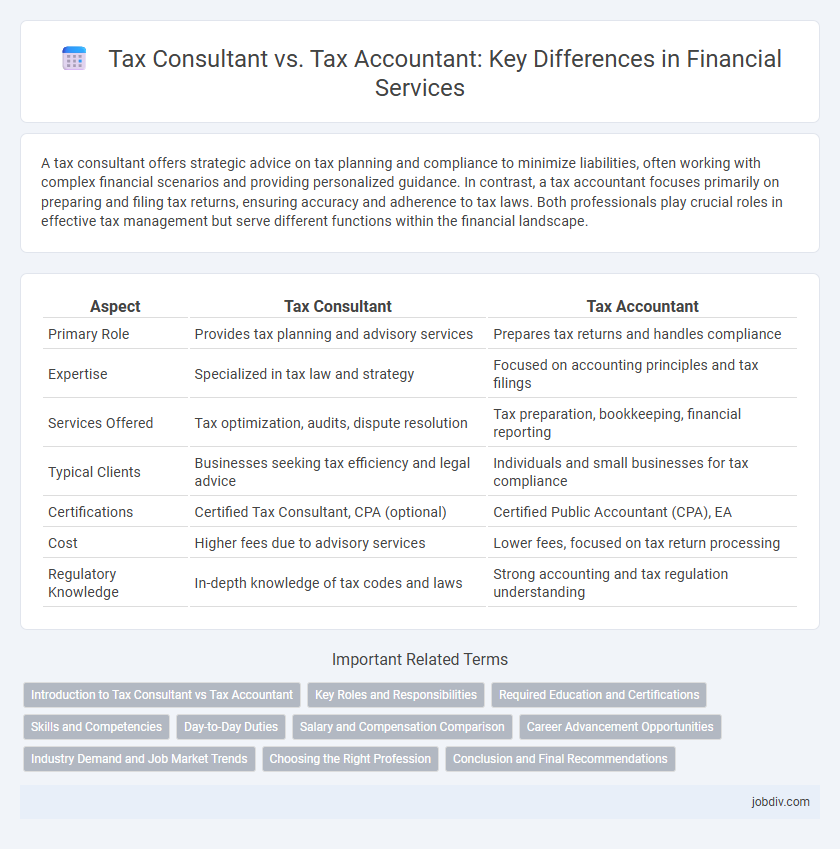

| Aspect | Tax Consultant | Tax Accountant |

|---|---|---|

| Primary Role | Provides tax planning and advisory services | Prepares tax returns and handles compliance |

| Expertise | Specialized in tax law and strategy | Focused on accounting principles and tax filings |

| Services Offered | Tax optimization, audits, dispute resolution | Tax preparation, bookkeeping, financial reporting |

| Typical Clients | Businesses seeking tax efficiency and legal advice | Individuals and small businesses for tax compliance |

| Certifications | Certified Tax Consultant, CPA (optional) | Certified Public Accountant (CPA), EA |

| Cost | Higher fees due to advisory services | Lower fees, focused on tax return processing |

| Regulatory Knowledge | In-depth knowledge of tax codes and laws | Strong accounting and tax regulation understanding |

Introduction to Tax Consultant vs Tax Accountant

A tax consultant specializes in providing strategic tax planning advice tailored to individual and business needs, focusing on minimizing tax liabilities and ensuring compliance with complex tax laws. Tax accountants handle the preparation, review, and filing of tax returns, maintaining accurate financial records to meet regulatory requirements. Both roles require strong knowledge of tax codes, but tax consultants emphasize advisory services, while tax accountants prioritize technical execution of tax reporting.

Key Roles and Responsibilities

Tax consultants specialize in providing strategic tax planning, compliance advice, and optimizing tax liabilities for individuals and businesses, often focusing on complex transactions and tax law interpretation. Tax accountants primarily handle the preparation, filing, and management of tax returns, ensuring accuracy and adherence to tax regulations while maintaining financial records. Both professionals play crucial roles in minimizing tax burdens, but tax consultants emphasize advisory services, whereas tax accountants focus on execution and reporting.

Required Education and Certifications

Tax consultants generally require a bachelor's degree in finance, accounting, or related fields, often complemented by certifications such as Certified Public Accountant (CPA) or Enrolled Agent (EA) to validate their expertise in tax law and advisory services. Tax accountants typically hold a degree in accounting or finance and pursue certifications like CPA or Chartered Accountant (CA), focusing on tax preparation, compliance, and financial record-keeping. Both roles demand thorough knowledge of tax regulations, but tax consultants prioritize advisory credentials, while tax accountants emphasize formal accounting qualifications.

Skills and Competencies

Tax consultants possess in-depth expertise in tax planning, compliance, and strategic advisory, leveraging strong analytical skills and up-to-date knowledge of tax laws and regulations. Tax accountants specialize in preparing accurate tax returns, managing financial records, and ensuring adherence to tax codes, requiring proficiency in accounting software and attention to detail. Both roles demand strong problem-solving abilities, communication skills, and an understanding of financial statements, but tax consultants typically engage in more complex tax strategy development.

Day-to-Day Duties

Tax consultants primarily offer strategic tax planning, advising clients on minimizing tax liabilities through deductions, credits, and compliance with tax laws. Tax accountants handle day-to-day tasks including preparing tax returns, maintaining financial records, and ensuring accurate tax filings for individuals or businesses. Both roles require deep knowledge of tax regulations, but tax accountants focus more on bookkeeping and documentation, while tax consultants specialize in advisory and planning services.

Salary and Compensation Comparison

Tax consultants typically earn an average salary ranging from $60,000 to $110,000 annually, while tax accountants generally have a salary range between $50,000 and $95,000, depending on experience and location. Compensation packages for tax consultants often include performance bonuses and client acquisition incentives, whereas tax accountants may receive benefits like retirement plans and paid leave as standard. Industry demand and certification credentials such as CPA or EA significantly influence salary variations in both professions.

Career Advancement Opportunities

Tax consultants often have broader career advancement opportunities due to their specialized advisory roles and involvement in strategic tax planning for businesses and high-net-worth clients. Tax accountants typically progress through structured paths in accounting firms or corporate finance departments, focusing on compliance and preparation of tax returns. Both careers offer pathways to senior roles, but tax consultants may leverage their expertise for consultancy firms, CFO positions, or entrepreneurship more frequently.

Industry Demand and Job Market Trends

Tax consultants are experiencing rising demand due to increasing corporate tax complexities and international tax law changes, making their advisory skills highly sought after in global markets. Tax accountants remain essential for compliance and reporting tasks, with steady job growth driven by regulatory updates and small-to-medium enterprise needs. Industry trends indicate a shift towards hybrid roles combining strategic tax planning expertise with traditional accounting functions to meet evolving business requirements.

Choosing the Right Profession

Choosing the right profession between a tax consultant and a tax accountant depends on your career goals and skill set, with tax consultants specializing in strategic tax planning and compliance, while tax accountants focus on preparing tax returns and maintaining financial records. Tax consultants often work with complex tax issues, providing advisory services to optimize tax liabilities, making them ideal for roles in corporate finance or advisory firms. Tax accountants excel in detailed financial reporting and tax filing accuracy, suited for accounting firms or in-house finance departments.

Conclusion and Final Recommendations

Tax consultants provide strategic tax planning and advisory services, while tax accountants focus on preparing and filing tax returns with accuracy and compliance. For businesses seeking proactive tax minimization and complex problem-solving, hiring a tax consultant is recommended. Companies prioritizing precise record-keeping and regulatory adherence should opt for a qualified tax accountant to ensure compliance and avoid penalties.

Tax Consultant vs Tax Accountant Infographic

jobdiv.com

jobdiv.com