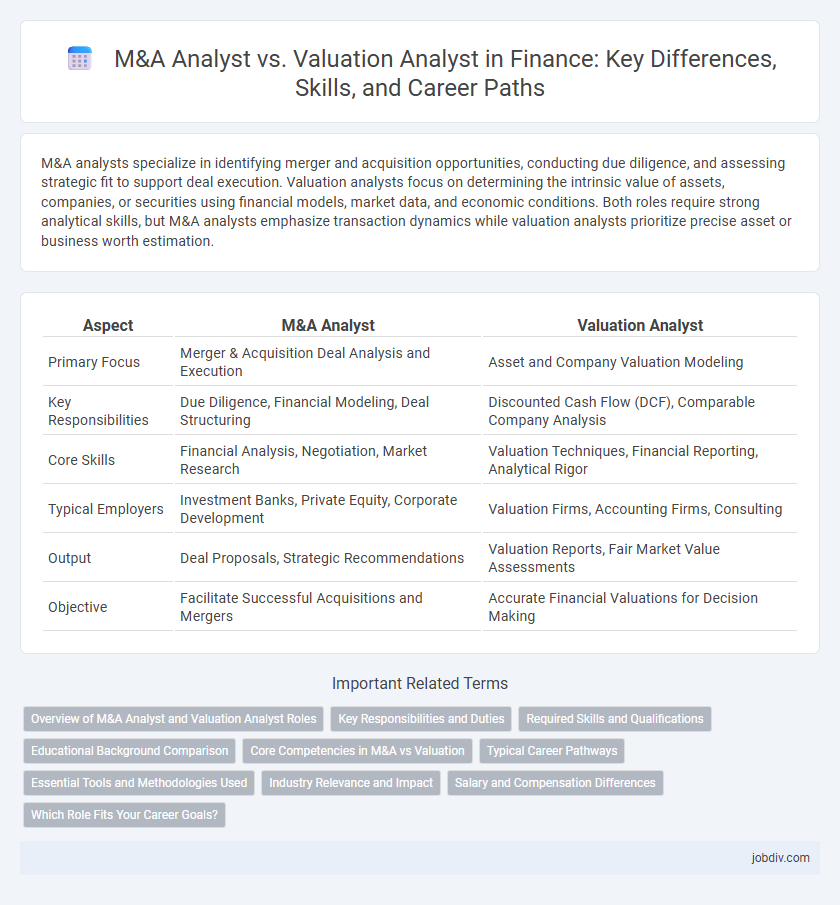

M&A analysts specialize in identifying merger and acquisition opportunities, conducting due diligence, and assessing strategic fit to support deal execution. Valuation analysts focus on determining the intrinsic value of assets, companies, or securities using financial models, market data, and economic conditions. Both roles require strong analytical skills, but M&A analysts emphasize transaction dynamics while valuation analysts prioritize precise asset or business worth estimation.

Table of Comparison

| Aspect | M&A Analyst | Valuation Analyst |

|---|---|---|

| Primary Focus | Merger & Acquisition Deal Analysis and Execution | Asset and Company Valuation Modeling |

| Key Responsibilities | Due Diligence, Financial Modeling, Deal Structuring | Discounted Cash Flow (DCF), Comparable Company Analysis |

| Core Skills | Financial Analysis, Negotiation, Market Research | Valuation Techniques, Financial Reporting, Analytical Rigor |

| Typical Employers | Investment Banks, Private Equity, Corporate Development | Valuation Firms, Accounting Firms, Consulting |

| Output | Deal Proposals, Strategic Recommendations | Valuation Reports, Fair Market Value Assessments |

| Objective | Facilitate Successful Acquisitions and Mergers | Accurate Financial Valuations for Decision Making |

Overview of M&A Analyst and Valuation Analyst Roles

M&A Analysts specialize in evaluating merger and acquisition opportunities by conducting financial modeling, due diligence, and market analysis to support strategic decision-making. Valuation Analysts focus on determining the intrinsic value of assets, companies, or securities using methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. Both roles require strong analytical skills and financial expertise, but M&A Analysts emphasize transaction execution while Valuation Analysts concentrate on precise asset valuation.

Key Responsibilities and Duties

M&A Analysts primarily focus on identifying merger and acquisition opportunities, conducting due diligence, and preparing detailed financial models to support deal decisions. Valuation Analysts specialize in determining the fair value of assets and companies using methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. Both roles require strong financial modeling skills, but M&A Analysts emphasize deal execution and strategic assessment, while Valuation Analysts concentrate on precision in asset valuation and financial reporting.

Required Skills and Qualifications

M&A Analysts require strong financial modeling, deal structuring, and negotiation skills with proficiency in Excel, PowerPoint, and financial databases like Capital IQ or Bloomberg. Valuation Analysts must possess expertise in discounted cash flow (DCF) analysis, market comparables, and accounting principles, alongside advanced skills in Excel and valuation software such as Valuation Workbook or FactSet. Both roles demand a solid understanding of corporate finance, strong analytical abilities, and often require a degree in finance, economics, or related fields, with certifications like CFA or CPA highly valued.

Educational Background Comparison

M&A analysts typically hold degrees in finance, business administration, or economics, emphasizing courses in corporate finance, financial modeling, and mergers and acquisitions. Valuation analysts often possess backgrounds in accounting, finance, or economics, with specialized training in asset valuation, financial statement analysis, and appraisal techniques. Both roles benefit from certifications such as CFA or CPA, which enhance expertise in financial analysis and valuation methodologies.

Core Competencies in M&A vs Valuation

M&A analysts excel in financial modeling, deal structuring, and strategic analysis to identify synergies and growth opportunities during mergers and acquisitions. Valuation analysts specialize in conducting detailed asset and business valuations using methodologies such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. Both roles require proficiency in Excel, financial statement analysis, and industry-specific knowledge, but M&A analysts emphasize transaction execution while valuation analysts focus on accurate asset appraisal.

Typical Career Pathways

M&A Analysts often progress towards roles in investment banking, private equity, or corporate development, leveraging deal execution experience and financial modeling skills. Valuation Analysts typically advance into specialized positions within corporate finance, strategic planning, or boutique valuation firms, focusing on asset appraisal and financial reporting expertise. Both career paths require strong analytical abilities, but M&A roles emphasize transaction execution while valuation paths prioritize in-depth asset and company valuation methodologies.

Essential Tools and Methodologies Used

M&A Analysts primarily utilize financial modeling, deal structuring tools, and merger simulation software to assess acquisition targets and synergies. Valuation Analysts rely on discounted cash flow (DCF) models, comparable company analysis (CCA), and precedent transaction analysis to determine asset or company value. Both roles employ Excel for detailed financial modeling, but M&A Analysts often integrate transaction databases like Capital IQ, while Valuation Analysts focus more on market data and valuation multiples.

Industry Relevance and Impact

M&A Analysts drive deal origination and execution, playing a crucial role in mergers, acquisitions, and corporate restructuring across industries such as private equity, investment banking, and consulting. Valuation Analysts specialize in assessing asset and company worth using financial modeling and market analysis, essential for making informed investment, litigation, and regulatory decisions in sectors like real estate, finance, and accounting. Both roles significantly influence strategic decision-making, with M&A Analysts impacting transaction outcomes and Valuation Analysts ensuring accurate financial assessments.

Salary and Compensation Differences

M&A Analysts typically earn higher base salaries, ranging from $70,000 to $120,000 annually, due to their involvement in deal execution and transaction management. Valuation Analysts generally have salaries between $60,000 and $100,000, reflecting their focus on financial modeling and asset appraisal. Bonus structures for M&A Analysts tend to be more lucrative, often constituting 20-50% of total compensation, whereas Valuation Analysts usually receive smaller performance-based bonuses around 10-25%.

Which Role Fits Your Career Goals?

M&A Analysts specialize in deal execution, financial modeling, and strategic assessment of mergers and acquisitions, ideal for those seeking dynamic, transaction-focused roles. Valuation Analysts concentrate on determining asset and company worth through in-depth market, financial, and risk analysis, suited for professionals aiming for precise financial appraisal expertise. Choosing between these roles depends on whether your career goals align more with high-stakes dealmaking or detailed valuation methodologies.

M&A Analyst vs Valuation Analyst Infographic

jobdiv.com

jobdiv.com