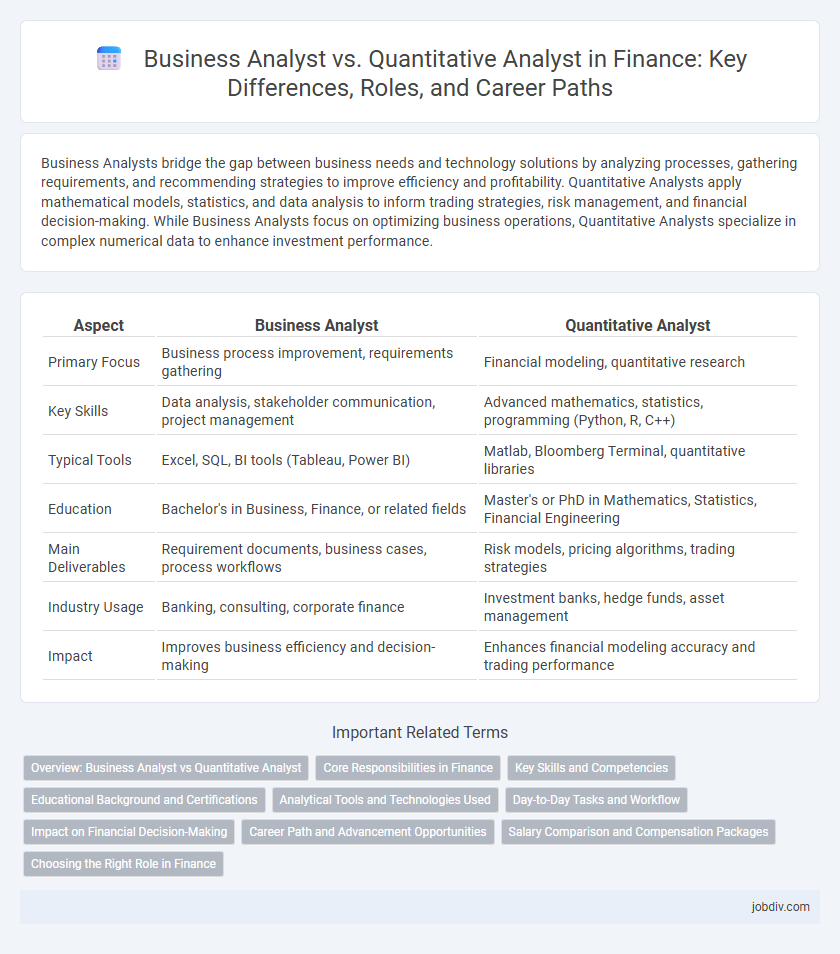

Business Analysts bridge the gap between business needs and technology solutions by analyzing processes, gathering requirements, and recommending strategies to improve efficiency and profitability. Quantitative Analysts apply mathematical models, statistics, and data analysis to inform trading strategies, risk management, and financial decision-making. While Business Analysts focus on optimizing business operations, Quantitative Analysts specialize in complex numerical data to enhance investment performance.

Table of Comparison

| Aspect | Business Analyst | Quantitative Analyst |

|---|---|---|

| Primary Focus | Business process improvement, requirements gathering | Financial modeling, quantitative research |

| Key Skills | Data analysis, stakeholder communication, project management | Advanced mathematics, statistics, programming (Python, R, C++) |

| Typical Tools | Excel, SQL, BI tools (Tableau, Power BI) | Matlab, Bloomberg Terminal, quantitative libraries |

| Education | Bachelor's in Business, Finance, or related fields | Master's or PhD in Mathematics, Statistics, Financial Engineering |

| Main Deliverables | Requirement documents, business cases, process workflows | Risk models, pricing algorithms, trading strategies |

| Industry Usage | Banking, consulting, corporate finance | Investment banks, hedge funds, asset management |

| Impact | Improves business efficiency and decision-making | Enhances financial modeling accuracy and trading performance |

Overview: Business Analyst vs Quantitative Analyst

Business Analysts specialize in bridging the gap between business needs and technological solutions by analyzing financial data, market trends, and organizational processes to recommend strategic improvements. Quantitative Analysts, often called quants, utilize advanced mathematical models, statistical techniques, and algorithmic trading strategies to assess financial risks and optimize investment portfolios. While Business Analysts focus on business operations and stakeholder communication, Quantitative Analysts concentrate on data-driven modeling and quantitative research within finance.

Core Responsibilities in Finance

A Business Analyst in finance primarily focuses on interpreting market trends, evaluating business processes, and providing actionable insights to improve decision-making and operational efficiency. A Quantitative Analyst specializes in developing complex mathematical models, risk assessments, and algorithmic trading strategies using statistical techniques and programming skills. Both roles require strong analytical capabilities but differ in emphasis, with Business Analysts targeting strategic solutions and Quantitative Analysts concentrating on data-driven financial modeling.

Key Skills and Competencies

Business Analysts excel in data interpretation, stakeholder communication, and requirement gathering to drive strategic decisions, emphasizing skills in qualitative analysis, project management, and business acumen. Quantitative Analysts specialize in mathematical modeling, statistical analysis, and programming languages such as Python and R to develop complex financial models and risk assessments. Both roles demand strong problem-solving abilities, but Quantitative Analysts require advanced expertise in algorithms and quantitative techniques, while Business Analysts prioritize market research and process optimization.

Educational Background and Certifications

Business Analysts in finance typically hold degrees in business administration, finance, or economics, with certifications such as Certified Business Analysis Professional (CBAP) enhancing their credentials. Quantitative Analysts often possess advanced degrees in mathematics, statistics, physics, or engineering, supported by certifications like the Financial Risk Manager (FRM) or Chartered Financial Analyst (CFA). The strong analytical and programming skills required for Quantitative Analysts contrast with the strategic and communication skills emphasized in Business Analyst training and certifications.

Analytical Tools and Technologies Used

Business Analysts commonly utilize tools such as Microsoft Excel, Tableau, and SQL for data visualization, reporting, and database querying, enhancing business decision-making processes. Quantitative Analysts rely heavily on programming languages like Python, R, and MATLAB, along with advanced statistical software and machine learning frameworks to develop complex financial models and algorithms. Both roles leverage data analytics platforms, but Quants focus more on quantitative modeling tools, whereas Business Analysts emphasize business intelligence and workflow optimization software.

Day-to-Day Tasks and Workflow

Business Analysts in finance primarily gather and analyze business requirements, develop process models, and facilitate communication between stakeholders to improve decision-making and operational efficiency. Quantitative Analysts focus on designing and implementing mathematical models, conducting statistical analysis, and optimizing trading strategies using programming languages like Python or R. While Business Analysts engage more in stakeholder management and requirement documentation, Quantitative Analysts work extensively with data sets, algorithms, and risk modeling to support quantitative finance functions.

Impact on Financial Decision-Making

Business Analysts influence financial decision-making by interpreting market trends and stakeholder requirements to guide strategic planning and operational improvements. Quantitative Analysts employ mathematical models and statistical techniques to forecast market behavior and assess risk, enabling data-driven investment decisions. Their combined expertise enhances accuracy and efficiency in portfolio management and financial forecasting.

Career Path and Advancement Opportunities

Business Analysts in finance typically advance by developing expertise in project management, stakeholder communication, and strategic planning, often progressing to roles like Senior Business Analyst or Product Manager. Quantitative Analysts focus on mathematical modeling, statistical analysis, and algorithm development, with career growth leading to positions such as Quantitative Researcher, Risk Manager, or Chief Quantitative Officer. Both paths offer opportunities in financial institutions, but Quantitative Analysts generally require advanced degrees in mathematics, statistics, or computer science, while Business Analysts benefit from certifications like CBAP and experience in business process optimization.

Salary Comparison and Compensation Packages

Business analysts in finance typically earn median salaries ranging from $70,000 to $110,000 annually, influenced by experience and industry, while quantitative analysts often command higher compensation, with median salaries between $90,000 and $140,000, driven by advanced mathematical and programming expertise. Compensation packages for quantitative analysts commonly include performance bonuses, stock options, and profit-sharing incentives, reflecting their critical role in risk assessment and algorithmic trading strategies. Business analysts receive competitive bonuses and benefits but generally have less variable pay compared to quants, whose packages align with the direct financial impact of their quantitative models.

Choosing the Right Role in Finance

Business Analysts in finance excel at bridging communication between stakeholders and technical teams, focusing on process improvements, requirements gathering, and strategic decision-making, while Quantitative Analysts specialize in developing mathematical models for pricing, risk management, and algorithmic trading using advanced statistical and programming skills. Selecting the right role depends on one's strengths: Business Analysts thrive on analytical thinking and interpersonal communication to drive business value, whereas Quantitative Analysts require strong quantitative, coding, and modeling expertise for data-driven financial strategies. Understanding career goals, skill sets, and interest in either finance operations or technical modeling is essential for making an informed choice between these roles.

Business Analyst vs Quantitative Analyst Infographic

jobdiv.com

jobdiv.com