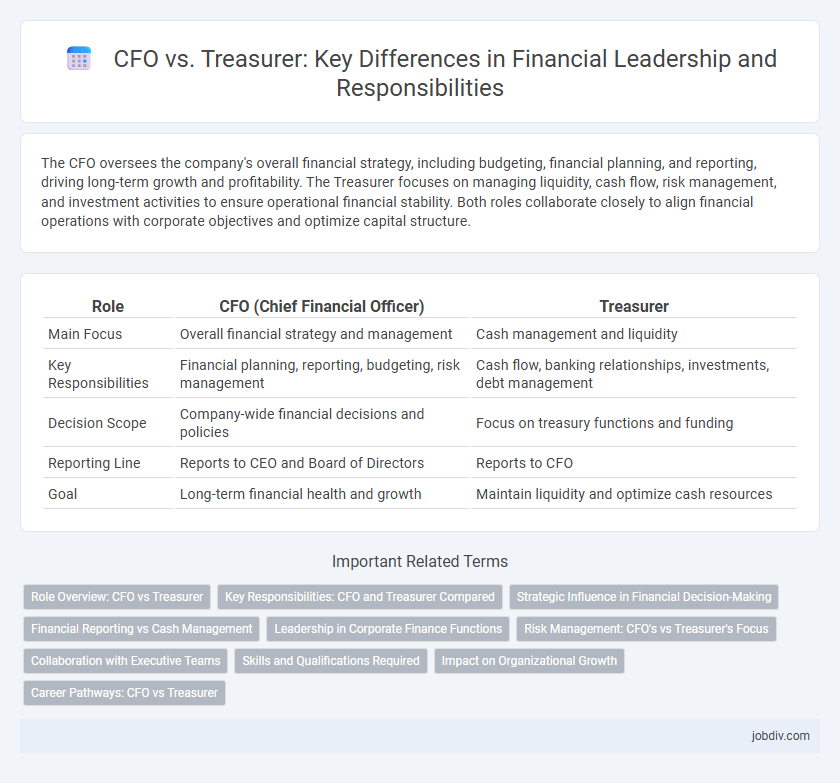

The CFO oversees the company's overall financial strategy, including budgeting, financial planning, and reporting, driving long-term growth and profitability. The Treasurer focuses on managing liquidity, cash flow, risk management, and investment activities to ensure operational financial stability. Both roles collaborate closely to align financial operations with corporate objectives and optimize capital structure.

Table of Comparison

| Role | CFO (Chief Financial Officer) | Treasurer |

|---|---|---|

| Main Focus | Overall financial strategy and management | Cash management and liquidity |

| Key Responsibilities | Financial planning, reporting, budgeting, risk management | Cash flow, banking relationships, investments, debt management |

| Decision Scope | Company-wide financial decisions and policies | Focus on treasury functions and funding |

| Reporting Line | Reports to CEO and Board of Directors | Reports to CFO |

| Goal | Long-term financial health and growth | Maintain liquidity and optimize cash resources |

Role Overview: CFO vs Treasurer

The CFO oversees the company's overall financial strategy, including budgeting, forecasting, financial reporting, and risk management, ensuring alignment with long-term business goals. The Treasurer manages cash flow, liquidity, banking relationships, and investment activities to maintain the organization's financial stability and optimize capital structure. While the CFO focuses on strategic financial planning and corporate finance, the Treasurer concentrates on day-to-day treasury operations and funding management.

Key Responsibilities: CFO and Treasurer Compared

The CFO oversees the company's overall financial strategy, including financial planning, risk management, and financial reporting to stakeholders. The Treasurer primarily manages cash flow, liquidity, and investment strategies, ensuring the company's funding needs are met efficiently. Both roles collaborate on capital structure decisions but differ in strategic scope and operational focus within corporate finance.

Strategic Influence in Financial Decision-Making

The CFO holds primary responsibility for strategic financial planning, budgeting, and forecasting, directly influencing long-term organizational growth and investment decisions. The Treasurer manages liquidity, risk, and capital structure, ensuring optimal cash flow and funding strategies to support financial stability. Both roles collaborate to align financial policies with corporate strategy, but the CFO typically drives overall financial vision and strategic impact.

Financial Reporting vs Cash Management

The CFO oversees comprehensive financial reporting, ensuring accuracy, regulatory compliance, and strategic financial planning to guide corporate decision-making. The Treasurer focuses on cash management, optimizing liquidity, managing banking relationships, and mitigating financial risk through effective cash flow forecasting. While both roles intersect in safeguarding the company's financial health, the CFO emphasizes external reporting and strategy, whereas the Treasurer prioritizes internal cash operations and funding.

Leadership in Corporate Finance Functions

The CFO leads overall financial strategy, risk management, and corporate reporting, driving long-term value creation and stakeholder communication. The Treasurer focuses on liquidity management, capital markets, and cash flow optimization, ensuring operational financial stability. Both roles collaborate to align financial leadership with corporate governance and strategic growth objectives.

Risk Management: CFO's vs Treasurer's Focus

The CFO primarily oversees enterprise-wide risk management, integrating financial, operational, and strategic risks to ensure long-term organizational stability. In contrast, the Treasurer focuses on liquidity risk and financial market exposures, managing cash flow, funding strategies, and investment risks to maintain optimal capital structure. Both roles collaborate to align risk mitigation with corporate financial goals and regulatory compliance.

Collaboration with Executive Teams

CFOs and Treasurers collaborate closely with executive teams to align financial strategy with overall business goals, ensuring optimal capital allocation and risk management. The CFO drives financial planning, reporting, and strategic decision-making, while the Treasurer focuses on liquidity management, funding, and financial risk mitigation. Effective partnership between both roles enhances corporate governance and supports sustainable growth initiatives.

Skills and Qualifications Required

CFOs require strong strategic leadership, financial analysis, and risk management skills, often supported by advanced degrees like an MBA or CPA certification. Treasurers need expertise in cash management, liquidity forecasting, and investment strategies, typically holding certifications such as Certified Treasury Professional (CTP). Both roles demand proficiency in financial software, regulatory compliance, and effective communication to align financial operations with corporate goals.

Impact on Organizational Growth

The CFO drives organizational growth by overseeing financial strategy, budgeting, and capital allocation to optimize resource deployment and maximize shareholder value. The Treasurer focuses on liquidity management, risk mitigation, and securing financing, ensuring the company maintains financial stability and operational flexibility. Together, their coordinated efforts enhance sustainable growth and long-term financial health.

Career Pathways: CFO vs Treasurer

CFOs typically follow a career pathway emphasizing strategic leadership, financial planning, and corporate governance, often progressing through roles such as controller or finance director. Treasurers usually advance by specializing in cash management, risk assessment, and capital structure, gaining experience in banking or treasury operations. Both career paths require strong financial expertise but diverge in focus areas, with CFOs overseeing broader financial strategy and Treasurers concentrating on liquidity and funding optimization.

CFO vs Treasurer Infographic

jobdiv.com

jobdiv.com