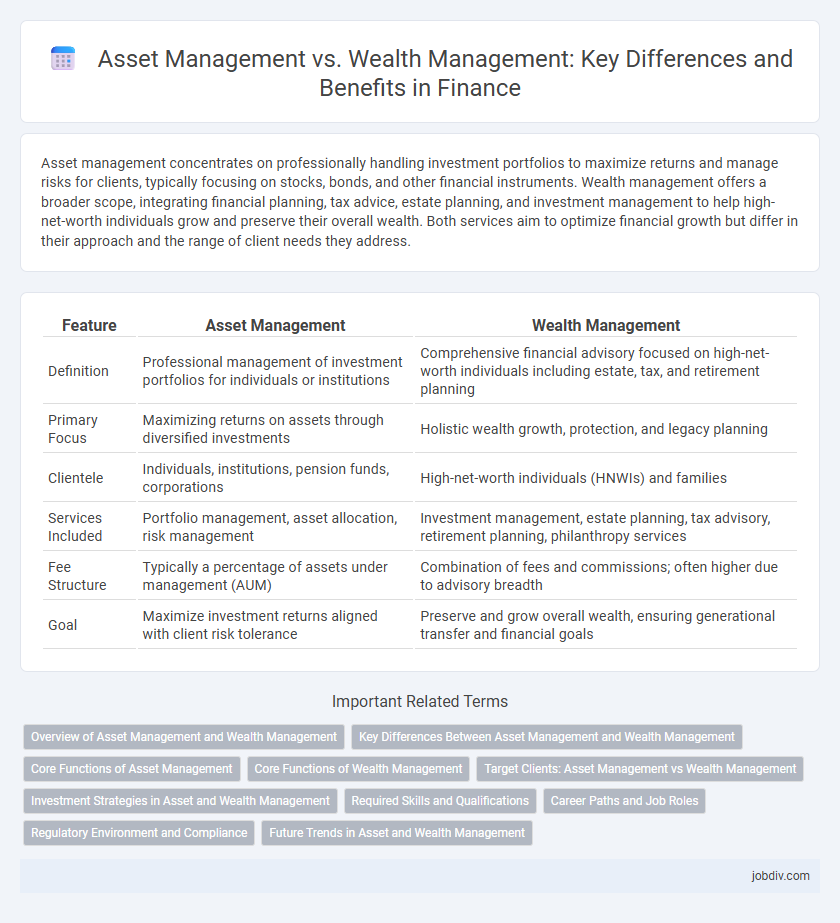

Asset management concentrates on professionally handling investment portfolios to maximize returns and manage risks for clients, typically focusing on stocks, bonds, and other financial instruments. Wealth management offers a broader scope, integrating financial planning, tax advice, estate planning, and investment management to help high-net-worth individuals grow and preserve their overall wealth. Both services aim to optimize financial growth but differ in their approach and the range of client needs they address.

Table of Comparison

| Feature | Asset Management | Wealth Management |

|---|---|---|

| Definition | Professional management of investment portfolios for individuals or institutions | Comprehensive financial advisory focused on high-net-worth individuals including estate, tax, and retirement planning |

| Primary Focus | Maximizing returns on assets through diversified investments | Holistic wealth growth, protection, and legacy planning |

| Clientele | Individuals, institutions, pension funds, corporations | High-net-worth individuals (HNWIs) and families |

| Services Included | Portfolio management, asset allocation, risk management | Investment management, estate planning, tax advisory, retirement planning, philanthropy services |

| Fee Structure | Typically a percentage of assets under management (AUM) | Combination of fees and commissions; often higher due to advisory breadth |

| Goal | Maximize investment returns aligned with client risk tolerance | Preserve and grow overall wealth, ensuring generational transfer and financial goals |

Overview of Asset Management and Wealth Management

Asset management involves the professional management of investment portfolios, including stocks, bonds, and other securities, aimed at achieving specific financial goals for individual or institutional clients. Wealth management offers a broader, holistic approach encompassing financial planning, tax strategies, estate planning, and investment advisory services tailored to high-net-worth individuals. Both services prioritize maximizing returns and preserving capital, but wealth management integrates a comprehensive understanding of the client's financial life beyond just investment management.

Key Differences Between Asset Management and Wealth Management

Asset management focuses primarily on managing investment portfolios and optimizing asset performance for institutional and individual clients. Wealth management offers a broader range of financial services, including investment planning, tax strategies, estate planning, and retirement solutions tailored to high-net-worth individuals. Key differences include the scope of services, client focus, and personalized financial planning intensity.

Core Functions of Asset Management

Asset management primarily focuses on the strategic allocation and optimization of investment portfolios to maximize returns and manage risks for clients. Core functions include asset selection, portfolio diversification, continuous performance monitoring, and rebalancing according to market conditions and client objectives. These processes ensure efficient capital growth and protection within institutional and individual investment frameworks.

Core Functions of Wealth Management

Wealth management primarily focuses on personalized financial planning, estate planning, tax optimization, and retirement strategies to preserve and grow individual or family wealth. It integrates investment management with tailored advisory services, addressing broader financial goals beyond asset allocation. Core functions include risk management, legacy planning, and coordination of legal and financial advisors to ensure holistic wealth preservation and transfer.

Target Clients: Asset Management vs Wealth Management

Asset management primarily targets institutional clients such as pension funds, corporations, and insurance companies, focusing on managing large-scale investment portfolios to maximize returns. Wealth management serves high-net-worth individuals (HNWIs) and families, providing personalized financial planning, estate planning, and investment advisory services. The distinction in target clients drives differences in service customization, regulatory requirements, and relationship management strategies.

Investment Strategies in Asset and Wealth Management

Investment strategies in asset management primarily focus on optimizing portfolio diversification, risk assessment, and maximizing returns across various asset classes such as equities, bonds, and real estate. Wealth management strategies emphasize personalized financial planning, integrating investment management with tax planning, estate planning, and retirement solutions tailored to individual client goals. Both disciplines deploy quantitative analysis and market research, but wealth management adopts a holistic approach to sustaining and growing an individual's comprehensive financial health.

Required Skills and Qualifications

Asset management requires strong analytical abilities, proficiency in financial modeling, and expertise in portfolio management to optimize investment performance. Wealth management demands comprehensive knowledge of tax planning, estate law, and personalized financial advising to address individual client needs. Both fields typically require certifications such as CFA for asset management and CFP for wealth management professionals.

Career Paths and Job Roles

Asset management careers emphasize portfolio analysis, investment strategies, and risk assessment to maximize client asset growth, involving roles such as portfolio managers, research analysts, and traders. Wealth management careers focus on comprehensive financial planning, estate, tax, and retirement strategies tailored to high-net-worth individuals, with job titles including wealth advisors, financial planners, and private client managers. Both fields require strong analytical skills and financial expertise but differ in client interaction intensity and service scope, influencing career progression and specialization opportunities.

Regulatory Environment and Compliance

Asset management firms primarily adhere to regulations such as the Investment Company Act of 1940 and the Dodd-Frank Act, focusing on fiduciary duties and reporting standards for pooled investment vehicles. Wealth management operates under a broader regulatory framework, including the Securities Exchange Act of 1934 and the Financial Industry Regulatory Authority (FINRA) rules, emphasizing personalized financial advice, anti-money laundering (AML) compliance, and suitability standards. Both sectors must comply with the Securities and Exchange Commission (SEC) regulations, but wealth management demands stricter client data protection and tailored compliance protocols due to its individualized service nature.

Future Trends in Asset and Wealth Management

Predictive analytics and artificial intelligence are transforming asset management by enabling more precise risk assessment and personalized investment strategies. Wealth management is increasingly integrating digital platforms to enhance client interaction and streamline portfolio customization. ESG investing and sustainable finance principles are driving growth, reflecting a shift toward responsible asset and wealth management practices.

Asset Management vs Wealth Management Infographic

jobdiv.com

jobdiv.com