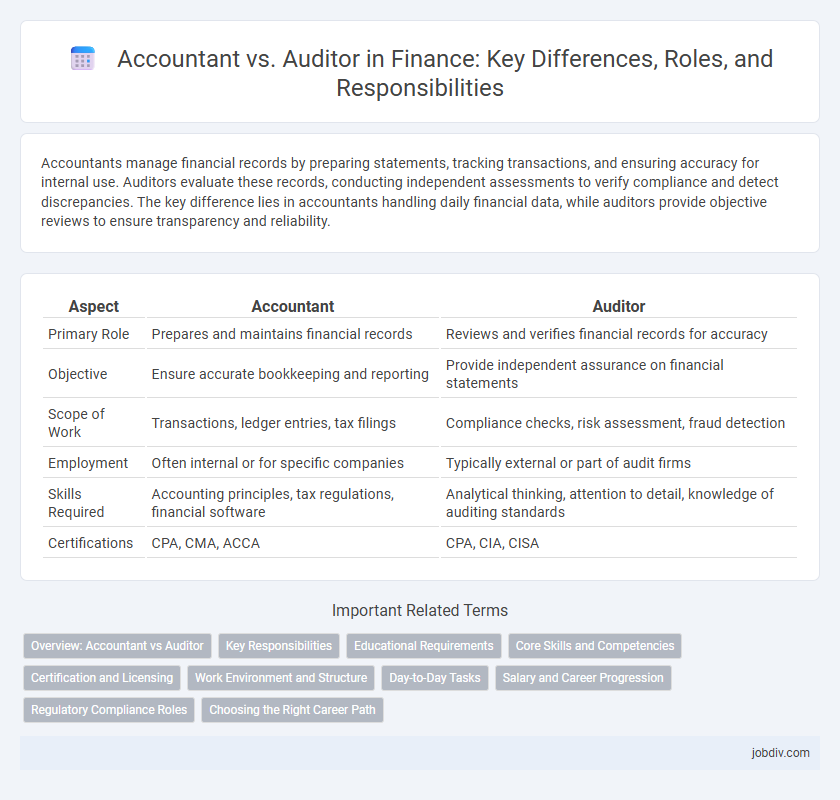

Accountants manage financial records by preparing statements, tracking transactions, and ensuring accuracy for internal use. Auditors evaluate these records, conducting independent assessments to verify compliance and detect discrepancies. The key difference lies in accountants handling daily financial data, while auditors provide objective reviews to ensure transparency and reliability.

Table of Comparison

| Aspect | Accountant | Auditor |

|---|---|---|

| Primary Role | Prepares and maintains financial records | Reviews and verifies financial records for accuracy |

| Objective | Ensure accurate bookkeeping and reporting | Provide independent assurance on financial statements |

| Scope of Work | Transactions, ledger entries, tax filings | Compliance checks, risk assessment, fraud detection |

| Employment | Often internal or for specific companies | Typically external or part of audit firms |

| Skills Required | Accounting principles, tax regulations, financial software | Analytical thinking, attention to detail, knowledge of auditing standards |

| Certifications | CPA, CMA, ACCA | CPA, CIA, CISA |

Overview: Accountant vs Auditor

Accountants manage financial records, prepare reports, and ensure compliance with accounting principles, focusing on accurate day-to-day financial data management. Auditors examine those financial records and reports to verify their accuracy, identify discrepancies, and assess internal controls, often providing assurance to stakeholders. While accountants primarily handle bookkeeping and reporting, auditors independently evaluate financial statements to ensure transparency and regulatory adherence.

Key Responsibilities

Accountants manage financial records, prepare budgets, and ensure accurate bookkeeping to support organizational decision-making and regulatory compliance. Auditors evaluate financial statements, assess internal controls, and verify the accuracy of accounting records to identify discrepancies and prevent fraud. Both roles require a strong understanding of accounting principles but differ in their focus on record management versus independent financial evaluation.

Educational Requirements

Accountants typically require a bachelor's degree in accounting or finance, often supplemented by certifications like CPA (Certified Public Accountant) to enhance their professional qualifications. Auditors usually hold similar educational backgrounds but may pursue additional specialized training in auditing standards and regulatory compliance, such as the CIA (Certified Internal Auditor) certification. Both roles demand strong knowledge in accounting principles, but auditors focus more on risk assessment and internal controls, necessitating targeted audit education.

Core Skills and Competencies

Accountants possess strong skills in financial reporting, bookkeeping, and tax preparation, with expertise in Generally Accepted Accounting Principles (GAAP) and accounting software such as QuickBooks and SAP. Auditors demonstrate competencies in risk assessment, internal controls evaluation, and compliance testing, often requiring proficiency in auditing standards like ISO 19011 and frameworks such as COSO. Both roles demand analytical thinking, attention to detail, and ethical judgment, but auditors emphasize independence and verification, whereas accountants focus on accurate record-keeping and financial data management.

Certification and Licensing

Accountants typically hold certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), which validate expertise in financial reporting, tax preparation, and management accounting. Auditors often require CPA certification as well, but may also pursue specialized credentials like CISA (Certified Information Systems Auditor) to emphasize proficiency in auditing information systems. Licensing requirements vary by jurisdiction but generally mandate passing rigorous exams and meeting continuing education standards to maintain professional credibility in both roles.

Work Environment and Structure

Accountants typically work within organizations, managing financial records, preparing reports, and ensuring regulatory compliance in office settings, often as part of a finance team. Auditors, on the other hand, operate in both internal and external environments, conducting independent evaluations of financial statements to verify accuracy and adherence to standards, frequently traveling to client sites. The structure for accountants generally involves routine office hours and consistent workflow, whereas auditors face project-based schedules with intensive periods during audit seasons.

Day-to-Day Tasks

Accountants manage financial records, preparing and maintaining ledgers, processing invoices, and handling payroll to ensure accurate transaction tracking. Auditors examine these financial documents, verifying compliance with regulations and detecting discrepancies through systematic review and testing of records. While accountants focus on recording and reporting financial data, auditors prioritize evaluating and validating the accuracy and integrity of those records.

Salary and Career Progression

Accountants typically earn an average salary ranging from $55,000 to $80,000 annually, with senior roles exceeding $100,000 depending on experience and certification. Auditors often command slightly higher salaries, averaging $60,000 to $90,000, due to specialized skills in financial compliance and risk assessment. Career progression for accountants includes advancement to managerial or CFO positions, while auditors may progress to senior audit manager or internal audit director roles, both offering lucrative growth opportunities in the finance industry.

Regulatory Compliance Roles

Accountants ensure financial records comply with applicable laws and accounting standards by preparing accurate financial statements and maintaining internal controls. Auditors independently evaluate organizations' financial reports to verify adherence to regulatory requirements, identifying discrepancies and potential risks. Both roles are crucial for regulatory compliance, with accountants managing internal processes and auditors providing external validation to maintain transparency and accountability.

Choosing the Right Career Path

Accountants manage financial records, prepare tax returns, and ensure compliance with regulations, ideal for those detail-oriented and interested in ongoing financial management. Auditors specialize in evaluating financial statements and internal controls to ensure accuracy and prevent fraud, suited for individuals who enjoy investigative work and risk assessment. Understanding the key responsibilities and skill sets of each role is essential for selecting a career path aligned with personal strengths and professional goals in finance.

Accountant vs Auditor Infographic

jobdiv.com

jobdiv.com