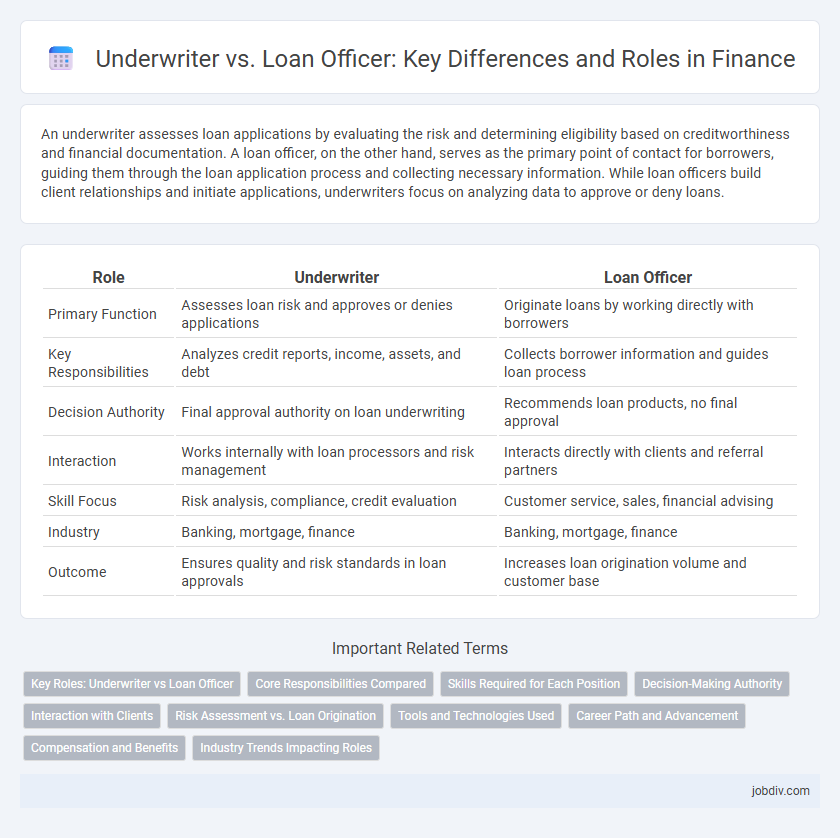

An underwriter assesses loan applications by evaluating the risk and determining eligibility based on creditworthiness and financial documentation. A loan officer, on the other hand, serves as the primary point of contact for borrowers, guiding them through the loan application process and collecting necessary information. While loan officers build client relationships and initiate applications, underwriters focus on analyzing data to approve or deny loans.

Table of Comparison

| Role | Underwriter | Loan Officer |

|---|---|---|

| Primary Function | Assesses loan risk and approves or denies applications | Originate loans by working directly with borrowers |

| Key Responsibilities | Analyzes credit reports, income, assets, and debt | Collects borrower information and guides loan process |

| Decision Authority | Final approval authority on loan underwriting | Recommends loan products, no final approval |

| Interaction | Works internally with loan processors and risk management | Interacts directly with clients and referral partners |

| Skill Focus | Risk analysis, compliance, credit evaluation | Customer service, sales, financial advising |

| Industry | Banking, mortgage, finance | Banking, mortgage, finance |

| Outcome | Ensures quality and risk standards in loan approvals | Increases loan origination volume and customer base |

Key Roles: Underwriter vs Loan Officer

Underwriters assess risk by thoroughly analyzing loan applications, credit reports, and financial documents to determine the borrower's eligibility for loan approval. Loan officers originate loans by guiding applicants through the application process, collecting necessary documentation, and evaluating initial creditworthiness. The underwriter's role emphasizes risk evaluation and decision-making, while the loan officer concentrates on client interaction and loan origination.

Core Responsibilities Compared

Underwriters evaluate loan applications by assessing credit risk, financial documentation, and compliance with lending guidelines to determine loan eligibility and terms. Loan officers originate loans by guiding applicants through the process, gathering necessary documents, and advising on suitable loan products based on borrower needs. The core responsibility of underwriters is risk assessment and approval, whereas loan officers focus on client interaction and loan origination.

Skills Required for Each Position

Underwriters require strong analytical skills, attention to detail, and expertise in risk assessment to evaluate loan applications accurately and ensure regulatory compliance. Loan officers need excellent interpersonal and communication skills, sales abilities, and a deep understanding of loan products to effectively guide clients through the borrowing process. Both roles demand proficiency in financial analysis, but underwriters emphasize data interpretation while loan officers focus on customer relationship management.

Decision-Making Authority

Underwriters possess the primary decision-making authority to evaluate loan applications by assessing risk and determining approval or denial based on creditworthiness and compliance with lending guidelines. Loan officers serve as intermediaries who gather client information, initiate applications, and offer preliminary guidance but ultimately rely on underwriters for final loan decisions. The division of responsibilities ensures risk management and regulatory adherence within financial institutions.

Interaction with Clients

Underwriters primarily assess risk by evaluating financial documents and credit histories, interacting indirectly with clients through loan officers rather than direct communication. Loan officers serve as the main point of contact, gathering client information, explaining loan options, and guiding applicants through the approval process. This client-facing role enhances customer experience and facilitates smoother loan origination by bridging communication between borrowers and underwriters.

Risk Assessment vs. Loan Origination

Underwriters specialize in risk assessment by analyzing creditworthiness, income stability, and collateral value to determine loan approval probabilities. Loan officers focus on loan origination by interacting directly with applicants, gathering documentation, and guiding borrowers through the application process. While underwriters evaluate financial risk and compliance, loan officers drive customer relationships and initial loan processing.

Tools and Technologies Used

Underwriters leverage advanced risk assessment software, AI-driven predictive analytics, and automated credit scoring systems to evaluate loan applications thoroughly. Loan officers use customer relationship management (CRM) platforms, digital application portals, and communication tools to facilitate client interactions and streamline the loan origination process. Integration of these technologies enhances accuracy, efficiency, and compliance in lending operations.

Career Path and Advancement

Underwriters analyze risk and determine loan approval by evaluating financial documents and creditworthiness, often requiring strong analytical skills and experience in finance or statistics. Loan officers build relationships with clients, guide them through application processes, and typically gain advancement by developing sales expertise and client management abilities. Career paths for underwriters may progress into senior risk management or credit analysis roles, while loan officers often advance to senior lending positions or branch management.

Compensation and Benefits

Underwriters typically earn a median annual salary of $73,000, with bonuses tied to accuracy and efficiency in risk assessment, while loan officers average around $63,000, often benefiting from commission-based compensation linked to loan origination volume. Benefits for underwriters often include comprehensive health plans, retirement contributions, and professional development allowances, reflecting their technical expertise and risk management roles. Loan officers may receive flexible schedules and client incentive bonuses, aligning with their sales-oriented responsibilities and direct client interactions.

Industry Trends Impacting Roles

Underwriters increasingly leverage artificial intelligence and machine learning to enhance risk assessment accuracy and streamline loan approval workflows. Loan officers focus on personalized customer interactions, integrating digital platforms to meet growing borrower expectations for speed and transparency. The rise of fintech disruptors drives both roles toward greater collaboration and technology adoption within traditional financial institutions.

Underwriter vs Loan Officer Infographic

jobdiv.com

jobdiv.com