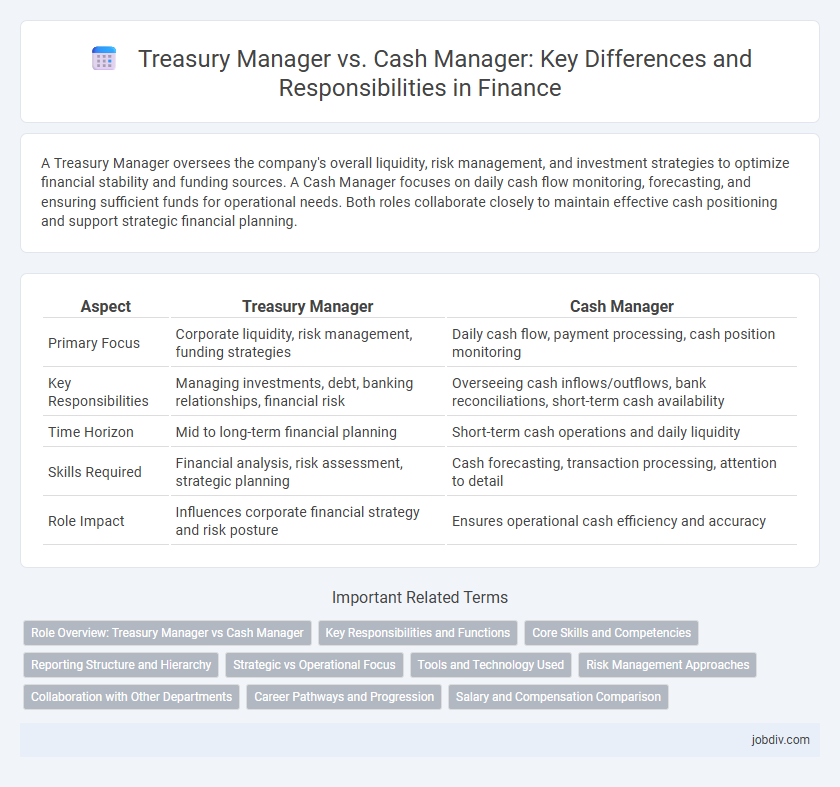

A Treasury Manager oversees the company's overall liquidity, risk management, and investment strategies to optimize financial stability and funding sources. A Cash Manager focuses on daily cash flow monitoring, forecasting, and ensuring sufficient funds for operational needs. Both roles collaborate closely to maintain effective cash positioning and support strategic financial planning.

Table of Comparison

| Aspect | Treasury Manager | Cash Manager |

|---|---|---|

| Primary Focus | Corporate liquidity, risk management, funding strategies | Daily cash flow, payment processing, cash position monitoring |

| Key Responsibilities | Managing investments, debt, banking relationships, financial risk | Overseeing cash inflows/outflows, bank reconciliations, short-term cash availability |

| Time Horizon | Mid to long-term financial planning | Short-term cash operations and daily liquidity |

| Skills Required | Financial analysis, risk assessment, strategic planning | Cash forecasting, transaction processing, attention to detail |

| Role Impact | Influences corporate financial strategy and risk posture | Ensures operational cash efficiency and accuracy |

Role Overview: Treasury Manager vs Cash Manager

A Treasury Manager oversees the organization's overall liquidity, risk management, and capital structure, ensuring optimal funding strategies and compliance with financial regulations. A Cash Manager concentrates on daily cash flow operations, including monitoring cash positions, managing short-term investments, and ensuring adequate liquidity for operational needs. Both roles are critical for financial stability but differ in scope, with Treasury Managers focusing on strategic financial planning and Cash Managers handling transactional cash management.

Key Responsibilities and Functions

Treasury Managers oversee an organization's liquidity, risk management, and investment strategies, ensuring efficient capital allocation and compliance with financial regulations. Cash Managers focus on daily cash flow monitoring, optimizing cash positions, and managing short-term funding to maintain operational liquidity. Both roles are critical in maintaining financial stability but differ in scope, with Treasury Managers handling broader strategic financial planning while Cash Managers address immediate cash handling and forecasting.

Core Skills and Competencies

A Treasury Manager specializes in strategic liquidity planning, risk management, and corporate finance, requiring strong skills in financial forecasting, cash flow optimization, and regulatory compliance. A Cash Manager focuses on daily cash operations, including cash positioning, payment processing, and short-term financing, emphasizing expertise in cash reconciliation, banking relationships, and transaction management. Proficiency in financial software, analytical abilities, and attention to detail are critical competencies across both roles to ensure efficient capital utilization and financial stability.

Reporting Structure and Hierarchy

A Treasury Manager typically reports directly to the CFO or Finance Director, overseeing strategic liquidity management, risk assessment, and long-term financial planning. In contrast, a Cash Manager often reports to the Treasury Manager or Financial Controller, focusing on daily cash flow monitoring, transaction processing, and short-term funding needs. The Treasury Manager holds a higher hierarchical position with broader responsibilities, while the Cash Manager operates within a more operational scope under the treasury function.

Strategic vs Operational Focus

Treasury Managers emphasize strategic financial planning, risk management, and capital structure optimization to enhance long-term corporate value. Cash Managers concentrate on operational activities like daily cash flow monitoring, liquidity management, and payment processing to ensure smooth business operations. The Treasury role aligns with broader financial strategy, while Cash Management prioritizes tactical execution of cash-related functions.

Tools and Technology Used

Treasury Managers utilize advanced Enterprise Resource Planning (ERP) systems and Treasury Management Systems (TMS) such as Kyriba or SAP Treasury to oversee corporate liquidity, risk management, and investment strategies. Cash Managers rely heavily on cash forecasting software and automated payment platforms like Coupa Pay or Tipalti to optimize daily cash flow and manage short-term liquidity efficiently. Both roles leverage financial analytics tools and real-time reporting dashboards to enhance decision-making and ensure precise cash positioning.

Risk Management Approaches

Treasury managers prioritize comprehensive risk management strategies, including currency risk, interest rate risk, and liquidity risk, using advanced hedging techniques such as derivatives and forward contracts to safeguard corporate assets. Cash managers focus primarily on optimizing cash flow and short-term liquidity, employing risk controls to prevent overdrafts and ensure sufficient operational funds, typically through daily forecasting and short-term investments. Both roles integrate risk assessment tools, but treasury managers adopt a broader financial risk perspective aligned with long-term company stability and market volatility.

Collaboration with Other Departments

Treasury Managers and Cash Managers collaborate closely with accounting, finance, and operations teams to ensure accurate cash flow forecasting and liquidity management. Coordination with procurement and sales departments is essential to align payment schedules and optimize working capital. Collaboration with risk management departments enhances the identification and mitigation of financial risks impacting cash availability.

Career Pathways and Progression

Treasury Managers typically advance from Cash Manager roles by gaining expertise in liquidity risk management, funding strategies, and corporate finance, positioning themselves for senior finance leadership such as Corporate Treasurer or CFO. Cash Managers concentrate on optimizing daily cash flow, banking relationships, and short-term liquidity, often progressing into Treasury functions as they develop strategic oversight skills. Career progression in Treasury management demands proficiency in financial analysis, regulatory compliance, and investment management, while Cash Managers build foundational expertise in cash forecasting, payment processing, and working capital optimization.

Salary and Compensation Comparison

Treasury managers typically earn higher salaries than cash managers due to broader responsibilities, with average annual compensation ranging from $90,000 to $150,000 compared to $60,000 to $100,000 for cash managers. Treasury managers often receive performance bonuses, stock options, and comprehensive benefits, reflecting their role in strategic financial planning and risk management. Cash managers' compensation packages focus more on operational cash flow tasks and may include incentives linked to cash optimization and liquidity maintenance.

Treasury Manager vs Cash Manager Infographic

jobdiv.com

jobdiv.com