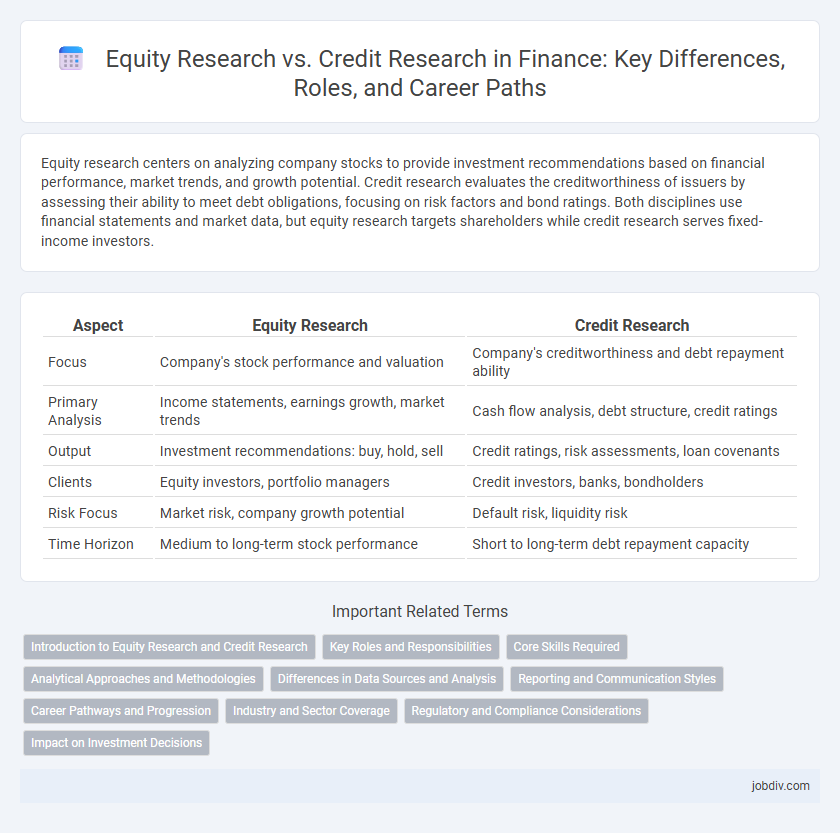

Equity research centers on analyzing company stocks to provide investment recommendations based on financial performance, market trends, and growth potential. Credit research evaluates the creditworthiness of issuers by assessing their ability to meet debt obligations, focusing on risk factors and bond ratings. Both disciplines use financial statements and market data, but equity research targets shareholders while credit research serves fixed-income investors.

Table of Comparison

| Aspect | Equity Research | Credit Research |

|---|---|---|

| Focus | Company's stock performance and valuation | Company's creditworthiness and debt repayment ability |

| Primary Analysis | Income statements, earnings growth, market trends | Cash flow analysis, debt structure, credit ratings |

| Output | Investment recommendations: buy, hold, sell | Credit ratings, risk assessments, loan covenants |

| Clients | Equity investors, portfolio managers | Credit investors, banks, bondholders |

| Risk Focus | Market risk, company growth potential | Default risk, liquidity risk |

| Time Horizon | Medium to long-term stock performance | Short to long-term debt repayment capacity |

Introduction to Equity Research and Credit Research

Equity research involves analyzing a company's financial statements, industry position, and market trends to assess stock value and investment potential. Credit research focuses on evaluating a borrower's creditworthiness by examining debt structure, cash flow, and risk of default. Both disciplines require deep financial analysis but target different investment instruments--equity shares versus debt securities.

Key Roles and Responsibilities

Equity research professionals analyze company financials, market trends, and competitive positioning to provide investment recommendations on stocks. Credit research analysts evaluate credit risk, solvency, and debt repayment capacity to assess corporate or sovereign bond issuers. Both roles require deep financial modeling, data interpretation, and report generation tailored to equity investors and credit stakeholders respectively.

Core Skills Required

Equity research demands strong analytical skills, financial modeling expertise, and proficiency in industry-specific valuation techniques to assess company performance and growth potential. Credit research requires a deep understanding of credit risk assessment, fixed income instruments, and debt covenant analysis to evaluate the likelihood of default and creditworthiness. Both roles benefit from strong quantitative abilities, attention to detail, and effective communication skills to present complex financial data clearly.

Analytical Approaches and Methodologies

Equity research employs fundamental analysis to evaluate company financials, market position, and growth potential, focusing on earnings forecasts and valuation models like discounted cash flow (DCF) and price-to-earnings (P/E) ratios. Credit research prioritizes assessing credit risk by analyzing debt structure, cash flow stability, and credit ratings, using methodologies such as credit spread analysis and scenario stress testing. Both approaches utilize quantitative and qualitative data but differ in their emphasis on equity value creation versus debt repayment capacity.

Differences in Data Sources and Analysis

Equity research primarily relies on company financial statements, market trends, and earnings forecasts to assess stock performance and growth potential, while credit research focuses on analyzing credit ratings, debt covenants, and repayment history to evaluate creditworthiness and default risk. Equity analysts emphasize qualitative factors such as competitive position and management quality, whereas credit analysts prioritize quantitative debt metrics, cash flow analysis, and macroeconomic conditions influencing credit risk. Data sources for equity research often include SEC filings, market data providers, and industry reports, contrasting with credit research's use of bond indentures, credit rating agencies, and lender disclosures.

Reporting and Communication Styles

Equity research reports typically emphasize detailed company analysis, including earnings forecasts, valuation models, and industry trends, designed to support investment decisions and stock recommendations. Credit research reports focus on evaluating a borrower's creditworthiness, highlighting debt structures, credit ratings, and default risks, with communication tailored to fixed income investors and risk managers. Equity analysts use narrative-driven reports with projections and qualitative insights, while credit analysts rely on quantitative assessments and structured summaries to communicate risk and repayment capacity.

Career Pathways and Progression

Equity research professionals typically advance by specializing in industry sectors, developing expertise in company valuations, and moving toward roles like senior analyst, portfolio manager, or equity strategist. Credit research analysts focus on assessing debt securities and credit risk, often progressing to positions such as credit portfolio manager, risk manager, or chief credit officer. Both pathways offer opportunities to influence investment decisions, but equity research leans toward equity markets and company fundamentals, while credit research centers on fixed income and creditworthiness analysis.

Industry and Sector Coverage

Equity research primarily focuses on analyzing individual companies within specific industries and sectors to assess their growth potential, profitability, and stock valuation. Credit research emphasizes evaluating companies' debt instruments by examining industry-specific risk factors, creditworthiness, and sectoral economic conditions that impact their ability to meet financial obligations. Both research types require deep sector expertise, but equity research centers on equity performance while credit research prioritizes credit risk across industry verticals.

Regulatory and Compliance Considerations

Equity research primarily involves analyzing company performance and market trends to provide investment recommendations, requiring compliance with securities regulations such as the SEC's Regulation Fair Disclosure. Credit research focuses on assessing creditworthiness and default risk for debt instruments, necessitating adherence to credit rating agency standards and strict monitoring under Basel III regulatory frameworks. Both fields must navigate insider trading laws and maintain data confidentiality to ensure investor protection and regulatory compliance.

Impact on Investment Decisions

Equity research provides detailed analysis of a company's financial health, growth prospects, and stock valuation, directly influencing portfolio allocation and stock selection decisions. Credit research assesses a firm's creditworthiness and default risk, guiding decisions on bond investments and debt instruments to manage credit risk exposure. Integrating both analyses enhances investment strategies by balancing potential returns with risk mitigation.

Equity Research vs Credit Research Infographic

jobdiv.com

jobdiv.com