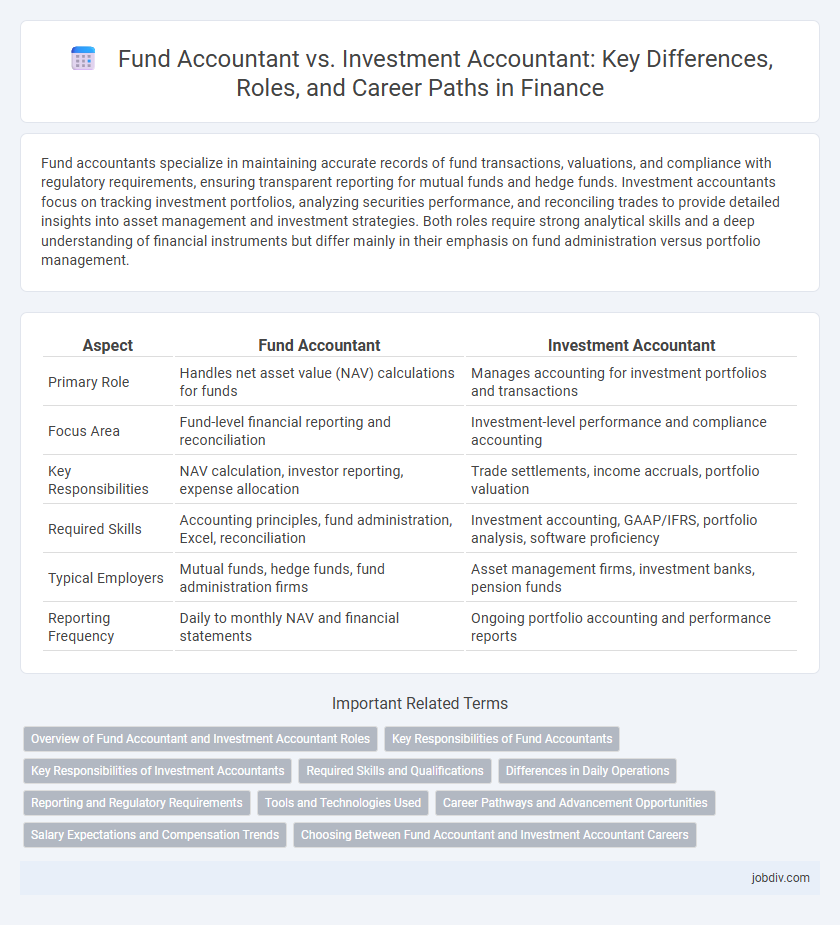

Fund accountants specialize in maintaining accurate records of fund transactions, valuations, and compliance with regulatory requirements, ensuring transparent reporting for mutual funds and hedge funds. Investment accountants focus on tracking investment portfolios, analyzing securities performance, and reconciling trades to provide detailed insights into asset management and investment strategies. Both roles require strong analytical skills and a deep understanding of financial instruments but differ mainly in their emphasis on fund administration versus portfolio management.

Table of Comparison

| Aspect | Fund Accountant | Investment Accountant |

|---|---|---|

| Primary Role | Handles net asset value (NAV) calculations for funds | Manages accounting for investment portfolios and transactions |

| Focus Area | Fund-level financial reporting and reconciliation | Investment-level performance and compliance accounting |

| Key Responsibilities | NAV calculation, investor reporting, expense allocation | Trade settlements, income accruals, portfolio valuation |

| Required Skills | Accounting principles, fund administration, Excel, reconciliation | Investment accounting, GAAP/IFRS, portfolio analysis, software proficiency |

| Typical Employers | Mutual funds, hedge funds, fund administration firms | Asset management firms, investment banks, pension funds |

| Reporting Frequency | Daily to monthly NAV and financial statements | Ongoing portfolio accounting and performance reports |

Overview of Fund Accountant and Investment Accountant Roles

Fund Accountants specialize in managing and reconciling investment fund portfolios, ensuring accurate valuation, compliance with accounting standards, and timely reporting to stakeholders. Investment Accountants focus on the recording, analysis, and reporting of investment transactions, monitoring portfolio performance, and supporting audit processes within asset management firms. Both roles are critical for transparency, regulatory compliance, and financial integrity in fund management.

Key Responsibilities of Fund Accountants

Fund Accountants are responsible for maintaining accurate records of fund transactions, calculating net asset values (NAV), and preparing financial statements in compliance with regulatory standards. They ensure proper reconciliation of accounts, monitor cash flows, and coordinate with custodians and administrators to validate fund data. Their role supports investor reporting, audit processes, and adherence to internal controls within hedge funds, mutual funds, and private equity entities.

Key Responsibilities of Investment Accountants

Investment Accountants manage and reconcile investment portfolios, ensuring accurate valuation of assets and compliance with accounting standards such as IFRS and GAAP. They prepare detailed financial reports, monitor investment performance, and analyze transactions including purchases, sales, and income distributions. Their role demands extensive knowledge of securities, derivatives, and market regulations to support accurate financial statements and audit readiness in investment firms.

Required Skills and Qualifications

Fund accountants require strong expertise in financial reporting, NAV calculations, and knowledge of regulatory compliance such as GAAP or IFRS standards. Investment accountants focus on portfolio valuation, trade reconciliation, and often need proficiency in investment management software alongside a deep understanding of securities and asset classes. Both roles typically demand degrees in finance, accounting, or economics, with certifications like CPA or CFA enhancing career prospects.

Differences in Daily Operations

Fund accountants primarily focus on maintaining accurate records of fund transactions, calculating net asset values (NAV), and ensuring regulatory compliance specific to mutual funds or hedge funds. Investment accountants concentrate on tracking portfolio holdings, reconciling investment transactions, and preparing detailed reports on asset performance and valuation for institutional investors. The key difference lies in fund accountants managing pooled investment vehicles' financial reporting, while investment accountants handle the accounting of individual investment portfolios.

Reporting and Regulatory Requirements

Fund Accountants specialize in preparing detailed financial reports that adhere to stringent fund-specific regulatory requirements, including NAV calculations and investor reporting under frameworks like GAAP and IFRS. Investment Accountants focus on compliance with broader financial regulations, ensuring accurate recording of investment transactions, portfolio reconciliations, and adherence to SEC, MiFID II, or AIFMD standards. Both roles require rigorous data accuracy and timely reporting to meet regulatory disclosures and audit demands within the financial industry.

Tools and Technologies Used

Fund accountants primarily utilize specialized fund accounting software such as Fundwave, SS&C GlobeOp, and Investran to manage complex investment portfolios and ensure compliance with regulatory standards. Investment accountants rely on advanced financial analytics platforms like Bloomberg Terminal, FactSet, and Alteryx for real-time market data integration, risk assessment, and portfolio performance tracking. Both roles leverage automation tools and ERP systems like SAP and Oracle Financials to streamline reconciliation, reporting, and audit processes efficiently.

Career Pathways and Advancement Opportunities

Fund accountants typically manage daily financial reporting and NAV calculations for investment funds, providing a foundation in regulatory compliance and portfolio valuation, which can lead to senior roles like Fund Accounting Manager or Financial Controller. Investment accountants focus on transactional processing, reconciliation, and detailed investment analysis, positioning themselves for advancement into roles such as Investment Accounting Manager, Portfolio Analyst, or Chief Investment Officer. Both career pathways offer advancement opportunities through gaining expertise in GAAP, IFRS, and relevant financial software, with progression often supported by certifications like CPA, CFA, or CAIA.

Salary Expectations and Compensation Trends

Fund accountants typically earn between $60,000 and $90,000 annually, reflecting the specialized nature of managing client funds and financial reporting. Investment accountants often command higher salaries, ranging from $70,000 to $110,000, due to their role in tracking investment portfolios and ensuring regulatory compliance. Compensation trends indicate increasing demand for investment accountants driven by complex market dynamics, leading to more competitive salary packages and performance-based bonuses.

Choosing Between Fund Accountant and Investment Accountant Careers

Choosing between fund accountant and investment accountant careers depends on your interest in specific financial responsibilities; fund accountants focus on the accurate calculation of net asset values, fund valuations, and compliance with fund accounting standards, while investment accountants specialize in tracking investment portfolios, analyzing asset performance, and supporting investment decision-making. Expertise in regulatory frameworks such as GAAP and IFRS is essential for fund accountants, whereas investment accountants require deep knowledge of portfolio management and securities analysis. Career advancement opportunities vary, with fund accountants often progressing into fund management and administration, while investment accountants can move toward portfolio management or financial analysis roles.

Fund Accountant vs Investment Accountant Infographic

jobdiv.com

jobdiv.com