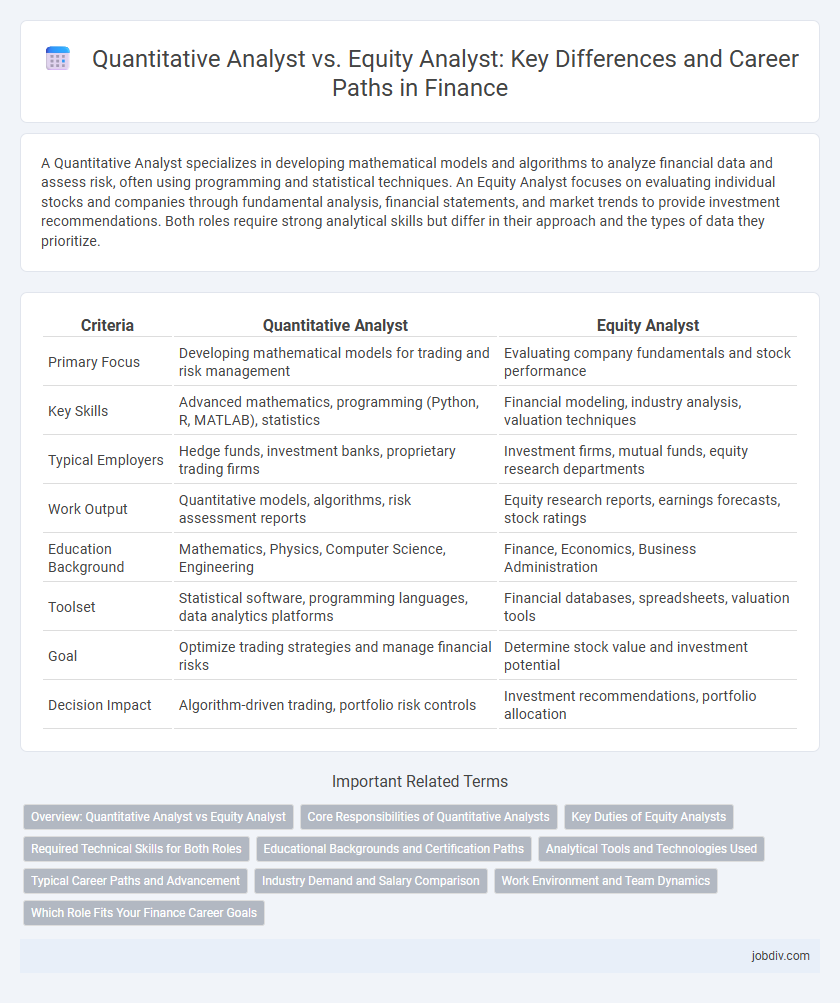

A Quantitative Analyst specializes in developing mathematical models and algorithms to analyze financial data and assess risk, often using programming and statistical techniques. An Equity Analyst focuses on evaluating individual stocks and companies through fundamental analysis, financial statements, and market trends to provide investment recommendations. Both roles require strong analytical skills but differ in their approach and the types of data they prioritize.

Table of Comparison

| Criteria | Quantitative Analyst | Equity Analyst |

|---|---|---|

| Primary Focus | Developing mathematical models for trading and risk management | Evaluating company fundamentals and stock performance |

| Key Skills | Advanced mathematics, programming (Python, R, MATLAB), statistics | Financial modeling, industry analysis, valuation techniques |

| Typical Employers | Hedge funds, investment banks, proprietary trading firms | Investment firms, mutual funds, equity research departments |

| Work Output | Quantitative models, algorithms, risk assessment reports | Equity research reports, earnings forecasts, stock ratings |

| Education Background | Mathematics, Physics, Computer Science, Engineering | Finance, Economics, Business Administration |

| Toolset | Statistical software, programming languages, data analytics platforms | Financial databases, spreadsheets, valuation tools |

| Goal | Optimize trading strategies and manage financial risks | Determine stock value and investment potential |

| Decision Impact | Algorithm-driven trading, portfolio risk controls | Investment recommendations, portfolio allocation |

Overview: Quantitative Analyst vs Equity Analyst

Quantitative analysts develop complex mathematical models to identify trading opportunities and manage financial risk using statistical methods and programming languages like Python or R, primarily in hedge funds and investment banks. Equity analysts specialize in evaluating publicly traded companies by analyzing financial statements, industry trends, and management strategies to provide investment recommendations useful for portfolio managers and retail investors. Both roles require strong analytical skills but diverge in approach: quantitative analysts emphasize data-driven algorithms, while equity analysts focus on fundamental financial analysis.

Core Responsibilities of Quantitative Analysts

Quantitative analysts specialize in developing complex mathematical models to identify trading opportunities, manage risk, and optimize investment portfolios by leveraging statistical techniques and programming skills. They focus on algorithmic trading, quantitative risk management, and data analysis, using tools such as Python, R, MATLAB, and machine learning frameworks to process large datasets. Unlike equity analysts who primarily conduct fundamental analysis on stocks, quantitative analysts provide data-driven insights and predictive analytics to support automated decision-making in finance.

Key Duties of Equity Analysts

Equity analysts primarily focus on evaluating publicly traded companies by analyzing financial statements, market trends, and economic data to provide investment recommendations and target prices for stocks. Their key duties include conducting fundamental research, creating detailed financial models, and preparing comprehensive reports to guide portfolio managers and investors. They interpret qualitative and quantitative data to assess a company's valuation, growth potential, and risk factors within specific industries.

Required Technical Skills for Both Roles

Quantitative Analysts require advanced proficiency in programming languages such as Python, R, and MATLAB, alongside strong skills in statistical modeling, machine learning, and data analysis to develop complex financial algorithms. Equity Analysts focus on financial statement analysis, valuation techniques, and industry-specific knowledge, using tools like Excel, Bloomberg Terminal, and financial databases to assess company performance and forecast stock prices. Both roles demand a solid understanding of financial markets, risk management, and quantitative methods, but Quantitative Analysts emphasize mathematical modeling while Equity Analysts prioritize fundamental analysis and market research.

Educational Backgrounds and Certification Paths

Quantitative Analysts typically hold advanced degrees in mathematics, statistics, computer science, or engineering, with certifications such as CQF (Certificate in Quantitative Finance) enhancing their expertise in modeling and algorithmic trading. Equity Analysts often possess degrees in finance, economics, or business administration, and pursue certifications like the CFA (Chartered Financial Analyst) to deepen their skills in equity valuation and financial statement analysis. Both roles demand strong analytical capabilities, but their educational and certification paths reflect distinct focuses on quantitative methods versus fundamental equity research.

Analytical Tools and Technologies Used

Quantitative analysts primarily utilize advanced statistical software, programming languages like Python and R, and machine learning algorithms to develop predictive models and optimize trading strategies. Equity analysts depend heavily on financial databases such as Bloomberg Terminal and FactSet, combined with financial modeling in Excel and fundamental analysis tools to evaluate company performance and forecast stock movements. Both roles leverage data visualization platforms, but quant analysts emphasize automated, algorithm-driven analysis while equity analysts focus on detailed company and industry research.

Typical Career Paths and Advancement

Quantitative analysts typically advance through roles such as quantitative researcher, model developer, and risk manager, often transitioning into executive positions like Chief Risk Officer due to their expertise in mathematical modeling and data analysis. Equity analysts usually progress from junior analyst positions to senior analyst roles, portfolio managers, and eventually lead asset management or research teams, leveraging their skills in fundamental analysis and market trends. Both career paths demand continuous learning and adaptability, with quantitative analysts focusing on algorithmic trading and risk metrics, while equity analysts deepen their expertise in company valuation and sector-specific insights.

Industry Demand and Salary Comparison

Quantitative Analysts command strong demand in the finance industry due to their expertise in mathematical modeling and algorithmic trading, often earning median salaries ranging from $95,000 to $150,000 annually. Equity Analysts focus on stock market research and valuation, with industry demand tied to equity markets' performance and salary averages between $70,000 and $120,000. The growing reliance on big data and automation elevates Quantitative Analysts' market value compared to Equity Analysts.

Work Environment and Team Dynamics

Quantitative analysts typically work in high-tech environments with strong emphasis on data modeling, coding, and algorithm development, often collaborating closely with software engineers and risk managers. Equity analysts operate in more traditional finance settings, engaging frequently with portfolio managers, sales teams, and corporate management to assess company performance and market trends. Both roles require teamwork but differ as quantitative analysts focus more on technical problem-solving within interdisciplinary teams, while equity analysts prioritize communication and market insight within investment-focused groups.

Which Role Fits Your Finance Career Goals

A Quantitative Analyst specializes in developing mathematical models to inform trading strategies and risk management, ideal for careers focused on data-driven decision-making and algorithmic trading. An Equity Analyst evaluates financial statements and market trends to provide investment recommendations, suitable for those interested in fundamental analysis and portfolio management. Choosing between these roles depends on your preference for quantitative modeling versus qualitative company evaluation within the finance sector.

Quantitative Analyst vs Equity Analyst Infographic

jobdiv.com

jobdiv.com