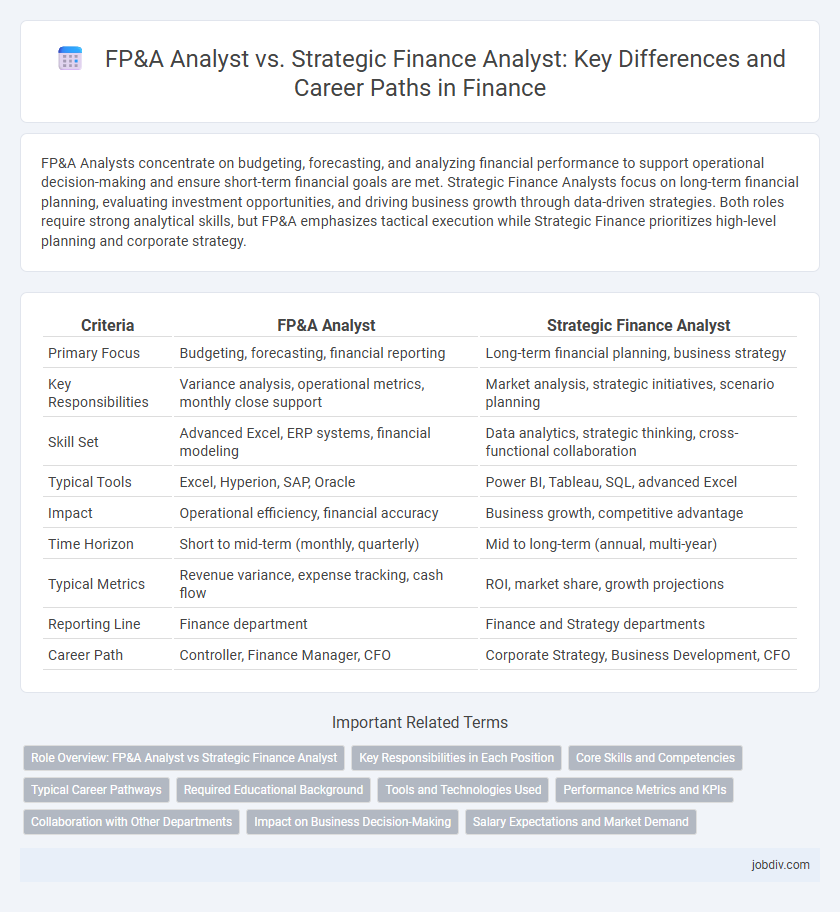

FP&A Analysts concentrate on budgeting, forecasting, and analyzing financial performance to support operational decision-making and ensure short-term financial goals are met. Strategic Finance Analysts focus on long-term financial planning, evaluating investment opportunities, and driving business growth through data-driven strategies. Both roles require strong analytical skills, but FP&A emphasizes tactical execution while Strategic Finance prioritizes high-level planning and corporate strategy.

Table of Comparison

| Criteria | FP&A Analyst | Strategic Finance Analyst |

|---|---|---|

| Primary Focus | Budgeting, forecasting, financial reporting | Long-term financial planning, business strategy |

| Key Responsibilities | Variance analysis, operational metrics, monthly close support | Market analysis, strategic initiatives, scenario planning |

| Skill Set | Advanced Excel, ERP systems, financial modeling | Data analytics, strategic thinking, cross-functional collaboration |

| Typical Tools | Excel, Hyperion, SAP, Oracle | Power BI, Tableau, SQL, advanced Excel |

| Impact | Operational efficiency, financial accuracy | Business growth, competitive advantage |

| Time Horizon | Short to mid-term (monthly, quarterly) | Mid to long-term (annual, multi-year) |

| Typical Metrics | Revenue variance, expense tracking, cash flow | ROI, market share, growth projections |

| Reporting Line | Finance department | Finance and Strategy departments |

| Career Path | Controller, Finance Manager, CFO | Corporate Strategy, Business Development, CFO |

Role Overview: FP&A Analyst vs Strategic Finance Analyst

FP&A Analysts specialize in budgeting, forecasting, and financial reporting to support short-term operational decisions. Strategic Finance Analysts focus on long-term financial planning, scenario analysis, and aligning financial strategies with corporate objectives. Both roles require strong analytical skills but differ in their impact on immediate business performance versus future growth initiatives.

Key Responsibilities in Each Position

FP&A Analysts focus on budgeting, forecasting, and variance analysis to support short-term financial planning and operational efficiency. Strategic Finance Analysts drive long-term business growth by conducting market research, scenario modeling, and competitive analysis to inform strategic decision-making. Both roles require strong financial modeling and data interpretation skills but differ in their emphasis on tactical versus strategic financial insights.

Core Skills and Competencies

FP&A Analysts excel in budgeting, forecasting, and variance analysis, demonstrating strong proficiency in financial modeling and data visualization tools like Excel and Power BI to support operational decision-making. Strategic Finance Analysts possess advanced skills in scenario planning, long-term financial strategy development, and competitive market analysis, often leveraging expertise in business intelligence and stakeholder communication to drive high-level corporate initiatives. Both roles require analytical rigor, attention to detail, and proficiency in financial software, but Strategic Finance Analysts emphasize strategic insight and cross-functional collaboration beyond the tactical, number-crunching focus of FP&A Analysts.

Typical Career Pathways

FP&A Analysts typically advance to senior FP&A roles, finance manager positions, or corporate controller opportunities by honing budgeting, forecasting, and variance analysis skills. Strategic Finance Analysts often progress toward business partnering roles, strategic planning director positions, or chief financial officer (CFO) tracks by developing expertise in long-term financial modeling, market analysis, and cross-functional leadership. Both pathways offer critical finance leadership opportunities but differ in focus areas--FP&A prioritizes operational financial management, while Strategic Finance emphasizes growth strategy and investment evaluation.

Required Educational Background

FP&A Analysts typically require a bachelor's degree in finance, accounting, economics, or business administration, emphasizing strong analytical and financial modeling skills. Strategic Finance Analysts often hold advanced degrees such as an MBA or a master's in finance, highlighting expertise in corporate strategy, financial forecasting, and long-term planning. Both roles value proficiency in data analysis, but Strategic Finance Analysts prioritize strategic decision-making and cross-functional collaboration.

Tools and Technologies Used

FP&A Analysts primarily utilize advanced Excel modeling, financial planning software like Adaptive Insights, and ERP systems such as SAP or Oracle to create budgets and forecasts. Strategic Finance Analysts frequently leverage data visualization tools like Tableau or Power BI along with advanced statistical software, including Python or R, for in-depth scenario analysis and strategic decision-making. Both roles depend heavily on cloud-based collaboration platforms like Microsoft Teams and SharePoint to streamline communication and reporting.

Performance Metrics and KPIs

FP&A Analysts primarily track and analyze operational performance metrics such as budget variance, forecast accuracy, and expense ratios to support short-term financial planning. Strategic Finance Analysts focus on long-term value drivers including ROI, economic profit, and strategic KPIs aligned with corporate growth objectives. Both roles utilize data-driven insights but differ in emphasis on tactical versus strategic performance measurement.

Collaboration with Other Departments

FP&A Analysts collaborate closely with accounting, operations, and sales teams to gather accurate financial data and ensure budgeting aligns with departmental goals. Strategic Finance Analysts engage cross-functionally with product development, marketing, and executive leadership to support long-term financial planning and strategic decision-making. Both roles rely heavily on effective interdepartmental communication to drive financial performance and business growth.

Impact on Business Decision-Making

FP&A Analysts provide detailed financial forecasts and variance analyses that enable data-driven budgeting and resource allocation, directly influencing operational efficiency. Strategic Finance Analysts focus on long-term financial planning, scenario modeling, and investment evaluations, driving high-level decisions that shape the company's growth trajectory. Both roles enhance business decision-making by delivering critical insights but differ in scope, with FP&A centering on near-term financial health and Strategic Finance targeting sustainable competitive advantage.

Salary Expectations and Market Demand

FP&A Analysts typically earn annual salaries ranging from $65,000 to $90,000, with higher pay in major financial hubs due to strong market demand for budgeting and forecasting expertise. Strategic Finance Analysts command higher salaries, often between $85,000 and $120,000, driven by their role in long-term financial planning and decision support, which is increasingly valued in competitive markets. Demand for Strategic Finance Analysts is growing faster as companies prioritize strategic growth initiatives over traditional financial analysis functions.

FP&A Analyst vs Strategic Finance Analyst Infographic

jobdiv.com

jobdiv.com