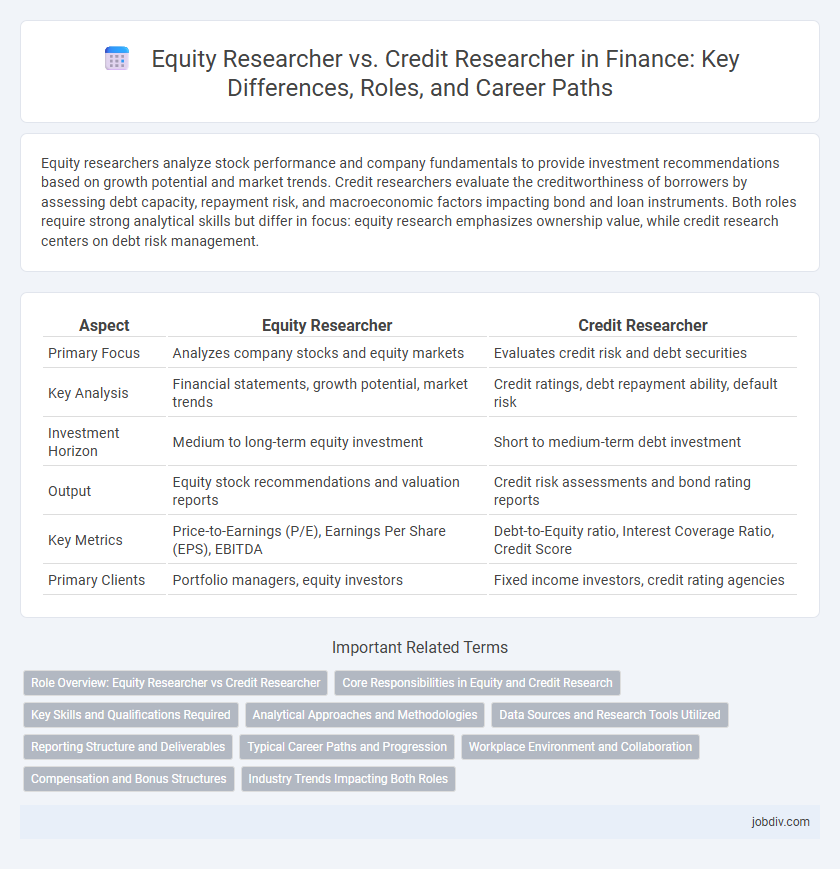

Equity researchers analyze stock performance and company fundamentals to provide investment recommendations based on growth potential and market trends. Credit researchers evaluate the creditworthiness of borrowers by assessing debt capacity, repayment risk, and macroeconomic factors impacting bond and loan instruments. Both roles require strong analytical skills but differ in focus: equity research emphasizes ownership value, while credit research centers on debt risk management.

Table of Comparison

| Aspect | Equity Researcher | Credit Researcher |

|---|---|---|

| Primary Focus | Analyzes company stocks and equity markets | Evaluates credit risk and debt securities |

| Key Analysis | Financial statements, growth potential, market trends | Credit ratings, debt repayment ability, default risk |

| Investment Horizon | Medium to long-term equity investment | Short to medium-term debt investment |

| Output | Equity stock recommendations and valuation reports | Credit risk assessments and bond rating reports |

| Key Metrics | Price-to-Earnings (P/E), Earnings Per Share (EPS), EBITDA | Debt-to-Equity ratio, Interest Coverage Ratio, Credit Score |

| Primary Clients | Portfolio managers, equity investors | Fixed income investors, credit rating agencies |

Role Overview: Equity Researcher vs Credit Researcher

Equity researchers analyze publicly traded companies to provide investment recommendations based on financial statements, market trends, and valuation models, focusing on stock performance and potential growth. Credit researchers evaluate the creditworthiness of bond issuers or borrowers, assessing default risk through credit ratings, debt structures, and macroeconomic factors. Both roles require deep financial analysis but differ in their emphasis on equity valuation versus credit risk assessment.

Core Responsibilities in Equity and Credit Research

Equity researchers analyze company fundamentals, industry trends, and market data to assess stock valuation and future performance, focusing on earnings forecasts and price targets. Credit researchers evaluate credit risk by examining financial statements, debt structure, and macroeconomic factors to determine the likelihood of default and creditworthiness. Both roles require building financial models and conducting qualitative and quantitative analysis, but equity research emphasizes shareholder value while credit research centers on debt repayment capacity.

Key Skills and Qualifications Required

Equity researchers require strong analytical skills, proficiency in financial modeling, and deep knowledge of stock market trends to evaluate company valuations and growth potential. Credit researchers focus on assessing credit risk by analyzing debt instruments, understanding credit ratings, and interpreting macroeconomic factors affecting borrower solvency. Both roles demand expertise in financial statement analysis, but equity researchers prioritize market dynamics while credit researchers specialize in risk assessment and fixed income securities.

Analytical Approaches and Methodologies

Equity researchers primarily analyze company fundamentals, market trends, and competitive positioning using qualitative assessments and financial modeling techniques like discounted cash flow (DCF) and comparable company analysis to value stocks. Credit researchers concentrate on assessing borrower creditworthiness by examining debt covenants, cash flow stability, and credit rating methodologies, emphasizing default risk and recovery rates through tools such as credit scoring models and scenario analysis. Both roles require strong quantitative skills, but equity research leans towards growth potential and earnings forecasts, while credit research prioritizes risk management and debt service capacity.

Data Sources and Research Tools Utilized

Equity researchers primarily rely on financial statements, market data, earnings reports, and industry analysis platforms like Bloomberg Terminal and FactSet to evaluate company valuation and growth potential. Credit researchers focus on credit ratings, bond yields, default probabilities, and debt covenants using tools such as Moody's, S&P Global Ratings, and proprietary risk models to assess creditworthiness and default risk. Both roles integrate macroeconomic data and sector-specific databases but differ fundamentally in their emphasis on equity valuation versus credit risk metrics.

Reporting Structure and Deliverables

Equity researchers typically report to portfolio managers or equity research directors, delivering detailed financial models, earnings forecasts, and stock valuation reports focused on company performance and market trends. Credit researchers report to credit risk managers or fixed income portfolio managers, providing credit risk assessments, bond rating analyses, and default probability reports that inform debt investment decisions. Both roles require rigorous data analysis but differ in deliverable emphasis--equity researchers prioritize ownership value drivers, while credit researchers focus on creditworthiness and debt repayment capacity.

Typical Career Paths and Progression

Equity researchers typically begin as junior analysts focusing on specific sectors, advancing to senior analyst roles with greater responsibility for stock recommendations and earnings forecasts. Career progression often leads to portfolio manager or research director positions within asset management firms or hedge funds, emphasizing equity investments. Credit researchers generally start as credit analysts assessing corporate or sovereign credit risk, progressing to senior credit analyst or credit strategist roles, with opportunities to move into risk management or credit portfolio management in banks and credit rating agencies.

Workplace Environment and Collaboration

Equity Researchers typically work in dynamic environments where collaboration with sales teams and portfolio managers is essential to analyze market trends and company performance, leveraging financial models to support investment decisions. Credit Researchers operate in more structured settings, focusing on assessing credit risk with close collaboration with credit analysts, risk managers, and compliance officers to evaluate creditworthiness and safeguard portfolios. Both roles demand strong communication skills and teamwork but differ in focus, where equity research is market-driven and credit research is risk-focused within the financial sector.

Compensation and Bonus Structures

Equity researchers typically receive compensation packages combining base salary with performance-based bonuses tied to stock market movements and company earnings analysis, often incentivizing long-term investment insights. Credit researchers' bonuses are more closely aligned with credit risk assessments, default predictions, and bond market performance, resulting in compensation structures that reward the mitigation of downside risk and accuracy in credit ratings. Both roles see variability in pay depending on firm size and location, but equity research generally commands higher bonuses due to its direct link to equity trading profits.

Industry Trends Impacting Both Roles

Equity researchers face increasing demand for integrating ESG factors and AI-driven analytics to evaluate stock performance and market sentiment, reflecting a shift toward sustainable and technology-driven investment strategies. Credit researchers encounter evolving regulatory frameworks and rising default risks amid economic uncertainty, requiring advanced credit risk modeling and constant monitoring of sector-specific debt conditions. Both roles are influenced by digital transformation and growing emphasis on real-time data, enhancing the precision of investment recommendations and risk assessments across financial markets.

Equity Researcher vs Credit Researcher Infographic

jobdiv.com

jobdiv.com