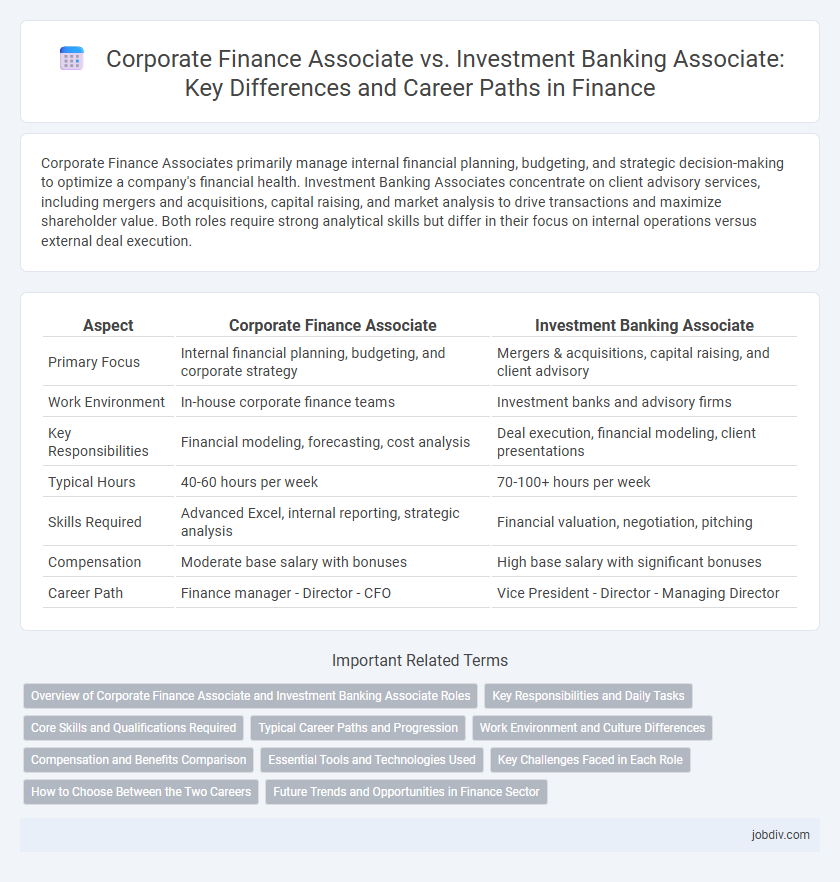

Corporate Finance Associates primarily manage internal financial planning, budgeting, and strategic decision-making to optimize a company's financial health. Investment Banking Associates concentrate on client advisory services, including mergers and acquisitions, capital raising, and market analysis to drive transactions and maximize shareholder value. Both roles require strong analytical skills but differ in their focus on internal operations versus external deal execution.

Table of Comparison

| Aspect | Corporate Finance Associate | Investment Banking Associate |

|---|---|---|

| Primary Focus | Internal financial planning, budgeting, and corporate strategy | Mergers & acquisitions, capital raising, and client advisory |

| Work Environment | In-house corporate finance teams | Investment banks and advisory firms |

| Key Responsibilities | Financial modeling, forecasting, cost analysis | Deal execution, financial modeling, client presentations |

| Typical Hours | 40-60 hours per week | 70-100+ hours per week |

| Skills Required | Advanced Excel, internal reporting, strategic analysis | Financial valuation, negotiation, pitching |

| Compensation | Moderate base salary with bonuses | High base salary with significant bonuses |

| Career Path | Finance manager - Director - CFO | Vice President - Director - Managing Director |

Overview of Corporate Finance Associate and Investment Banking Associate Roles

Corporate Finance Associates primarily focus on managing a company's financial activities, including budgeting, forecasting, and strategic planning to optimize internal capital structure and drive long-term growth. Investment Banking Associates concentrate on executing mergers and acquisitions, raising capital through equity or debt offerings, and advising clients on complex financial transactions in capital markets. Both roles require strong financial modeling skills and deal analysis, but Corporate Finance Associates work within corporations, whereas Investment Banking Associates operate in client-oriented investment banks.

Key Responsibilities and Daily Tasks

Corporate Finance Associates primarily manage internal financial planning, budgeting, and forecasting to optimize a company's capital structure and support strategic initiatives. Investment Banking Associates focus on executing mergers and acquisitions, underwriting securities, and preparing detailed financial models and pitch books for client presentations. Both roles require strong analytical skills but differ in client interaction, with Investment Banking Associates engaging heavily with external clients and Corporate Finance Associates working internally.

Core Skills and Qualifications Required

Corporate Finance Associates require strong analytical skills, proficiency in financial modeling, and expertise in budgeting, forecasting, and strategic planning to support mergers, acquisitions, and capital structure management. Investment Banking Associates demand advanced capabilities in valuation techniques, deal structuring, client relationship management, and the ability to work under intense deadlines on complex transactions such as IPOs and leveraged buyouts. Both roles necessitate a solid foundation in accounting, Excel mastery, and effective communication skills, with Investment Banking Associates typically expected to have extensive experience in financial analysis and negotiation.

Typical Career Paths and Progression

Corporate Finance Associates typically advance to roles such as Financial Manager or Corporate Development Manager, focusing on strategic planning, budgeting, and internal capital allocation within a company. Investment Banking Associates often progress to Vice President or Director positions, specializing in deal execution, client relationship management, and complex financial modeling in mergers and acquisitions or capital raising. Both paths offer opportunities for leadership roles, but Corporate Finance emphasizes operational finance, while Investment Banking centers on transaction-driven expertise.

Work Environment and Culture Differences

Corporate Finance Associates typically operate within a stable, structured environment focused on long-term financial planning, budgeting, and internal decision-making, fostering a collaborative culture emphasizing strategic growth and risk management. Investment Banking Associates work in a high-pressure, fast-paced setting characterized by tight deal deadlines, extensive client interaction, and frequent travel, cultivating a competitive culture driven by deal execution and revenue generation. The variance in work hours, stress levels, and team dynamics between the two roles distinctly shapes their respective professional experiences.

Compensation and Benefits Comparison

Corporate Finance Associates typically receive a base salary ranging from $70,000 to $120,000 annually, often complemented by performance bonuses averaging 10-20% of base pay, with benefits including health insurance, retirement plans, and paid time off. Investment Banking Associates command higher total compensation, with base salaries between $120,000 and $180,000 and bonuses that can double or triple the base, reflecting the high-pressure environment and longer hours. Equity participation and signing bonuses are more common in investment banking, alongside comprehensive benefits packages that include premium healthcare and extensive professional development opportunities.

Essential Tools and Technologies Used

Corporate Finance Associates primarily utilize financial modeling software like Excel and ERP systems such as SAP to optimize budgeting, forecasting, and financial analysis. Investment Banking Associates rely heavily on advanced financial databases including Bloomberg Terminal and Capital IQ, alongside industry-specific valuation models and pitch book creation tools to support deal execution and capital raising. Both roles demand proficiency in data analytics platforms and presentation software like PowerPoint to communicate complex financial insights effectively.

Key Challenges Faced in Each Role

Corporate Finance Associates often face challenges related to long-term financial planning, capital structuring, and managing internal stakeholder expectations to align with corporate growth strategies. Investment Banking Associates encounter intense pressure from deal origination, executing complex mergers and acquisitions, and stringent regulatory compliance under tight deadlines. Both roles demand strong analytical skills but differ significantly in pace and client interaction, with investment banking requiring faster decision-making in high-stakes environments.

How to Choose Between the Two Careers

Evaluating a career as a Corporate Finance Associate versus an Investment Banking Associate requires understanding key differences in work scope, deal types, and lifestyle demands; corporate finance associates primarily focus on internal financial strategy, budgeting, and capital structure optimization, while investment banking associates engage in client-driven transactions such as mergers and acquisitions and public offerings. Assess factors like long-term career goals, preferred work environment, and desired work-life balance, with investment banking often entailing longer hours but higher compensation and faster deal execution versus corporate finance's strategic depth and operational involvement. Analyzing firm culture, growth opportunities, industry exposure, and compensation packages helps identify which path aligns better with personal skills and career aspirations in the finance sector.

Future Trends and Opportunities in Finance Sector

Corporate Finance Associates will increasingly leverage digital tools and artificial intelligence to enhance financial planning, risk management, and strategic decision-making within corporations. Investment Banking Associates are expected to adapt to growing demand for sustainable finance, ESG advisory services, and cross-border transactions fueled by globalization and regulatory changes. Both roles will benefit from advancements in fintech, data analytics, and automation, creating opportunities for specialization in emerging sectors such as green finance and blockchain-based asset management.

Corporate Finance Associate vs Investment Banking Associate Infographic

jobdiv.com

jobdiv.com