Tax accountants specialize in preparing tax returns and ensuring compliance with tax laws to minimize liabilities, while management accountants focus on internal financial analysis, budgeting, and strategic planning to support business decision-making. Tax accountants often work with regulatory authorities and handle audits, whereas management accountants provide insights that drive operational efficiency and profitability. Both roles require strong accounting skills but serve different purposes within an organization's financial management framework.

Table of Comparison

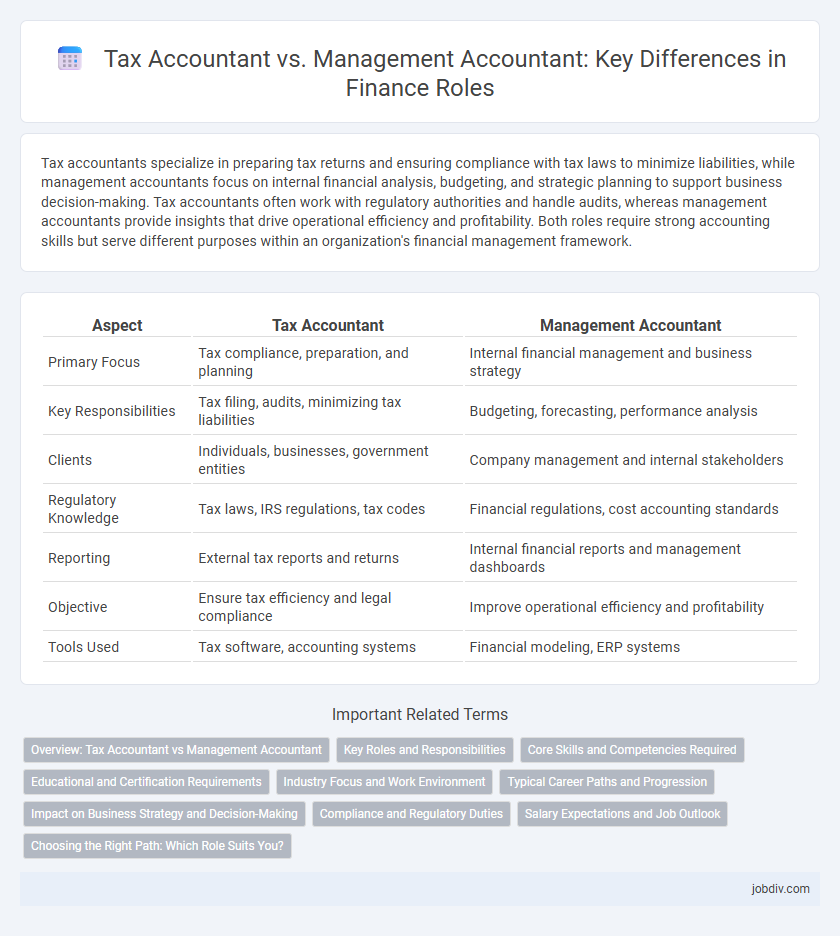

| Aspect | Tax Accountant | Management Accountant |

|---|---|---|

| Primary Focus | Tax compliance, preparation, and planning | Internal financial management and business strategy |

| Key Responsibilities | Tax filing, audits, minimizing tax liabilities | Budgeting, forecasting, performance analysis |

| Clients | Individuals, businesses, government entities | Company management and internal stakeholders |

| Regulatory Knowledge | Tax laws, IRS regulations, tax codes | Financial regulations, cost accounting standards |

| Reporting | External tax reports and returns | Internal financial reports and management dashboards |

| Objective | Ensure tax efficiency and legal compliance | Improve operational efficiency and profitability |

| Tools Used | Tax software, accounting systems | Financial modeling, ERP systems |

Overview: Tax Accountant vs Management Accountant

Tax accountants specialize in preparing and filing tax returns while ensuring compliance with tax laws and regulations specific to both individuals and businesses. Management accountants focus on internal financial analysis, budgeting, and strategic planning to support decision-making and improve organizational performance. Both roles require expertise in accounting principles, but tax accountants emphasize regulatory compliance whereas management accountants prioritize financial management and operational efficiency.

Key Roles and Responsibilities

Tax accountants specialize in preparing and filing tax returns, ensuring compliance with tax laws, and optimizing tax liabilities for individuals or corporations. Management accountants focus on internal financial analysis, budgeting, and performance evaluation to support strategic decision-making and improve organizational efficiency. Both roles require strong accounting expertise but differ in their emphasis on external compliance versus internal business management.

Core Skills and Competencies Required

Tax accountants require deep expertise in tax laws, regulations, and compliance to accurately prepare tax returns and optimize tax liabilities. Management accountants focus on financial analysis, budgeting, and strategic planning skills to support internal decision-making and improve organizational performance. Both roles demand strong analytical abilities, proficiency in accounting software, and effective communication to interpret complex financial data.

Educational and Certification Requirements

Tax accountants typically require a degree in accounting or finance and must obtain certifications such as the CPA (Certified Public Accountant) to specialize in tax laws and compliance. Management accountants often hold certifications like CMA (Certified Management Accountant) that emphasize strategic planning, budgeting, and financial management within organizations. Both roles demand strong foundational knowledge in accounting principles, but their certification paths reflect distinct professional focuses.

Industry Focus and Work Environment

Tax accountants specialize in compliance and regulations within industries such as real estate, manufacturing, and financial services, often working in firms or government agencies with a structured and deadline-driven environment. Management accountants focus on internal financial analysis, budgeting, and strategic planning primarily in corporate sectors like retail, healthcare, and technology, operating in dynamic, collaborative office settings. Their industry focus and work environments distinctly shape their roles, with tax accountants emphasizing external reporting and legal adherence, while management accountants prioritize internal decision support and performance management.

Typical Career Paths and Progression

Tax accountants typically advance by specializing in tax compliance, planning, and consulting roles within accounting firms or corporate tax departments, often progressing to senior tax advisor or tax manager positions. Management accountants usually follow a path through financial planning, budgeting, and internal control roles, aiming to become financial controllers, cost accountants, or CFOs. Both career tracks demand continuous certification, such as CPA for tax accountants and CMA for management accountants, to enhance expertise and leadership opportunities.

Impact on Business Strategy and Decision-Making

Tax accountants primarily focus on compliance, tax planning, and minimizing tax liabilities, ensuring businesses meet regulatory requirements while optimizing tax positions. Management accountants analyze operational data, budgeting, and financial performance to provide actionable insights, directly influencing strategic decisions and resource allocation. Both roles impact business strategy by balancing regulatory adherence with informed decision-making to drive profitability and growth.

Compliance and Regulatory Duties

Tax accountants specialize in ensuring compliance with tax laws and regulations, preparing tax returns, and advising on tax strategies to minimize liabilities. Management accountants focus on internal financial reporting, budget management, and regulatory compliance related to corporate governance and operational controls. Both roles require thorough knowledge of financial regulations, but tax accountants primarily deal with external compliance, while management accountants ensure adherence to internal policies and regulatory standards.

Salary Expectations and Job Outlook

Tax accountants typically earn between $55,000 and $90,000 annually, with growth driven by complex tax regulations and year-round demand. Management accountants report higher median salaries ranging from $65,000 to $105,000 due to their strategic role in financial planning and business management. Job outlook for both professions remains strong, with the Bureau of Labor Statistics projecting a 7% growth rate for accountants and auditors through 2031, fueled by increasing regulatory compliance and organizational financial needs.

Choosing the Right Path: Which Role Suits You?

Tax accountants specialize in preparing tax returns, ensuring compliance with tax laws, and optimizing tax liabilities for individuals and businesses, making them ideal for those detail-oriented with a strong understanding of tax codes. Management accountants focus on internal financial analysis, budgeting, and strategic decision support to improve business performance, suitable for professionals interested in driving operational efficiency and business strategy. Assessing your skills, interests, and career goals in areas like regulatory compliance versus strategic planning will guide you in choosing the right accounting path.

Tax Accountant vs Management Accountant Infographic

jobdiv.com

jobdiv.com