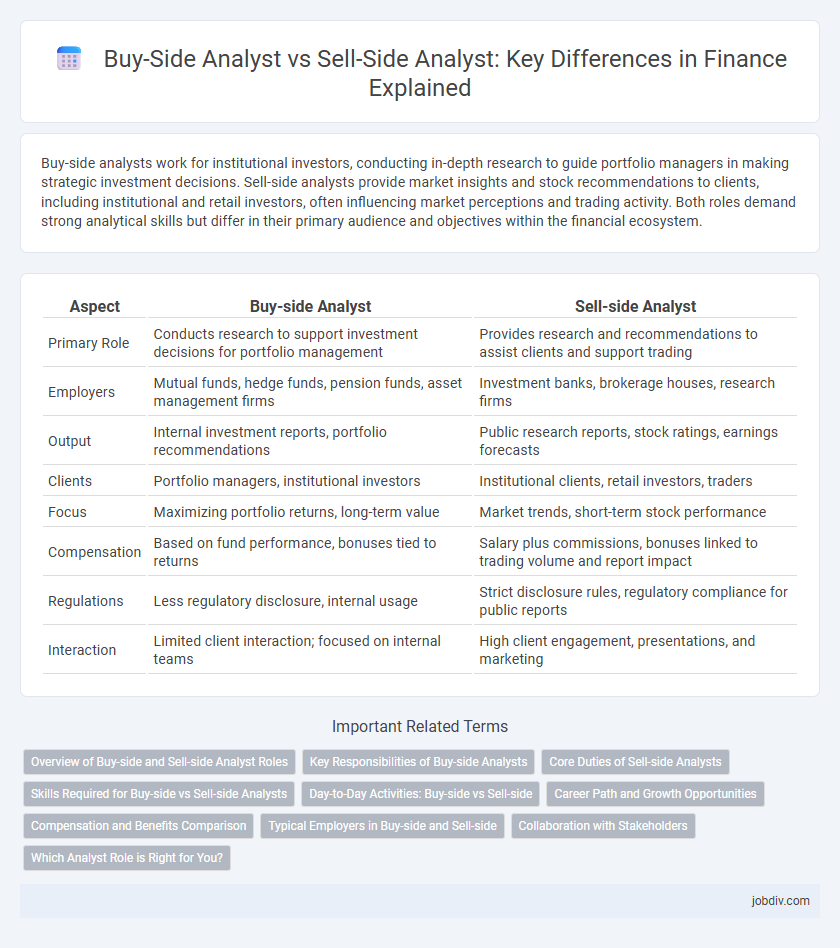

Buy-side analysts work for institutional investors, conducting in-depth research to guide portfolio managers in making strategic investment decisions. Sell-side analysts provide market insights and stock recommendations to clients, including institutional and retail investors, often influencing market perceptions and trading activity. Both roles demand strong analytical skills but differ in their primary audience and objectives within the financial ecosystem.

Table of Comparison

| Aspect | Buy-side Analyst | Sell-side Analyst |

|---|---|---|

| Primary Role | Conducts research to support investment decisions for portfolio management | Provides research and recommendations to assist clients and support trading |

| Employers | Mutual funds, hedge funds, pension funds, asset management firms | Investment banks, brokerage houses, research firms |

| Output | Internal investment reports, portfolio recommendations | Public research reports, stock ratings, earnings forecasts |

| Clients | Portfolio managers, institutional investors | Institutional clients, retail investors, traders |

| Focus | Maximizing portfolio returns, long-term value | Market trends, short-term stock performance |

| Compensation | Based on fund performance, bonuses tied to returns | Salary plus commissions, bonuses linked to trading volume and report impact |

| Regulations | Less regulatory disclosure, internal usage | Strict disclosure rules, regulatory compliance for public reports |

| Interaction | Limited client interaction; focused on internal teams | High client engagement, presentations, and marketing |

Overview of Buy-side and Sell-side Analyst Roles

Buy-side analysts work for institutional investors such as mutual funds, hedge funds, and pension funds, focusing on generating investment ideas and managing portfolios to maximize returns. Sell-side analysts, employed by brokerage firms or investment banks, provide research and recommendations to support client decision-making and facilitate trading activities. Both roles require strong financial modeling and industry expertise, but buy-side analysts prioritize long-term investment performance, whereas sell-side analysts emphasize market accessibility and transaction execution.

Key Responsibilities of Buy-side Analysts

Buy-side analysts primarily conduct in-depth research and analysis to support investment decisions for institutional investors such as mutual funds, pension funds, and hedge funds. They focus on identifying undervalued securities and provide detailed financial models, valuation assessments, and risk evaluations to portfolio managers. Their work directly influences asset allocation and portfolio management strategies by recommending buy, hold, or sell actions based on proprietary insights.

Core Duties of Sell-side Analysts

Sell-side analysts primarily focus on providing research and recommendations to support brokerages and investment banks in selling securities, preparing detailed equity reports, earnings forecasts, and market trend analyses. They play a critical role in producing investment ratings, targeting stock prices, and advising institutional clients to execute trades effectively. Their core duties also involve maintaining strong relationships with company management and market participants to gather timely information for market insights.

Skills Required for Buy-side vs Sell-side Analysts

Buy-side analysts require strong portfolio management skills, deep fundamental analysis expertise, and the ability to generate long-term investment ideas aligned with institutional investor goals. Sell-side analysts focus on financial modeling, market research, and effective communication skills to provide actionable recommendations for clients and support brokerage sales teams. Both roles demand analytical proficiency, but buy-side analysts emphasize investment decision-making, while sell-side analysts prioritize client advisory and market insights.

Day-to-Day Activities: Buy-side vs Sell-side

Buy-side analysts spend their day conducting in-depth research to identify investment opportunities that align with portfolio objectives, often collaborating closely with portfolio managers to support decision-making. Sell-side analysts focus on producing detailed equity research reports and providing timely market insights to assist sales and trading teams in advising clients and generating trading activity. Both roles require continuous monitoring of market trends and company performance, but buy-side analysts emphasize portfolio impact while sell-side analysts prioritize client-facing analysis.

Career Path and Growth Opportunities

Buy-side analysts typically work within asset management firms, hedge funds, or mutual funds, focusing on investment decisions to maximize portfolio returns, which offers a direct impact on fund performance and potential for advancement into portfolio management. Sell-side analysts are employed by brokerage firms or investment banks, providing research and recommendations to clients, with career growth often leading to senior analyst roles or transitioning into investment banking or sales. The buy-side career path generally emphasizes in-depth analysis and decision-making, while the sell-side path prioritizes market communication and client advisory skills, influencing long-term progression and specialization.

Compensation and Benefits Comparison

Buy-side analysts typically receive higher total compensation packages, often including base salary, performance bonuses, and profit-sharing tied to portfolio returns, reflecting their direct impact on investment decisions for asset management firms. Sell-side analysts usually earn a base salary supplemented by bonuses linked to the revenue generated from trading commissions and investment banking deals, with greater emphasis on client relationships. Benefits for buy-side roles often include long-term incentives like stock options, whereas sell-side positions may offer more structured benefits but less upside tied directly to firm profits.

Typical Employers in Buy-side and Sell-side

Buy-side analysts typically work for institutional investors such as mutual funds, pension funds, hedge funds, and private equity firms, focusing on making investment decisions to maximize portfolio returns. Sell-side analysts are commonly employed by brokerage firms, investment banks, and research firms, providing market research and stock recommendations to support client trading activities. The distinct roles cater to different market needs, with buy-side analysts driving internal investment strategies and sell-side analysts delivering insights for external clients.

Collaboration with Stakeholders

Buy-side analysts work closely with portfolio managers and internal stakeholders to provide in-depth investment research tailored to asset management decisions and risk assessments. Sell-side analysts collaborate with sales teams, traders, and institutional clients by delivering detailed market insights and stock recommendations that influence trading strategies and client portfolios. Effective communication and alignment between analysts and stakeholders enhance decision-making processes and investment performance on both sides.

Which Analyst Role is Right for You?

Buy-side analysts focus on providing investment recommendations to portfolio managers within asset management firms, aiming to maximize returns for their clients by conducting in-depth research on securities. Sell-side analysts work for brokerage firms or investment banks, producing detailed reports and stock ratings to assist traders and sales teams in advising external clients. Choosing between buy-side and sell-side roles depends on your preference for in-depth research and investment decision-making versus client interaction and market communication.

Buy-side Analyst vs Sell-side Analyst Infographic

jobdiv.com

jobdiv.com