Actuaries analyze statistical data to assess risk and forecast financial costs, primarily for insurance companies, using advanced mathematics and probability models. Underwriters evaluate individual applications and determine coverage terms and premiums based on the actuary's models and established guidelines. Both roles are essential in managing risk, with actuaries focusing on long-term risk assessment and underwriters handling immediate risk decisions for policies.

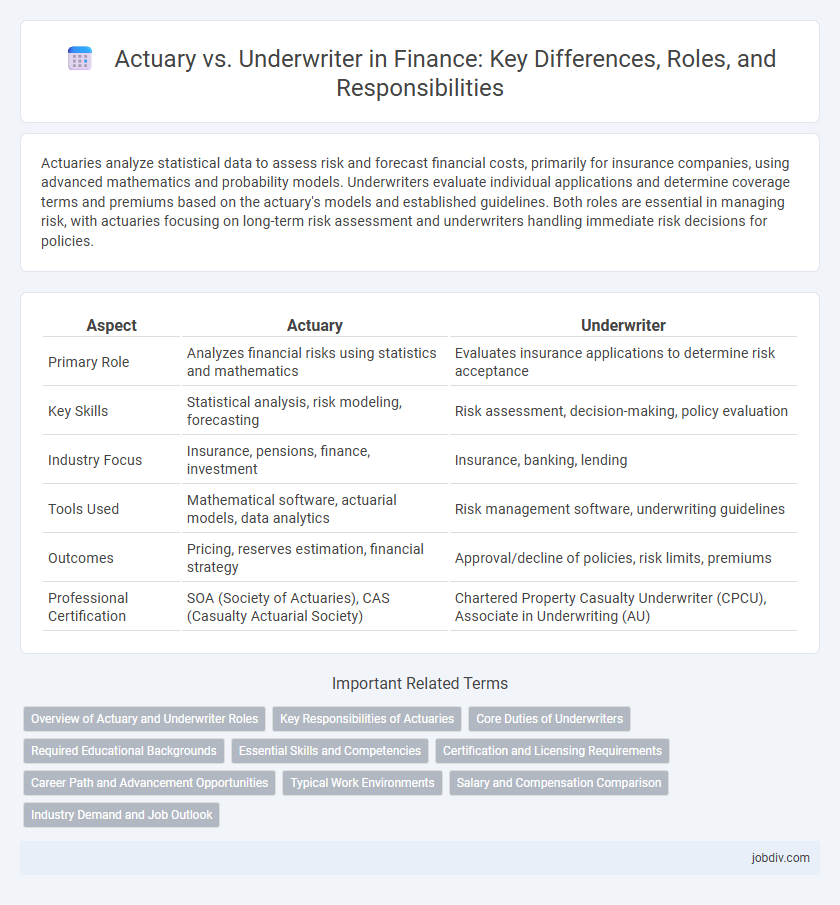

Table of Comparison

| Aspect | Actuary | Underwriter |

|---|---|---|

| Primary Role | Analyzes financial risks using statistics and mathematics | Evaluates insurance applications to determine risk acceptance |

| Key Skills | Statistical analysis, risk modeling, forecasting | Risk assessment, decision-making, policy evaluation |

| Industry Focus | Insurance, pensions, finance, investment | Insurance, banking, lending |

| Tools Used | Mathematical software, actuarial models, data analytics | Risk management software, underwriting guidelines |

| Outcomes | Pricing, reserves estimation, financial strategy | Approval/decline of policies, risk limits, premiums |

| Professional Certification | SOA (Society of Actuaries), CAS (Casualty Actuarial Society) | Chartered Property Casualty Underwriter (CPCU), Associate in Underwriting (AU) |

Overview of Actuary and Underwriter Roles

Actuaries analyze statistical data to assess financial risks and determine premium rates for insurance policies, using mathematical models to forecast future events like mortality or natural disasters. Underwriters evaluate insurance applications and decide whether to accept or reject risks, ensuring compliance with company guidelines and regulatory standards. Both roles are essential in risk management but emphasize different aspects: actuaries focus on risk quantification while underwriters concentrate on risk selection.

Key Responsibilities of Actuaries

Actuaries analyze statistical data, such as mortality, accident, sickness, disability, and retirement rates, to estimate future risks and financial costs for insurance companies. They develop and validate mathematical models to calculate premium rates, reserves, and ensure the financial stability of insurance products. Actuaries also collaborate with underwriters to assess policy risks and refine underwriting guidelines based on predictive risk assessments.

Core Duties of Underwriters

Underwriters assess financial risk by evaluating applications for insurance, mortgages, or loans, determining coverage terms, and setting premium rates based on detailed analysis. They review credit reports, medical records, and other relevant information to decide approval or denial, ensuring the company minimizes exposure to loss. Accuracy in risk assessment and adherence to regulatory standards are essential for underwriters to maintain profitability and compliance.

Required Educational Backgrounds

Actuaries typically require a strong foundation in mathematics, statistics, and finance, often holding degrees in actuarial science, mathematics, or economics, combined with professional certifications like the Society of Actuaries (SOA) or Casualty Actuarial Society (CAS). Underwriters generally hold degrees in finance, business administration, or economics, with specialized training in risk assessment and insurance underwriting principles. Both professions demand rigorous analytical skills, but actuaries emphasize advanced mathematical modeling, while underwriters focus on evaluating and pricing insurance risks.

Essential Skills and Competencies

Actuaries excel in advanced statistical analysis, risk modeling, and proficiency in mathematics, enabling them to predict financial outcomes and assess insurance risks accurately. Underwriters specialize in evaluating individual risk profiles, strong decision-making abilities, and comprehensive knowledge of insurance policies to determine coverage eligibility and pricing. Both roles require attention to detail, analytical thinking, and expertise in regulatory compliance within the financial and insurance sectors.

Certification and Licensing Requirements

Actuaries typically require certification from professional bodies such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS), involving rigorous exams and continuous education. Underwriters often hold licenses based on the specific insurance products they handle, such as property and casualty or life insurance, which may require passing state exams and adhering to regulatory standards. Both roles demand ongoing professional development, but actuaries emphasize mathematical and statistical credentials, while underwriters prioritize product-specific licensure and practical risk assessment skills.

Career Path and Advancement Opportunities

Actuaries typically advance by gaining specialized expertise in risk modeling, predictive analytics, and financial theory, often progressing to senior analyst, consulting actuary, or chief risk officer roles. Underwriters build career growth through mastering risk assessment, underwriting policies, and regulatory compliance, moving toward senior underwriter, underwriting manager, or underwriting director positions. Both professions offer strong career trajectories, with actuaries often entering strategic planning and financial forecasting, while underwriters focus on operational risk mitigation and policy development.

Typical Work Environments

Actuaries typically work in insurance companies, consulting firms, government agencies, and pension funds, analyzing statistical data to evaluate financial risks and develop pricing models. Underwriters are commonly employed by insurance companies and banks, assessing applications and determining coverage terms based on risk factors. Both professionals often operate in collaborative office settings, utilizing advanced software tools for data analysis and decision-making.

Salary and Compensation Comparison

Actuaries generally earn higher average salaries, with entry-level positions starting around $65,000 and experienced professionals exceeding $150,000 annually, reflecting their advanced mathematical expertise and complex risk assessments. Underwriters typically have starting salaries near $55,000, with senior roles reaching approximately $100,000, influenced by industry and specialization such as mortgage or insurance underwriting. Compensation packages for actuaries often include bonuses tied to performance metrics and certifications like the ASA or FSA, while underwriters may receive commission-based incentives in addition to base pay.

Industry Demand and Job Outlook

Actuaries in the finance industry are experiencing strong demand driven by the increasing complexity of risk management and regulatory requirements, with projected job growth of 18% through 2031 according to the U.S. Bureau of Labor Statistics. Underwriters face steady demand as financial institutions seek professionals skilled in evaluating loan, insurance, and investment risks, with employment growth expected around 5% over the next decade. Both roles require specialized knowledge, but actuaries typically command higher salaries due to their advanced statistical expertise and critical role in strategic financial planning.

Actuary vs Underwriter Infographic

jobdiv.com

jobdiv.com