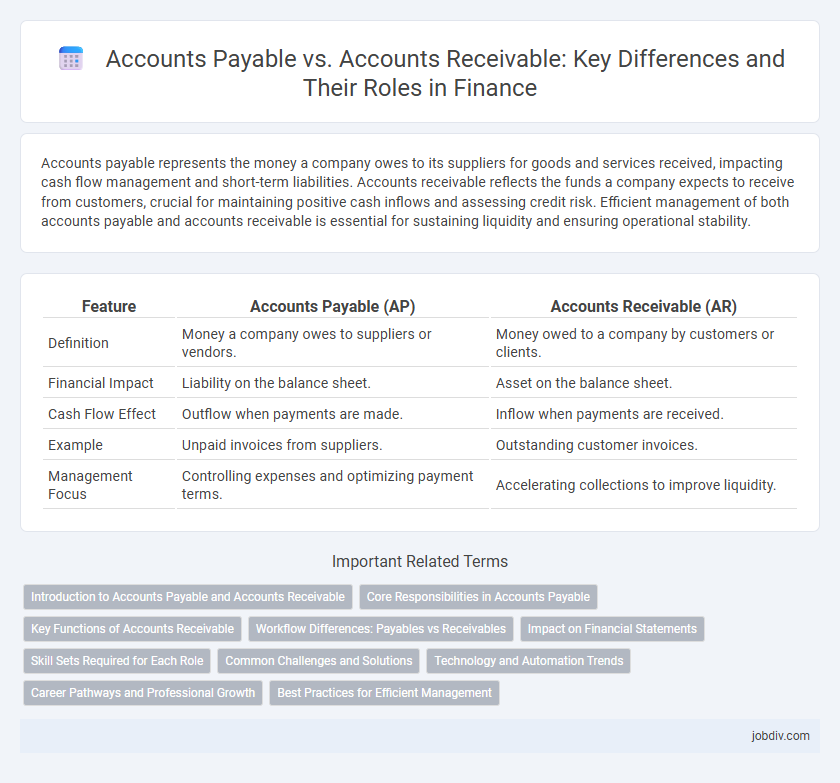

Accounts payable represents the money a company owes to its suppliers for goods and services received, impacting cash flow management and short-term liabilities. Accounts receivable reflects the funds a company expects to receive from customers, crucial for maintaining positive cash inflows and assessing credit risk. Efficient management of both accounts payable and accounts receivable is essential for sustaining liquidity and ensuring operational stability.

Table of Comparison

| Feature | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Definition | Money a company owes to suppliers or vendors. | Money owed to a company by customers or clients. |

| Financial Impact | Liability on the balance sheet. | Asset on the balance sheet. |

| Cash Flow Effect | Outflow when payments are made. | Inflow when payments are received. |

| Example | Unpaid invoices from suppliers. | Outstanding customer invoices. |

| Management Focus | Controlling expenses and optimizing payment terms. | Accelerating collections to improve liquidity. |

Introduction to Accounts Payable and Accounts Receivable

Accounts Payable represents a company's obligations to pay suppliers or vendors for goods and services received, recorded as liabilities on the balance sheet. Accounts Receivable refers to the outstanding invoices a company holds from customers, seen as assets indicating money owed to the business. Efficient management of both accounts is critical for maintaining healthy cash flow and financial stability.

Core Responsibilities in Accounts Payable

Accounts Payable manages a company's obligations to suppliers by processing, verifying, and recording invoices to ensure timely and accurate payments. Core responsibilities include maintaining vendor relationships, tracking outstanding debts, and reconciling payment discrepancies to optimize cash flow and avoid late fees. Efficient accounts payable processes support financial stability and contribute to accurate financial reporting and budgeting.

Key Functions of Accounts Receivable

Accounts Receivable (AR) manages incoming payments, tracking customer invoices and ensuring timely collection to maintain cash flow. Key functions include issuing invoices, monitoring outstanding balances, and recording payments to accurately reflect revenue. Effective AR processes reduce bad debts and improve working capital management in finance operations.

Workflow Differences: Payables vs Receivables

Accounts payable workflows prioritize invoice verification, approval routing, and timely payment execution to manage outgoing cash flow efficiently. Accounts receivable processes emphasize invoice generation, payment tracking, and collection follow-ups to ensure steady incoming revenue. Both workflows require robust communication and reconciliation steps but differ significantly in managing cash outflows versus inflows.

Impact on Financial Statements

Accounts Payable represents a company's outstanding obligations to suppliers, directly increasing current liabilities on the balance sheet and reducing cash flow until paid. Accounts Receivable indicates the money owed by customers, boosting current assets and contributing to revenue recognition and cash inflows when collected. Both accounts significantly influence working capital management, liquidity ratios, and overall financial health, shaping the company's short-term financial strategy.

Skill Sets Required for Each Role

Accounts Payable roles require proficiency in invoice processing, attention to detail for accurate payment tracking, and strong organizational skills to manage vendor relationships. Accounts Receivable professionals need expertise in credit management, collections strategies, and excellent communication skills to ensure timely customer payments. Both roles demand familiarity with accounting software and compliance regulations to maintain financial accuracy and integrity.

Common Challenges and Solutions

Accounts Payable (AP) often faces challenges such as invoice discrepancies, late payments, and inefficient manual processing, which can be mitigated by implementing automated accounting software and establishing consistent vendor communication protocols. Accounts Receivable (AR) struggles with delayed customer payments, credit risk assessment, and accurate cash flow forecasting; employing robust credit management systems and proactive collection strategies improves cash inflow reliability. Both AP and AR benefit from integrated financial platforms that enhance data accuracy, streamline transaction tracking, and improve overall financial reporting for better decision-making.

Technology and Automation Trends

Accounts Payable (AP) and Accounts Receivable (AR) departments are increasingly leveraging technologies such as robotic process automation (RPA), artificial intelligence (AI), and cloud-based platforms to streamline invoice processing, reduce errors, and accelerate cash flow cycles. Automation tools enable real-time data integration and predictive analytics, enhancing accuracy in financial forecasting and decision-making. Emerging trends include blockchain implementation for secure transaction verification and machine learning models for fraud detection and payment optimization.

Career Pathways and Professional Growth

Expertise in accounts payable sharpens skills in managing outgoing cash flow, vendor relations, and payment processing, positioning professionals for roles in treasury or financial operations management. Accounts receivable experience emphasizes credit management, customer invoicing, and revenue tracking, paving the way toward careers in credit analysis and revenue cycle management. Both pathways enhance analytical abilities and financial reporting proficiency, fostering advancement into senior accounting, controller, or finance leadership positions.

Best Practices for Efficient Management

Effective management of accounts payable and accounts receivable requires implementing automated invoicing systems to reduce errors and accelerate processing times. Establishing clear credit policies and regular reconciliation schedules improves cash flow transparency and minimizes the risk of outstanding debts. Leveraging real-time analytics enables proactive identification of payment trends and enhances decision-making for financial stability.

Accounts Payable vs Accounts Receivable Infographic

jobdiv.com

jobdiv.com