M&A analysts specialize in evaluating mergers and acquisitions by conducting detailed financial modeling, valuation, and due diligence to support strategic decision-making. Leveraged finance analysts focus on structuring and assessing high-yield debt transactions, analyzing credit risk, and optimizing capital structures for leveraged buyouts and recapitalizations. Both roles require strong financial analysis skills but differ in emphasis, with M&A centered on equity deals and strategic growth, while leveraged finance centers on debt financing and risk management.

Table of Comparison

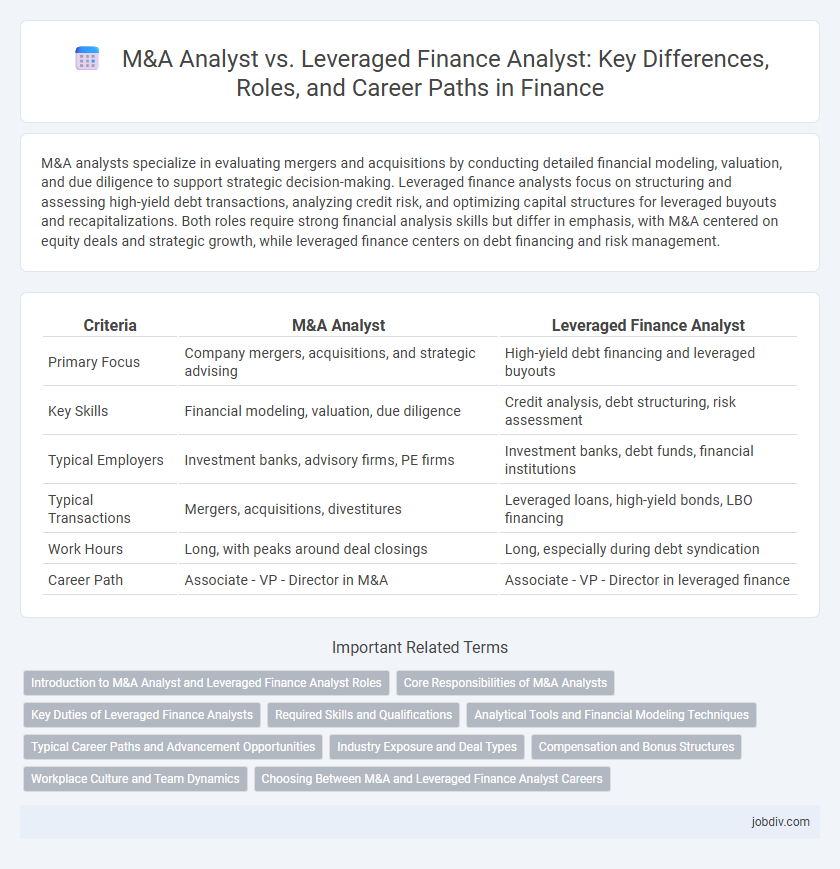

| Criteria | M&A Analyst | Leveraged Finance Analyst |

|---|---|---|

| Primary Focus | Company mergers, acquisitions, and strategic advising | High-yield debt financing and leveraged buyouts |

| Key Skills | Financial modeling, valuation, due diligence | Credit analysis, debt structuring, risk assessment |

| Typical Employers | Investment banks, advisory firms, PE firms | Investment banks, debt funds, financial institutions |

| Typical Transactions | Mergers, acquisitions, divestitures | Leveraged loans, high-yield bonds, LBO financing |

| Work Hours | Long, with peaks around deal closings | Long, especially during debt syndication |

| Career Path | Associate - VP - Director in M&A | Associate - VP - Director in leveraged finance |

Introduction to M&A Analyst and Leveraged Finance Analyst Roles

M&A Analysts specialize in evaluating merger and acquisition opportunities by conducting financial modeling, due diligence, and market research to advise corporate clients on strategic transactions. Leveraged Finance Analysts focus on structuring and analyzing high-yield debt and leveraged loans used to finance acquisitions, emphasizing credit risk assessment and covenant analysis. Both roles require strong analytical skills but differ in their primary focus: M&A on transaction strategy and deal execution, and Leveraged Finance on debt structuring and financing solutions.

Core Responsibilities of M&A Analysts

M&A Analysts primarily conduct thorough due diligence, financial modeling, and valuation analyses to support merger and acquisition transactions. They focus on identifying target companies' strategic fit and assessing potential synergies, preparing buyer presentations and assisting in deal structuring. Their core responsibilities also include monitoring industry trends and market conditions to advise clients on acquisition risks and opportunities.

Key Duties of Leveraged Finance Analysts

Leveraged finance analysts primarily structure and evaluate high-yield debt instruments used to fund acquisitions, focusing on credit risk assessment, cash flow analysis, and debt covenant compliance. They model leveraged buyouts, assess borrower creditworthiness, and manage relationships with institutional investors and rating agencies. These analysts closely monitor market conditions to optimize debt issuance strategy and ensure alignment with the firm's capital structure goals.

Required Skills and Qualifications

M&A Analysts require strong financial modeling, valuation techniques, and strategic thinking skills, with proficiency in Excel, PowerPoint, and industry research. Leveraged Finance Analysts must excel in credit analysis, debt structuring, and risk assessment, alongside expertise in covenant compliance and rating agency methodologies. Both roles demand exceptional analytical abilities, attention to detail, and effective communication skills, often complemented by degrees in finance, economics, or related fields and relevant certifications like CFA or CPA.

Analytical Tools and Financial Modeling Techniques

M&A Analysts primarily utilize discounted cash flow (DCF) models, accretion/dilution analysis, and precedent transaction analyses to evaluate deal synergies and valuation impact. Leveraged Finance Analysts emphasize leveraged buyout (LBO) modeling, debt capacity assessments, and scenario stress testing to assess credit risk and covenant compliance. Both roles leverage Excel proficiency and Bloomberg Terminal data extraction, but M&A focuses on strategic valuation while Leveraged Finance prioritizes capital structure optimization.

Typical Career Paths and Advancement Opportunities

M&A analysts typically advance by moving from junior roles to senior associate and vice president positions within investment banks or private equity firms, often transitioning into strategic advisory or corporate development roles. Leveraged finance analysts progress by gaining expertise in structuring high-yield debt, advancing to associate and director roles within banks or debt-focused firms, frequently branching into credit analysis, syndications, or portfolio management. Both paths emphasize financial modeling and deal execution skills but differ in focus areas, with M&A centered on acquisitions and mergers, while leveraged finance targets debt financing and capital markets.

Industry Exposure and Deal Types

M&A Analysts primarily focus on corporate mergers, acquisitions, and restructuring deals across industries such as technology, healthcare, and consumer goods, providing deep exposure to strategic and cross-border transactions. Leveraged Finance Analysts specialize in debt financing for leveraged buyouts, recapitalizations, and leveraged acquisitions, with significant involvement in high-yield bond and syndicated loan markets across sectors like private equity, energy, and retail. The deal types in M&A emphasize equity transactions and valuation modeling, whereas Leveraged Finance centers on credit risk assessment and capital structure optimization.

Compensation and Bonus Structures

M&A Analysts typically receive higher base salaries ranging from $85,000 to $120,000 annually, with bonuses often constituting 50% to 100% of their base pay, reflecting deal-driven performance metrics. Leveraged Finance Analysts have slightly lower base salaries, generally between $80,000 and $110,000, but bonuses remain substantial at approximately 40% to 90%, influenced by debt syndication and credit risk assessments. Both roles offer performance-based compensation, yet M&A Analysts tend to benefit from larger transaction fees and revenue-sharing bonuses tied to deal closures.

Workplace Culture and Team Dynamics

M&A Analysts often work in high-pressure environments characterized by fast-paced deal execution and frequent cross-department collaboration, fostering a dynamic yet intense workplace culture. Leveraged Finance Analysts experience a culture emphasizing structured risk assessment and close coordination with credit teams, promoting meticulous analysis within a supportive, detail-oriented team. Both roles require strong communication skills, but M&A teams tend to have a more fluid hierarchy, whereas Leveraged Finance groups maintain a more formal and process-driven structure.

Choosing Between M&A and Leveraged Finance Analyst Careers

Choosing between M&A analyst and leveraged finance analyst roles depends on your interest in deal types and financial modeling complexity. M&A analysts focus on mergers, acquisitions, and equity transactions, honing skills in valuation and strategic advisory. Leveraged finance analysts specialize in high-yield debt and leveraged buyouts, requiring expertise in credit analysis and debt structuring.

M&A Analyst vs Leveraged Finance Analyst Infographic

jobdiv.com

jobdiv.com