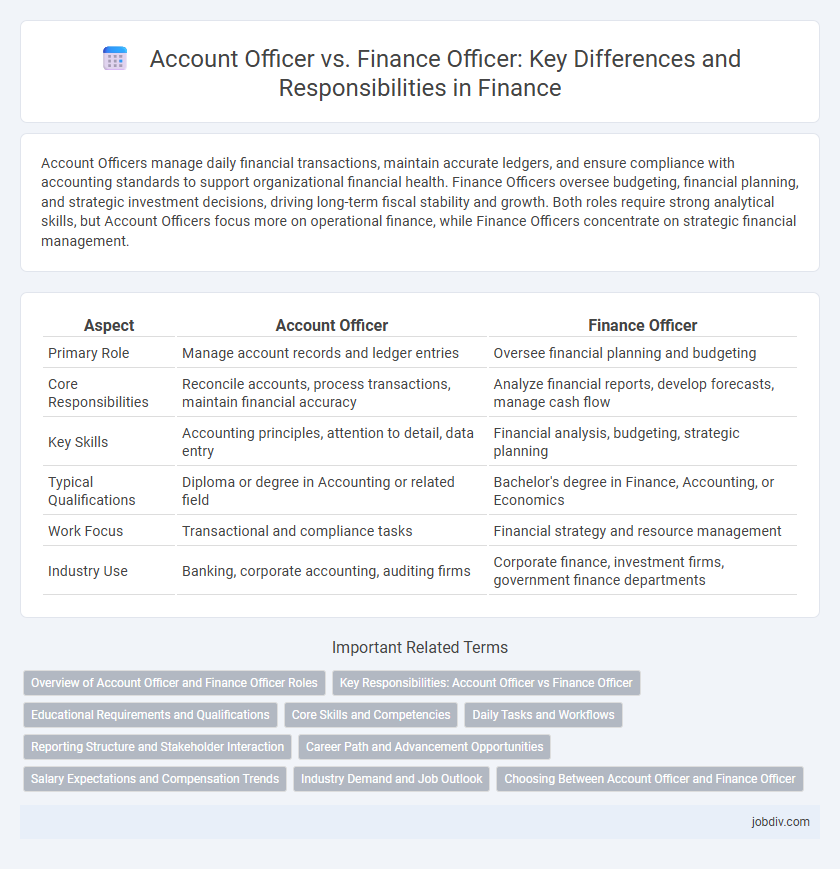

Account Officers manage daily financial transactions, maintain accurate ledgers, and ensure compliance with accounting standards to support organizational financial health. Finance Officers oversee budgeting, financial planning, and strategic investment decisions, driving long-term fiscal stability and growth. Both roles require strong analytical skills, but Account Officers focus more on operational finance, while Finance Officers concentrate on strategic financial management.

Table of Comparison

| Aspect | Account Officer | Finance Officer |

|---|---|---|

| Primary Role | Manage account records and ledger entries | Oversee financial planning and budgeting |

| Core Responsibilities | Reconcile accounts, process transactions, maintain financial accuracy | Analyze financial reports, develop forecasts, manage cash flow |

| Key Skills | Accounting principles, attention to detail, data entry | Financial analysis, budgeting, strategic planning |

| Typical Qualifications | Diploma or degree in Accounting or related field | Bachelor's degree in Finance, Accounting, or Economics |

| Work Focus | Transactional and compliance tasks | Financial strategy and resource management |

| Industry Use | Banking, corporate accounting, auditing firms | Corporate finance, investment firms, government finance departments |

Overview of Account Officer and Finance Officer Roles

Account Officers primarily manage client accounts, handle billing, and ensure accurate financial record-keeping, focusing on customer relationship management and transaction processing. Finance Officers oversee budgeting, financial planning, and reporting, ensuring compliance with financial regulations and strategic allocation of resources. Both roles require strong analytical skills but differ in their emphasis on client interaction versus organizational financial management.

Key Responsibilities: Account Officer vs Finance Officer

Account Officers manage client accounts, ensuring accurate transaction processing, maintaining financial records, and facilitating communication between clients and the finance department. Finance Officers oversee budgeting, financial reporting, and compliance with regulatory standards to support organizational financial health. Both roles require expertise in financial analysis, but Account Officers emphasize client relations while Finance Officers focus on internal financial controls.

Educational Requirements and Qualifications

Account Officers typically require a bachelor's degree in accounting, finance, or business administration, emphasizing knowledge of bookkeeping, financial reporting, and auditing principles. Finance Officers often hold degrees in finance, economics, or business management, with qualifications focusing on financial analysis, budgeting, and investment strategies. Professional certifications such as CPA for Account Officers and CFA for Finance Officers enhance career prospects and demonstrate specialized expertise in their respective fields.

Core Skills and Competencies

Account Officers excel in financial record-keeping, auditing, and managing client accounts, emphasizing attention to detail and strong numerical analysis skills. Finance Officers specialize in budgeting, financial planning, and risk management, requiring strategic thinking and proficiency in financial modeling. Both roles demand expertise in regulatory compliance, effective communication, and the ability to analyze financial data to support organizational goals.

Daily Tasks and Workflows

Account Officers primarily manage daily financial transactions, including processing invoices, maintaining ledgers, and reconciling accounts to ensure accurate record-keeping. Finance Officers focus on broader financial planning, budgeting, and analysis, preparing detailed reports to support strategic decision-making and optimize resource allocation. Both roles require collaboration with internal departments to streamline workflows and maintain regulatory compliance.

Reporting Structure and Stakeholder Interaction

Account Officers typically report to the Finance Manager or Controller and primarily interact with internal stakeholders such as accounting teams, auditors, and departmental heads to ensure accurate financial records and compliance. Finance Officers often have a broader reporting structure, including direct communication with senior executives and external stakeholders like investors and regulatory bodies, focusing on strategic financial planning and regulatory reporting. Both roles require strong collaboration, but Finance Officers usually engage in higher-level decision-making and cross-functional stakeholder management.

Career Path and Advancement Opportunities

Account Officers typically focus on managing client accounts, reconciling financial data, and ensuring compliance with financial regulations, providing a foundation for advancing into roles such as Senior Account Manager or Audit Supervisor. Finance Officers handle budgeting, financial analysis, and strategic planning, positioning themselves for career growth into Financial Controller or Finance Manager roles. Both paths offer advancement opportunities, with Finance Officers often progressing toward broader financial leadership roles, while Account Officers may specialize in client relationship management or auditing.

Salary Expectations and Compensation Trends

Account Officers typically earn a median salary ranging from $45,000 to $60,000 annually, with compensation influenced by client portfolio size and commission structures. Finance Officers command higher average salaries between $60,000 and $80,000, reflecting responsibilities in budgeting, financial reporting, and strategic planning. Emerging compensation trends emphasize performance bonuses and stock options for Finance Officers, while Account Officers benefit more from incentive-based pay tied to sales targets.

Industry Demand and Job Outlook

Account Officers are in high demand within banking and corporate sectors due to their expertise in managing client accounts, financial recordkeeping, and compliance monitoring. Finance Officers, with skills in budgeting, financial analysis, and strategic planning, are sought after across industries such as healthcare, government, and manufacturing to optimize organizational financial health. The job outlook for both roles remains strong, driven by growing regulatory requirements and the increasing complexity of financial operations worldwide.

Choosing Between Account Officer and Finance Officer

Choosing between an Account Officer and a Finance Officer depends on the specific financial needs and organizational goals. An Account Officer primarily manages account transactions, ledger reconciliation, and financial record accuracy, making them ideal for businesses focused on detailed accounting tasks. In contrast, a Finance Officer handles budget planning, financial analysis, and strategic financial management, which suits organizations aiming for long-term financial growth and resource optimization.

Account Officer vs Finance Officer Infographic

jobdiv.com

jobdiv.com