M&A advisors specialize in facilitating mergers and acquisitions, guiding clients through deal negotiations, due diligence, and strategic planning to maximize transaction value. Valuation analysts focus on determining the financial worth of assets, companies, or securities using various methodologies such as discounted cash flow, comparable company analysis, and precedent transactions. While both roles require financial expertise, M&A advisors emphasize deal execution and client strategy, whereas valuation analysts concentrate on precise asset valuation and financial modeling.

Table of Comparison

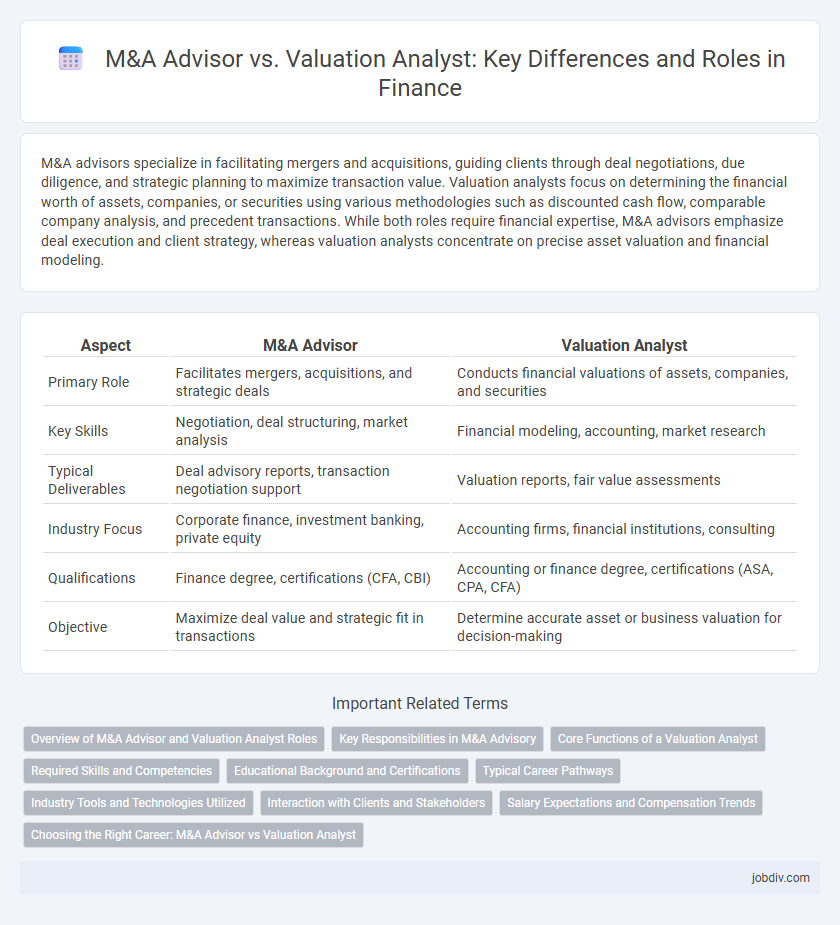

| Aspect | M&A Advisor | Valuation Analyst |

|---|---|---|

| Primary Role | Facilitates mergers, acquisitions, and strategic deals | Conducts financial valuations of assets, companies, and securities |

| Key Skills | Negotiation, deal structuring, market analysis | Financial modeling, accounting, market research |

| Typical Deliverables | Deal advisory reports, transaction negotiation support | Valuation reports, fair value assessments |

| Industry Focus | Corporate finance, investment banking, private equity | Accounting firms, financial institutions, consulting |

| Qualifications | Finance degree, certifications (CFA, CBI) | Accounting or finance degree, certifications (ASA, CPA, CFA) |

| Objective | Maximize deal value and strategic fit in transactions | Determine accurate asset or business valuation for decision-making |

Overview of M&A Advisor and Valuation Analyst Roles

M&A Advisors specialize in facilitating mergers and acquisitions by identifying potential targets, structuring deals, and negotiating terms to maximize transaction value. Valuation Analysts focus on assessing the financial worth of companies, assets, or securities using methodologies like discounted cash flow (DCF), comparable company analysis, and precedent transactions. Both roles require strong financial modeling skills and in-depth market knowledge, but M&A Advisors concentrate on deal execution, while Valuation Analysts emphasize detailed financial assessments.

Key Responsibilities in M&A Advisory

M&A Advisors primarily focus on identifying acquisition opportunities, negotiating deals, and managing transaction processes to ensure successful mergers and acquisitions. Valuation Analysts are responsible for conducting comprehensive financial analyses and determining the fair market value of companies or assets involved in M&A transactions. Both roles require expertise in financial modeling, due diligence, and market research to support strategic decision-making during the advisory process.

Core Functions of a Valuation Analyst

A Valuation Analyst specializes in assessing the worth of assets, companies, or securities using quantitative models, market data, and financial statements to support investment decisions and transactions. Core functions include performing discounted cash flow (DCF) analysis, comparable company analysis, and precedent transaction reviews to produce accurate valuation reports. Their expertise in financial modeling, industry research, and regulatory compliance is critical for mergers and acquisitions, risk assessment, and strategic planning.

Required Skills and Competencies

M&A Advisors require strong negotiation, strategic thinking, and financial modeling skills to guide mergers and acquisitions effectively, along with deep industry knowledge and client relationship management abilities. Valuation Analysts must possess expertise in financial analysis, accounting principles, and valuation methodologies such as DCF, comparable company analysis, and precedent transactions while demonstrating attention to detail and proficiency in Excel and financial software. Both roles demand analytical rigor, communication skills, and the capability to interpret complex financial data to support corporate decision-making.

Educational Background and Certifications

M&A Advisors typically hold degrees in finance, business administration, or economics, often complemented by certifications like the Chartered Financial Analyst (CFA) or Certified Mergers and Acquisitions Professional (CMAP). Valuation Analysts frequently possess backgrounds in accounting, finance, or economics and pursue credentials such as the Accredited Senior Appraiser (ASA) or Certified Valuation Analyst (CVA) to demonstrate expertise in asset and business valuation. Both roles require strong analytical skills but emphasize different certifications aligned with transaction advisory and valuation accuracy respectively.

Typical Career Pathways

M&A Advisors typically progress from roles in investment banking or corporate development, advancing to senior advisory positions focused on deal structuring and client relationship management. Valuation Analysts often begin their careers in financial analysis or accounting, moving toward specialization in business valuation methodologies used for litigation support, tax compliance, and financial reporting. Both career pathways demand strong analytical skills and financial expertise, but M&A Advisors emphasize negotiation and strategic advisory, while Valuation Analysts focus on precise asset and business valuation techniques.

Industry Tools and Technologies Utilized

M&A advisors leverage advanced deal sourcing platforms, CRM systems, and financial modeling software like Capital IQ and DealCloud to streamline transactions and client management. Valuation analysts utilize specialized valuation tools such as Argus Enterprise for real estate, and financial analysis software including Excel with VBA, Bloomberg Terminal, and proprietary DCF models to assess company worth with precision. Both roles increasingly incorporate AI-driven data analytics and cloud-based platforms to enhance forecasting accuracy and operational efficiency.

Interaction with Clients and Stakeholders

M&A Advisors play a crucial role in client interactions by managing negotiations, fostering relationships with stakeholders, and offering strategic deal guidance throughout the transaction process. Valuation Analysts engage with clients primarily to understand financial data requirements and explain valuation methodologies, supporting informed decision-making with precise asset and company valuations. Both roles require effective communication skills, but M&A Advisors emphasize broader stakeholder management, while Valuation Analysts focus on technical financial insights.

Salary Expectations and Compensation Trends

M&A Advisors typically command higher salaries due to their role in facilitating complex transactions and deal negotiations, with median compensation ranging from $120,000 to $200,000 annually, driven by bonuses and deal-based incentives. Valuation Analysts earn between $70,000 and $110,000, reflecting their focus on assessing asset and company values without direct involvement in deal closure, though specialized certifications can boost earnings. Compensation trends show a widening gap as M&A activity intensifies, rewarding advisors for revenue generation, while valuation analysts see steady growth tied to demand for accurate financial assessments.

Choosing the Right Career: M&A Advisor vs Valuation Analyst

Choosing the right career between an M&A Advisor and a Valuation Analyst depends on your skill set and professional interests within finance. M&A Advisors concentrate on deal structuring, negotiation, and client relationship management, often requiring strong interpersonal skills and market insight. Valuation Analysts focus on financial modeling, asset appraisal, and data analysis, ideal for those with analytical precision and expertise in accounting standards.

M&A Advisor vs Valuation Analyst Infographic

jobdiv.com

jobdiv.com