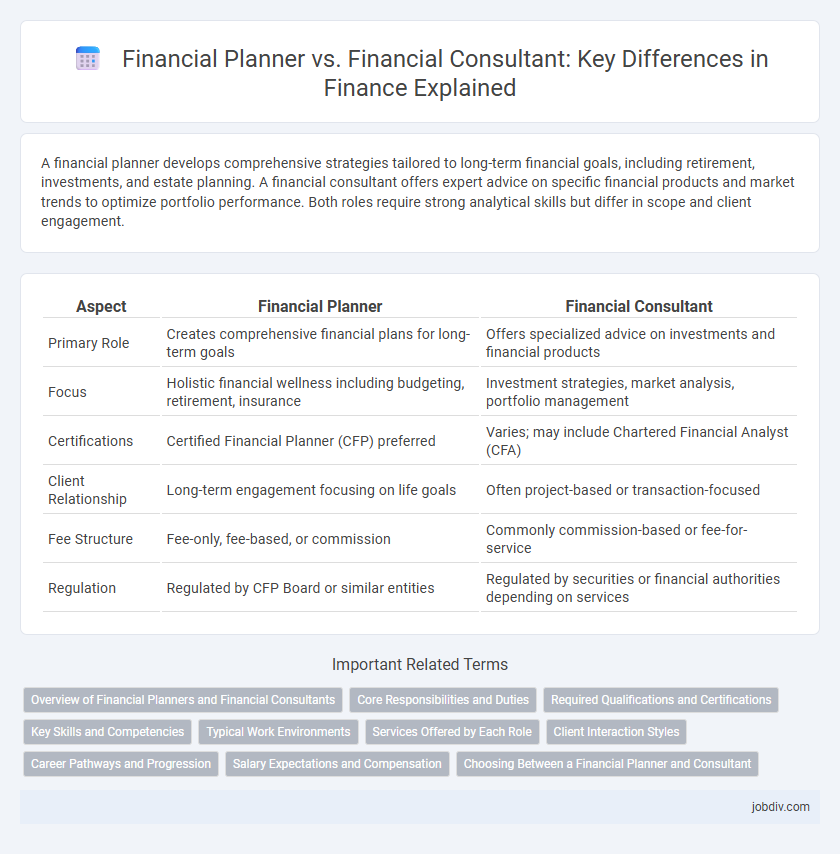

A financial planner develops comprehensive strategies tailored to long-term financial goals, including retirement, investments, and estate planning. A financial consultant offers expert advice on specific financial products and market trends to optimize portfolio performance. Both roles require strong analytical skills but differ in scope and client engagement.

Table of Comparison

| Aspect | Financial Planner | Financial Consultant |

|---|---|---|

| Primary Role | Creates comprehensive financial plans for long-term goals | Offers specialized advice on investments and financial products |

| Focus | Holistic financial wellness including budgeting, retirement, insurance | Investment strategies, market analysis, portfolio management |

| Certifications | Certified Financial Planner (CFP) preferred | Varies; may include Chartered Financial Analyst (CFA) |

| Client Relationship | Long-term engagement focusing on life goals | Often project-based or transaction-focused |

| Fee Structure | Fee-only, fee-based, or commission | Commonly commission-based or fee-for-service |

| Regulation | Regulated by CFP Board or similar entities | Regulated by securities or financial authorities depending on services |

Overview of Financial Planners and Financial Consultants

Financial planners develop comprehensive strategies for managing clients' long-term financial goals, including retirement planning, investment management, tax strategies, and estate planning. Financial consultants offer specialized advice focused on specific financial products or services, often tailored to business needs or targeted investment opportunities. Both roles require expertise in market trends and financial instruments but differ in scope and client engagement depth.

Core Responsibilities and Duties

Financial planners develop comprehensive personal finance strategies, including retirement, investment, tax, and estate planning tailored to individual client goals. Financial consultants provide expert advice on investment portfolios, risk management, and corporate financial strategies, often focusing on optimizing client wealth and business finances. Both roles require strong analytical skills, market knowledge, and client communication to deliver effective financial solutions.

Required Qualifications and Certifications

Financial planners typically hold certifications such as the Certified Financial Planner (CFP) designation, which requires passing a rigorous exam, meeting education requirements, and maintaining continuing education. Financial consultants may have diverse qualifications, including Chartered Financial Analyst (CFA) or Certified Investment Management Analyst (CIMA), depending on their specialization and services. Both roles often require relevant licenses like the Series 7 or Series 65 to provide investment advice legally.

Key Skills and Competencies

Financial planners excel in comprehensive financial goal setting, retirement planning, and tax-efficient investment strategies, leveraging strong analytical and interpersonal skills to tailor personalized plans. Financial consultants specialize in advising businesses and individuals on asset management, risk assessment, and wealth optimization, requiring expertise in market analysis, regulatory compliance, and client relationship management. Both roles demand proficiency in financial modeling, communication, and understanding of financial products, but financial planners emphasize long-term financial well-being while consultants focus on strategic financial decision-making.

Typical Work Environments

Financial planners typically work in environments such as banks, investment firms, and independent advisory offices, focusing on long-term financial goal setting and retirement planning. Financial consultants often operate within corporate settings, insurance companies, and financial service firms, providing specialized advice on investments, risk management, and portfolio optimization. Both roles may also engage in client meetings and regulatory compliance tasks within professional office spaces.

Services Offered by Each Role

Financial Planners develop comprehensive plans that cover budgeting, retirement, tax strategies, and estate planning tailored to long-term financial goals. Financial Consultants offer specialized advice on investments, portfolio management, and market analysis to optimize asset growth and risk management. Both roles provide valuable guidance, but Financial Planners focus on holistic financial health, while Financial Consultants emphasize investment strategies.

Client Interaction Styles

Financial planners typically adopt a holistic and long-term client interaction style, focusing on comprehensive financial goal setting and personalized investment strategies. Financial consultants often engage in more transactional interactions, providing targeted advice on specific financial products or market opportunities. Both roles require strong communication skills but differ in the depth and frequency of client engagement.

Career Pathways and Progression

Financial Planner roles typically require certification such as the CFP, with career progression moving from entry-level planning to senior advisory positions or firm management, emphasizing long-term client wealth strategies. Financial Consultants often begin with a background in finance or sales, advancing through specialist knowledge areas like investment, insurance, or corporate finance advisory, frequently transitioning into portfolio management or executive finance roles. Both career pathways offer opportunities for specialization and leadership, but Financial Planners focus more on individual financial goals, while Financial Consultants often address broader financial solutions for businesses or high-net-worth clients.

Salary Expectations and Compensation

Financial planners typically earn a median salary of $70,000 to $90,000 annually, often supplemented by commissions and performance bonuses tied to client portfolio growth. Financial consultants, on average, command higher compensation, ranging from $80,000 to $120,000 per year, with additional earnings derived from advisory fees and profit-sharing arrangements. Both roles may access firm-specific incentive programs, but consultants generally benefit from more substantial variable pay components linked to business development and investment strategy outcomes.

Choosing Between a Financial Planner and Consultant

Choosing between a financial planner and financial consultant depends on individual financial goals and needs. Financial planners typically offer comprehensive, long-term strategies including retirement, estate, and tax planning, while financial consultants provide specialized advice, investment management, and portfolio analysis. Evaluating credentials such as CFP certification and assessing fee structures helps determine the best professional for tailored financial guidance.

Financial Planner vs Financial Consultant Infographic

jobdiv.com

jobdiv.com