Hedge fund analysts primarily focus on short-term market trends and trading strategies to generate high returns by actively managing portfolios, while private equity analysts concentrate on evaluating long-term investments in private companies for value creation and growth. Hedge fund roles demand strong skills in quantitative analysis and market timing, whereas private equity analysts emphasize due diligence, financial modeling, and deal structuring. Both careers require deep financial expertise but differ significantly in investment horizons, risk profiles, and operational involvement.

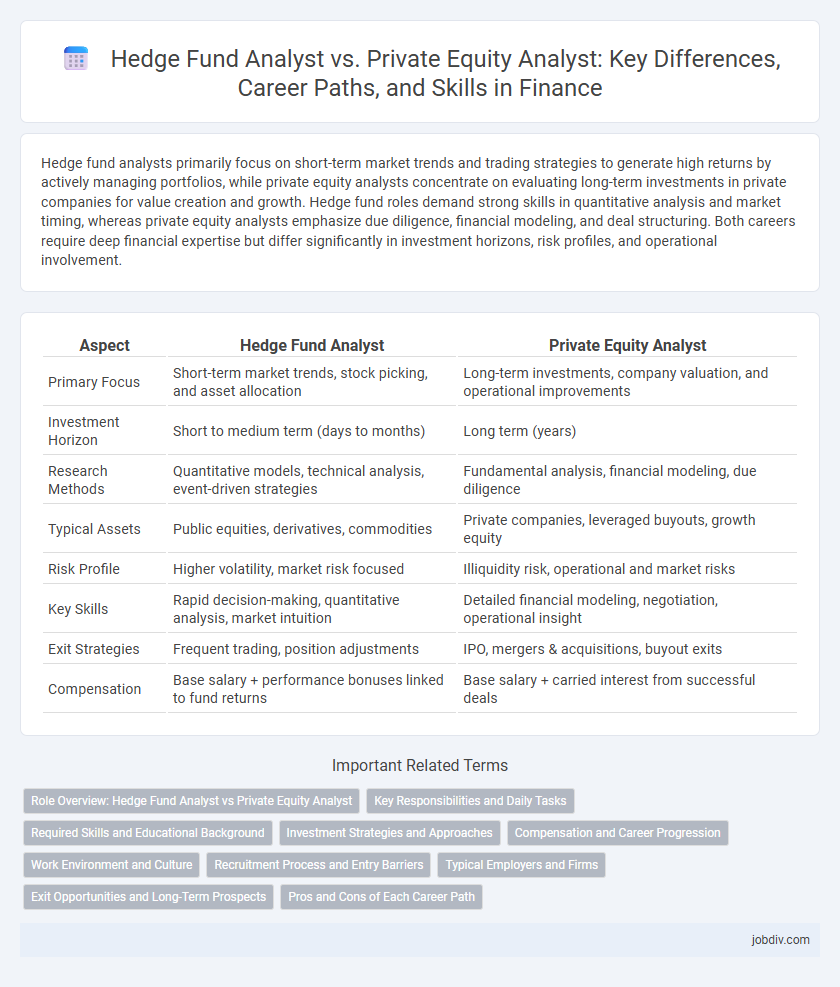

Table of Comparison

| Aspect | Hedge Fund Analyst | Private Equity Analyst |

|---|---|---|

| Primary Focus | Short-term market trends, stock picking, and asset allocation | Long-term investments, company valuation, and operational improvements |

| Investment Horizon | Short to medium term (days to months) | Long term (years) |

| Research Methods | Quantitative models, technical analysis, event-driven strategies | Fundamental analysis, financial modeling, due diligence |

| Typical Assets | Public equities, derivatives, commodities | Private companies, leveraged buyouts, growth equity |

| Risk Profile | Higher volatility, market risk focused | Illiquidity risk, operational and market risks |

| Key Skills | Rapid decision-making, quantitative analysis, market intuition | Detailed financial modeling, negotiation, operational insight |

| Exit Strategies | Frequent trading, position adjustments | IPO, mergers & acquisitions, buyout exits |

| Compensation | Base salary + performance bonuses linked to fund returns | Base salary + carried interest from successful deals |

Role Overview: Hedge Fund Analyst vs Private Equity Analyst

Hedge Fund Analysts primarily evaluate publicly traded securities and market trends to recommend investment strategies aimed at short- to medium-term gains, leveraging quantitative models and risk assessment tools. Private Equity Analysts focus on in-depth due diligence, financial modeling, and valuation of private companies to support long-term investment decisions and portfolio company management. Both roles require strong analytical skills, but Hedge Fund Analysts emphasize market volatility and liquidity, while Private Equity Analysts prioritize company fundamentals and growth potential.

Key Responsibilities and Daily Tasks

Hedge Fund Analysts focus on analyzing financial markets, identifying investment opportunities, and monitoring portfolio performance to generate high returns in short to medium-term horizons. Private Equity Analysts conduct in-depth company valuations, due diligence, and market research to support long-term investment decisions and deal execution within private companies. Both roles require strong financial modeling skills, but Hedge Fund Analysts emphasize market trends and trading strategies, whereas Private Equity Analysts concentrate on operational improvements and exit strategies.

Required Skills and Educational Background

Hedge Fund Analysts require strong quantitative skills, expertise in financial modeling, and proficiency in market analysis, often backed by degrees in finance, economics, or mathematics. Private Equity Analysts emphasize due diligence, valuation techniques, and strategic assessment with educational backgrounds typically in business administration, accounting, or finance. Both roles demand advanced analytical abilities and familiarity with financial statements, but Private Equity Analysts often need experience in deal structuring and portfolio management.

Investment Strategies and Approaches

Hedge fund analysts typically focus on short-term market opportunities using strategies such as long/short equity, event-driven, and global macro to generate alpha and manage risk dynamically. Private equity analysts concentrate on long-term value creation through detailed due diligence, leveraged buyouts, and operational improvements in portfolio companies. The hedge fund approach emphasizes market timing and liquidity, while private equity centers on strategic growth and exit planning over multiple years.

Compensation and Career Progression

Hedge fund analysts typically earn higher base salaries and bonuses due to the performance-driven nature of hedge funds, with total compensation often exceeding $150,000 annually in early career stages and rising significantly with assets under management growth. Private equity analysts receive competitive compensation packages, including carried interest, which can substantially boost long-term earnings beyond the initial $100,000 to $120,000 base salary range. Career progression for hedge fund analysts often leads to portfolio manager roles or senior analyst positions, while private equity analysts commonly advance to associate and principal roles with increasing responsibility in deal sourcing and management.

Work Environment and Culture

Hedge fund analysts typically work in fast-paced, high-pressure environments where rapid decision-making and market responsiveness are critical, often with a focus on short-term trading strategies and immediate results. Private equity analysts experience a more collaborative and research-intensive culture, emphasizing long-term investment horizons, deal sourcing, and portfolio company management. Both roles demand strong analytical skills, but hedge funds prioritize agility and market timing, while private equity centers on due diligence and strategic value creation.

Recruitment Process and Entry Barriers

The recruitment process for hedge fund analysts typically emphasizes quantitative skills, financial modeling, and previous experience in asset management or investment banking, with a strong preference for candidates who demonstrate sharp analytical abilities and market intuition. Entry barriers for private equity analysts include rigorous screening for deal experience, proficiency in valuation techniques, and often an MBA or relevant internships in LBO modeling, which are critical due to the long-term investment focus and complex deal structures. Both roles demand high academic achievement and competitive internships, but private equity recruitment is more relationship-driven, leveraging networking and direct interview access to senior dealmakers.

Typical Employers and Firms

Hedge Fund Analysts commonly work for hedge funds, asset management firms, and proprietary trading firms, specializing in public market investments and short-term trading strategies. Private Equity Analysts typically find employment at private equity firms, venture capital firms, and investment banks, focusing on long-term investments in private companies and buyouts. Leading employers in hedge funds include Bridgewater Associates, Citadel, and Millennium Management, while prominent private equity firms hiring analysts feature Blackstone, KKR, and Carlyle Group.

Exit Opportunities and Long-Term Prospects

Hedge fund analysts often transition to roles in asset management or portfolio management, leveraging their expertise in market strategies and risk analysis, while private equity analysts typically advance toward leadership positions in corporate development or direct investment roles, emphasizing operational improvements and value creation. Exit opportunities for hedge fund analysts include moving to hedge fund management or proprietary trading, whereas private equity analysts frequently pursue careers in venture capital or senior private equity management. Long-term prospects favor private equity analysts for opportunities in executing strategic business turnarounds and managing large-scale investments, whereas hedge fund analysts benefit from quicker trading cycle experience and diverse market exposure.

Pros and Cons of Each Career Path

Hedge Fund Analysts benefit from dynamic market exposure and high-performance incentives but face intense pressure and job volatility due to rapid trading environments. Private Equity Analysts enjoy deep involvement in company operations and long-term investment strategies, offering stability but requiring longer deal cycles and less liquidity. Both careers demand strong analytical skills, yet Hedge Fund roles emphasize market timing, whereas Private Equity focuses on value creation through strategic management.

Hedge Fund Analyst vs Private Equity Analyst Infographic

jobdiv.com

jobdiv.com