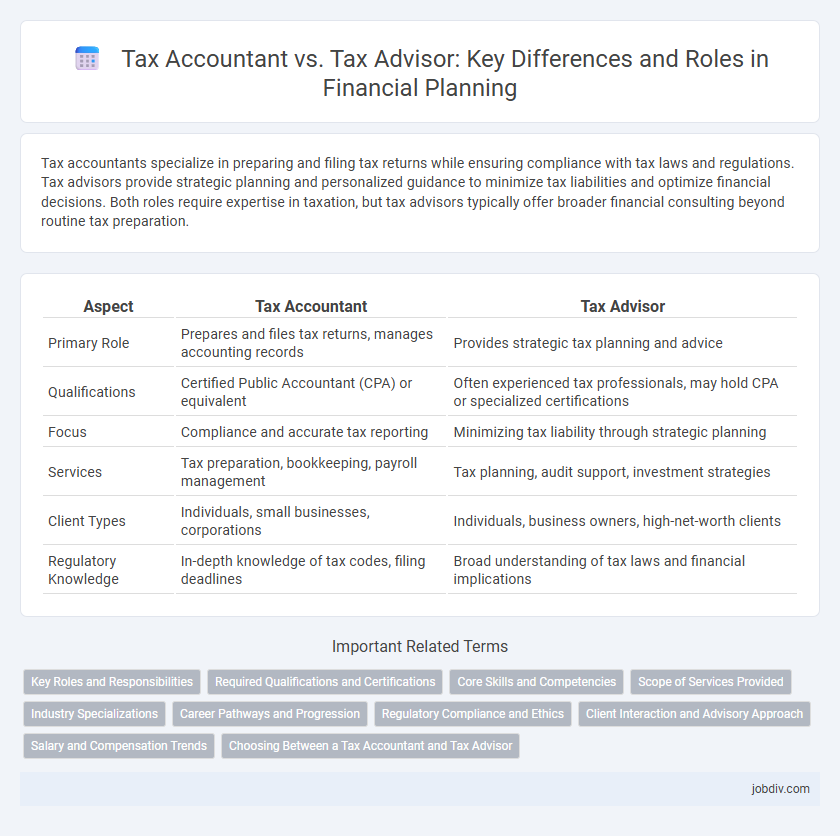

Tax accountants specialize in preparing and filing tax returns while ensuring compliance with tax laws and regulations. Tax advisors provide strategic planning and personalized guidance to minimize tax liabilities and optimize financial decisions. Both roles require expertise in taxation, but tax advisors typically offer broader financial consulting beyond routine tax preparation.

Table of Comparison

| Aspect | Tax Accountant | Tax Advisor |

|---|---|---|

| Primary Role | Prepares and files tax returns, manages accounting records | Provides strategic tax planning and advice |

| Qualifications | Certified Public Accountant (CPA) or equivalent | Often experienced tax professionals, may hold CPA or specialized certifications |

| Focus | Compliance and accurate tax reporting | Minimizing tax liability through strategic planning |

| Services | Tax preparation, bookkeeping, payroll management | Tax planning, audit support, investment strategies |

| Client Types | Individuals, small businesses, corporations | Individuals, business owners, high-net-worth clients |

| Regulatory Knowledge | In-depth knowledge of tax codes, filing deadlines | Broad understanding of tax laws and financial implications |

Key Roles and Responsibilities

Tax accountants specialize in preparing and filing tax returns while ensuring compliance with tax laws and regulations for individuals and businesses. Tax advisors provide strategic tax planning, minimizing tax liabilities through advice on investments, business structures, and transactions. Both professionals aim to optimize tax outcomes but differ in execution, with tax accountants focusing on detailed reporting and tax advisors emphasizing long-term strategy.

Required Qualifications and Certifications

Tax accountants typically require a bachelor's degree in accounting or finance and often must obtain a Certified Public Accountant (CPA) license to demonstrate expertise in tax preparation and compliance. Tax advisors may hold a variety of certifications, including Certified Tax Consultant (CTC) or Enrolled Agent (EA), emphasizing advisory skills and strategic tax planning rather than detailed accounting. Both roles demand in-depth knowledge of tax laws and continuous professional education to remain current with evolving regulations.

Core Skills and Competencies

Tax accountants specialize in preparing and reviewing tax returns, ensuring compliance with tax laws, and maintaining accurate financial records, demonstrating strong analytical skills and attention to detail. Tax advisors provide strategic tax planning, helping clients minimize liabilities and optimize financial decisions through in-depth knowledge of tax regulations and effective communication skills. Both roles require expertise in tax codes, but tax advisors emphasize advisory competencies while tax accountants focus on execution and accuracy.

Scope of Services Provided

Tax accountants specialize in preparing and filing tax returns, ensuring compliance with current tax laws and regulations, and maintaining accurate financial records for audit purposes. Tax advisors offer broader strategic planning services, including tax minimization strategies, estate planning, and advising on complex financial transactions to optimize tax outcomes. The scope of services provided by tax advisors often extends beyond compliance to proactive tax management and financial decision support.

Industry Specializations

Tax accountants typically specialize in compliance-focused roles within industries such as manufacturing, retail, and finance, ensuring accurate tax filings and adherence to regulations. Tax advisors offer strategic tax planning services across sectors like technology, real estate, and healthcare, optimizing tax liabilities and advising on complex transactions. Both professionals require deep knowledge of industry-specific tax codes, but advisors often engage more in proactive risk management and tailored financial strategies.

Career Pathways and Progression

Tax accountants typically follow a structured career pathway beginning with entry-level roles such as junior tax consultant or tax associate, advancing to senior accountant and eventually managerial positions within accounting firms or corporate finance departments. Tax advisors often pursue a broader progression involving specialization in tax planning, compliance, and consultancy, with opportunities to become certified tax professionals, senior advisors, or partners in advisory firms. Both career tracks emphasize continuous education in tax law and regulations, with growth propelled by developing expertise in complex tax strategies and regulatory changes.

Regulatory Compliance and Ethics

Tax accountants specialize in preparing tax returns and ensuring strict adherence to tax laws and regulations, maintaining detailed documentation to support compliance audits. Tax advisors provide strategic guidance on tax planning and regulatory changes, emphasizing ethical decision-making to minimize risks and avoid penalties. Both roles are critical for regulatory compliance, with tax accountants focusing on accurate reporting and tax advisors prioritizing ethical tax strategies aligned with legal standards.

Client Interaction and Advisory Approach

Tax accountants primarily focus on preparing and filing accurate tax returns, ensuring compliance with regulatory requirements through a detailed review of financial documents. Tax advisors emphasize personalized client interaction by offering strategic tax planning tailored to long-term financial goals, often guiding clients through complex tax regulations and investment decisions. The advisory approach of tax advisors involves proactive communication to optimize tax outcomes, while tax accountants concentrate on transactional and compliance accuracy.

Salary and Compensation Trends

Tax accountants typically earn a median salary of $60,000 to $75,000 annually, with variations based on experience and certification such as CPA. Tax advisors often command higher compensation, ranging from $70,000 to over $100,000 per year, reflecting their strategic role in tax planning and compliance. Recent trends show growing demand for tax advisors in corporate sectors, driving salaries upward due to their specialized expertise in minimizing tax liabilities.

Choosing Between a Tax Accountant and Tax Advisor

Choosing between a tax accountant and a tax advisor depends on your specific financial needs; tax accountants specialize in preparing and filing tax returns with accuracy and compliance, while tax advisors offer strategic planning to minimize tax liabilities and maximize savings. For complex tax situations involving investments, business ownership, or estate planning, a tax advisor provides tailored guidance and ongoing support. For straightforward tax filings, a licensed tax accountant ensures proper documentation and adherence to tax laws, making the choice crucial based on the scope of your financial goals.

Tax Accountant vs Tax Advisor Infographic

jobdiv.com

jobdiv.com