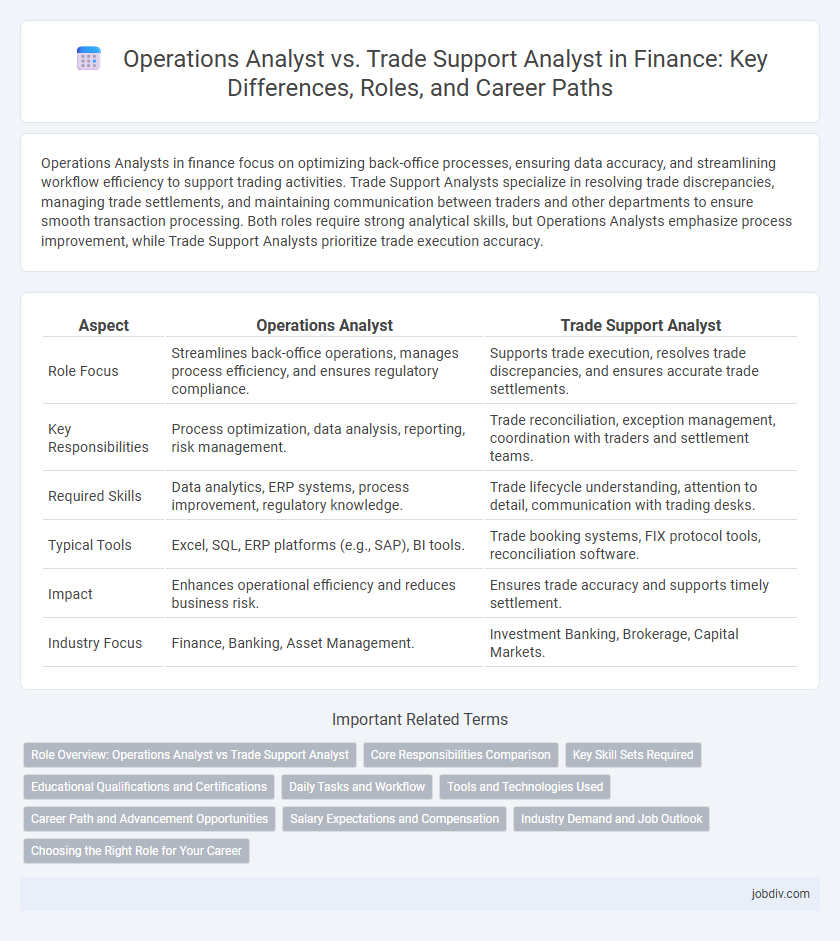

Operations Analysts in finance focus on optimizing back-office processes, ensuring data accuracy, and streamlining workflow efficiency to support trading activities. Trade Support Analysts specialize in resolving trade discrepancies, managing trade settlements, and maintaining communication between traders and other departments to ensure smooth transaction processing. Both roles require strong analytical skills, but Operations Analysts emphasize process improvement, while Trade Support Analysts prioritize trade execution accuracy.

Table of Comparison

| Aspect | Operations Analyst | Trade Support Analyst |

|---|---|---|

| Role Focus | Streamlines back-office operations, manages process efficiency, and ensures regulatory compliance. | Supports trade execution, resolves trade discrepancies, and ensures accurate trade settlements. |

| Key Responsibilities | Process optimization, data analysis, reporting, risk management. | Trade reconciliation, exception management, coordination with traders and settlement teams. |

| Required Skills | Data analytics, ERP systems, process improvement, regulatory knowledge. | Trade lifecycle understanding, attention to detail, communication with trading desks. |

| Typical Tools | Excel, SQL, ERP platforms (e.g., SAP), BI tools. | Trade booking systems, FIX protocol tools, reconciliation software. |

| Impact | Enhances operational efficiency and reduces business risk. | Ensures trade accuracy and supports timely settlement. |

| Industry Focus | Finance, Banking, Asset Management. | Investment Banking, Brokerage, Capital Markets. |

Role Overview: Operations Analyst vs Trade Support Analyst

Operations Analysts in finance focus on optimizing internal processes, analyzing data to improve efficiency, and supporting risk management through workflow automation and performance metrics. Trade Support Analysts specialize in confirming trade agreements, resolving settlement issues, and liaising between front-office traders and back-office operations to ensure accurate transaction processing. Both roles require strong analytical skills and attention to detail but differ in their operational scope and direct interaction with trading activities.

Core Responsibilities Comparison

Operations Analysts primarily manage process improvements, workflow automation, and data analysis to enhance operational efficiency within financial institutions. Trade Support Analysts focus on verifying trade accuracy, resolving trade discrepancies, and ensuring compliance with regulatory requirements in securities transactions. Both roles require strong analytical skills, but Operations Analysts emphasize operational processes, while Trade Support Analysts concentrate on trade lifecycle management.

Key Skill Sets Required

Operations Analysts require strong data analysis, process optimization, and risk management skills to streamline financial workflows and enhance operational efficiency. Trade Support Analysts must possess in-depth knowledge of trade lifecycle management, trade reconciliation, and regulatory compliance, with proficiency in trade capture systems and real-time issue resolution. Both roles demand advanced Excel abilities, attention to detail, and effective communication skills for cross-team collaboration.

Educational Qualifications and Certifications

Operations Analysts typically require a bachelor's degree in finance, economics, or business administration, with certifications like CFA (Chartered Financial Analyst) or PMP (Project Management Professional) enhancing career prospects. Trade Support Analysts often hold degrees in finance, accounting, or mathematics and benefit from certifications such as FRM (Financial Risk Manager) or ACAMS (Certified Anti-Money Laundering Specialist) to deepen expertise in trade settlement and compliance. Both roles value strong analytical skills and domain-specific certifications that align with risk management and operational efficiency in financial markets.

Daily Tasks and Workflow

Operations Analysts oversee transaction processing, data reconciliation, and performance reporting to ensure accuracy and efficiency within financial operations. Trade Support Analysts focus on trade capture, trade confirmation, and resolving trade discrepancies to maintain seamless trade lifecycle management. Both roles require collaboration with front-office teams but differ in specialization, with Operations Analysts emphasizing operational workflows and Trade Support Analysts concentrating on trade execution support.

Tools and Technologies Used

Operations Analysts in finance primarily utilize data analysis tools such as SQL, Excel, and Python to optimize back-office processes and improve operational efficiency. Trade Support Analysts rely heavily on electronic trading platforms, real-time market data systems, and risk management software like Bloomberg Terminal and Calypso to monitor and validate trade transactions. Both roles increasingly adopt automation technologies, including robotic process automation (RPA) and workflow management systems, to streamline tasks and reduce errors.

Career Path and Advancement Opportunities

Operations Analysts typically advance into roles such as Operations Manager or Business Analyst by developing expertise in process optimization and data analytics. Trade Support Analysts often progress toward positions like Trade Support Manager or Risk Analyst by deepening their knowledge of trade lifecycle, regulatory compliance, and market operations. Both career paths offer opportunities for specialization, with Operations Analysts focusing on operational efficiency and Trade Support Analysts emphasizing trade execution and risk management.

Salary Expectations and Compensation

Operations Analysts in finance typically earn a salary range of $60,000 to $90,000 annually, with compensation influenced by firm size and experience level. Trade Support Analysts often command slightly higher salaries, between $70,000 and $100,000, reflecting their critical role in trade lifecycle management and risk mitigation. Bonuses and performance incentives are significant components of total compensation in both roles, with Trade Support Analysts potentially receiving larger variable pay due to direct impact on trading operations.

Industry Demand and Job Outlook

Operations Analysts and Trade Support Analysts are both pivotal in the finance industry, with rising demand driven by increased market complexity and regulatory requirements. Operations Analysts are sought for their expertise in optimizing workflow efficiency and risk management, particularly in asset management and banking sectors, reflecting an expected growth rate of around 8% over the next decade. Trade Support Analysts continue to be in high demand due to their role in transaction reconciliation and trade lifecycle management, especially within investment banks and brokerage firms, with job outlooks projected to grow by approximately 6% annually.

Choosing the Right Role for Your Career

Operations Analysts specialize in streamlining financial processes and improving efficiency within trading operations, making them ideal for individuals interested in data analysis and process optimization. Trade Support Analysts focus on resolving trade discrepancies and ensuring accurate transaction settlements, suited for those who excel in problem-solving and detail-oriented tasks in high-pressure environments. Assess your strengths in analytical skills versus transactional troubleshooting to select the role that aligns best with your career goals in finance.

Operations Analyst vs Trade Support Analyst Infographic

jobdiv.com

jobdiv.com