Mergers & Acquisitions (M&A) serve as a tactical tool within corporate strategy to accelerate growth, diversify assets, and enhance competitive positioning. Corporate strategy provides the overarching framework that guides decision-making, resource allocation, and long-term objectives, aligning M&A activities with broader business goals. The synergy between M&A and corporate strategy drives value creation by ensuring acquisitions complement the company's vision and mitigate integration risks.

Table of Comparison

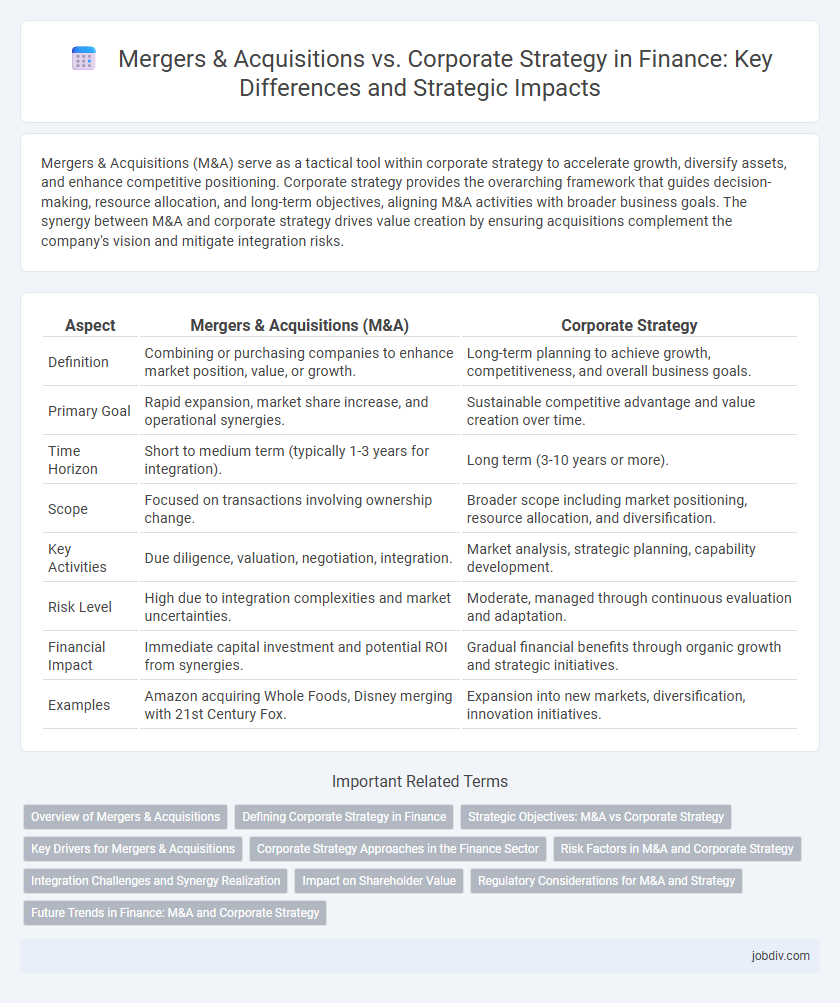

| Aspect | Mergers & Acquisitions (M&A) | Corporate Strategy |

|---|---|---|

| Definition | Combining or purchasing companies to enhance market position, value, or growth. | Long-term planning to achieve growth, competitiveness, and overall business goals. |

| Primary Goal | Rapid expansion, market share increase, and operational synergies. | Sustainable competitive advantage and value creation over time. |

| Time Horizon | Short to medium term (typically 1-3 years for integration). | Long term (3-10 years or more). |

| Scope | Focused on transactions involving ownership change. | Broader scope including market positioning, resource allocation, and diversification. |

| Key Activities | Due diligence, valuation, negotiation, integration. | Market analysis, strategic planning, capability development. |

| Risk Level | High due to integration complexities and market uncertainties. | Moderate, managed through continuous evaluation and adaptation. |

| Financial Impact | Immediate capital investment and potential ROI from synergies. | Gradual financial benefits through organic growth and strategic initiatives. |

| Examples | Amazon acquiring Whole Foods, Disney merging with 21st Century Fox. | Expansion into new markets, diversification, innovation initiatives. |

Overview of Mergers & Acquisitions

Mergers and acquisitions (M&A) involve the consolidation of companies or assets to drive growth, increase market share, or achieve competitive advantage. Key components include due diligence, valuation, negotiation, and integration processes, which are critical for maximizing deal value and minimizing risks. M&A strategies are often aligned with corporate objectives like diversification, vertical integration, or global expansion to enhance long-term shareholder value.

Defining Corporate Strategy in Finance

Corporate strategy in finance focuses on long-term value creation by managing a portfolio of businesses and allocating resources effectively across them. It establishes the overarching goals, scope, and direction of a corporation, incorporating decisions on mergers and acquisitions to optimize growth and competitive advantage. Aligning financial objectives with corporate strategy ensures sustainable profitability and market positioning.

Strategic Objectives: M&A vs Corporate Strategy

Mergers & Acquisitions (M&A) primarily focus on accelerating growth, gaining market share, and acquiring new capabilities rapidly. Corporate strategy emphasizes long-term value creation through organic growth, competitive positioning, and resource allocation aligned with the company's vision. Strategic objectives in M&A center on synergy realization and integration, while corporate strategy targets sustainable competitive advantage and innovation-driven growth.

Key Drivers for Mergers & Acquisitions

Key drivers for mergers and acquisitions include achieving synergies, expanding market share, and acquiring new technologies or capabilities. Financial factors such as cost reduction, revenue enhancement, and improving shareholder value are also critical motivators. Regulatory environment, competitive pressures, and strategic alignment with long-term corporate goals play essential roles in shaping M&A decisions.

Corporate Strategy Approaches in the Finance Sector

Corporate strategy approaches in the finance sector prioritize long-term value creation through diversification, vertical integration, and market penetration to strengthen competitive positioning. Financial institutions employ portfolio management techniques and strategic risk assessment to optimize capital allocation and enhance shareholder returns. These strategies often guide decisions on mergers and acquisitions, fostering sustainable growth while balancing regulatory compliance and market dynamics.

Risk Factors in M&A and Corporate Strategy

Risk factors in Mergers & Acquisitions (M&A) include valuation inaccuracies, cultural mismatches, regulatory hurdles, and integration challenges that can undermine deal success. In corporate strategy, risk factors often stem from market volatility, competitive dynamics, and misalignment between strategic goals and execution capabilities. Effective risk management requires comprehensive due diligence, scenario planning, and continuous monitoring to mitigate financial exposure and operational disruptions.

Integration Challenges and Synergy Realization

Mergers & Acquisitions often present complex integration challenges including cultural clashes, system incompatibilities, and redundant processes that can impede synergy realization. Effective corporate strategy prioritizes detailed integration planning and change management to align operations and maximize value creation. Achieving targeted synergies relies on continuous monitoring and adaptive leadership to address evolving post-merger dynamics.

Impact on Shareholder Value

Mergers & Acquisitions (M&A) directly influence shareholder value by enabling rapid market expansion, cost synergies, and enhanced competitive positioning, which can lead to increased stock prices and dividends. Corporate strategy, however, emphasizes long-term value creation through organic growth, innovation, and risk management, often resulting in more sustainable shareholder returns. The alignment of M&A activities with the overarching corporate strategy is crucial for maximizing shareholder value and minimizing integration risks.

Regulatory Considerations for M&A and Strategy

Regulatory considerations in mergers and acquisitions (M&A) play a critical role in shaping corporate strategy by ensuring compliance with antitrust laws, securities regulations, and industry-specific rules. Effective due diligence on regulatory approvals, such as those from the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC), helps mitigate risks associated with deal delays, fines, or forced divestitures. Integrating regulatory risk assessment into corporate strategy enables companies to align growth initiatives with legal frameworks, protecting shareholder value and fostering sustainable market expansion.

Future Trends in Finance: M&A and Corporate Strategy

Future trends in finance indicate that mergers and acquisitions (M&A) will increasingly align with corporate strategy to drive digital transformation and sustainability goals. Integration of advanced analytics and artificial intelligence enhances deal sourcing and post-merger integration, optimizing value creation. Strategic M&A activities are expected to focus on sector convergence, cross-border expansion, and innovation-driven growth to maintain competitive advantage.

Mergers & Acquisitions vs Corporate Strategy Infographic

jobdiv.com

jobdiv.com