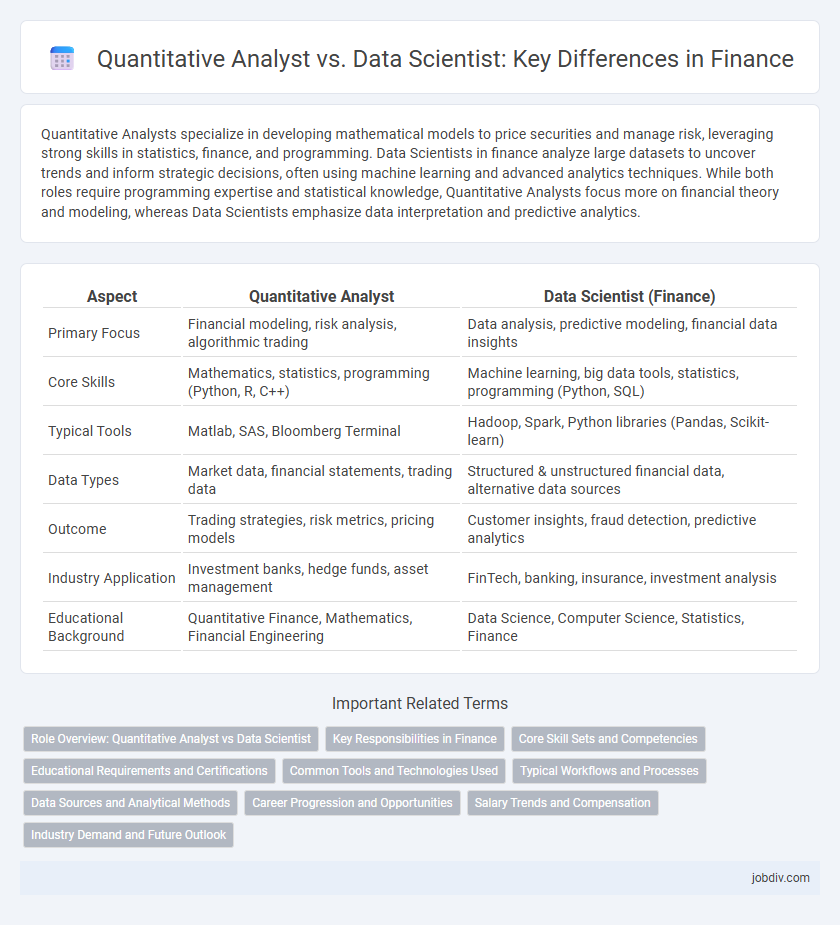

Quantitative Analysts specialize in developing mathematical models to price securities and manage risk, leveraging strong skills in statistics, finance, and programming. Data Scientists in finance analyze large datasets to uncover trends and inform strategic decisions, often using machine learning and advanced analytics techniques. While both roles require programming expertise and statistical knowledge, Quantitative Analysts focus more on financial theory and modeling, whereas Data Scientists emphasize data interpretation and predictive analytics.

Table of Comparison

| Aspect | Quantitative Analyst | Data Scientist (Finance) |

|---|---|---|

| Primary Focus | Financial modeling, risk analysis, algorithmic trading | Data analysis, predictive modeling, financial data insights |

| Core Skills | Mathematics, statistics, programming (Python, R, C++) | Machine learning, big data tools, statistics, programming (Python, SQL) |

| Typical Tools | Matlab, SAS, Bloomberg Terminal | Hadoop, Spark, Python libraries (Pandas, Scikit-learn) |

| Data Types | Market data, financial statements, trading data | Structured & unstructured financial data, alternative data sources |

| Outcome | Trading strategies, risk metrics, pricing models | Customer insights, fraud detection, predictive analytics |

| Industry Application | Investment banks, hedge funds, asset management | FinTech, banking, insurance, investment analysis |

| Educational Background | Quantitative Finance, Mathematics, Financial Engineering | Data Science, Computer Science, Statistics, Finance |

Role Overview: Quantitative Analyst vs Data Scientist

Quantitative Analysts leverage advanced mathematical models and statistical techniques to develop trading strategies, risk assessments, and pricing models essential in finance, often focusing on structured financial data. Data Scientists in finance apply machine learning algorithms and big data analytics to extract insights from diverse, unstructured data sources, enhancing predictive modeling, fraud detection, and customer segmentation. Both roles require strong programming skills in languages like Python and R, but Quantitative Analysts emphasize financial theory and quantitative finance, while Data Scientists prioritize data engineering and exploratory data analysis.

Key Responsibilities in Finance

Quantitative analysts in finance specialize in developing mathematical models to price securities, manage risk, and optimize investment portfolios using statistical techniques and financial theory. Data scientists in finance focus on extracting insights from large-scale financial datasets, employing machine learning algorithms and data mining to inform trading strategies and detect fraud. Both roles require strong programming skills and domain expertise, but quant analysts emphasize model development for pricing and hedging, while data scientists prioritize predictive analytics and data-driven decision-making.

Core Skill Sets and Competencies

Quantitative Analysts in finance excel in mathematical modeling, statistical analysis, and programming languages such as Python, R, and MATLAB to develop pricing models and risk management strategies. Data Scientists focus on big data analytics, machine learning algorithms, and data visualization tools like SQL, Hadoop, and Tableau to extract actionable insights and optimize trading strategies. Both roles require strong analytical skills, but Quantitative Analysts emphasize financial theory and quantitative methods, while Data Scientists prioritize data engineering and predictive analytics.

Educational Requirements and Certifications

Quantitative Analysts typically require advanced degrees in mathematics, statistics, or financial engineering, often complemented by certifications such as CFA or FRM for enhanced industry credibility. Data Scientists in finance usually possess degrees in computer science, data science, or applied mathematics, with certifications like Certified Data Scientist (CDS) or specific machine learning credentials boosting their practical expertise. Both roles emphasize strong quantitative skills, but Quantitative Analysts focus more on financial theories and instruments while Data Scientists emphasize data modeling and algorithm development.

Common Tools and Technologies Used

Quantitative Analysts in finance primarily utilize programming languages such as Python, R, and MATLAB alongside statistical software like SAS for building mathematical models and conducting risk assessments. Data Scientists in finance rely heavily on big data platforms like Hadoop and Spark, combined with machine learning frameworks including TensorFlow and Scikit-learn, to extract insights from large datasets and optimize trading strategies. Both roles commonly use SQL for database management and visualization tools like Tableau or Power BI to present financial data effectively.

Typical Workflows and Processes

Quantitative analysts in finance develop and implement mathematical models to price securities, assess risk, and optimize portfolios using statistical techniques and financial theory. Data scientists focus on extracting insights from large datasets, employing machine learning algorithms and data preprocessing workflows to detect patterns, forecast trends, and support decision-making. Both roles rely on programming languages such as Python and R, but quantitative analysts emphasize stochastic calculus and time-series analysis, whereas data scientists leverage big data platforms and advanced visualization tools.

Data Sources and Analytical Methods

Quantitative Analysts in finance primarily utilize structured data such as historical price series, financial statements, and transaction records, applying statistical models and stochastic calculus to develop trading algorithms and risk assessments. Data Scientists in finance handle diverse data sources including unstructured data from news feeds, social media sentiment, and alternative datasets, leveraging machine learning techniques and big data analytics to uncover market trends and predictive insights. Both roles rely on advanced programming and statistical tools but differ in their focus on traditional financial data modeling versus expansive data integration and exploratory analysis.

Career Progression and Opportunities

Quantitative Analysts in finance typically advance by deepening expertise in mathematical modeling, risk management, and algorithmic trading, often progressing to roles such as Quantitative Researcher or Chief Risk Officer. Data Scientists in finance leverage machine learning, big data analytics, and predictive modeling to drive data-driven decision-making, frequently moving into positions like Lead Data Scientist or Head of Data Analytics. Both career paths offer lucrative opportunities, but Quantitative Analysts often emphasize quantitative finance skills, while Data Scientists focus on broader data ecosystems and technological innovation.

Salary Trends and Compensation

Quantitative analysts in finance typically command higher median salaries, averaging around $120,000 annually, due to specialized expertise in mathematical modeling and risk management. Data scientists in finance earn competitive compensation, generally between $100,000 and $130,000, driven by demand for advanced analytics and machine learning skills applied to large financial datasets. Salary trends indicate strong growth potential for both roles, with compensation influenced by experience, education, and the complexity of financial instruments handled.

Industry Demand and Future Outlook

Quantitative analysts in finance primarily focus on developing mathematical models to price securities and manage risk, with strong demand driven by hedge funds and investment banks seeking advanced quantitative strategies. Data scientists in finance leverage big data, machine learning, and artificial intelligence to extract insights from large financial datasets, with growing demand in fintech, retail banking, and regulatory compliance. Future outlook for both roles is robust, but data scientists are increasingly favored for their ability to integrate diverse data sources and automate decision-making processes amid the rise of AI in financial services.

Quantitative Analyst vs Data Scientist (Finance) Infographic

jobdiv.com

jobdiv.com