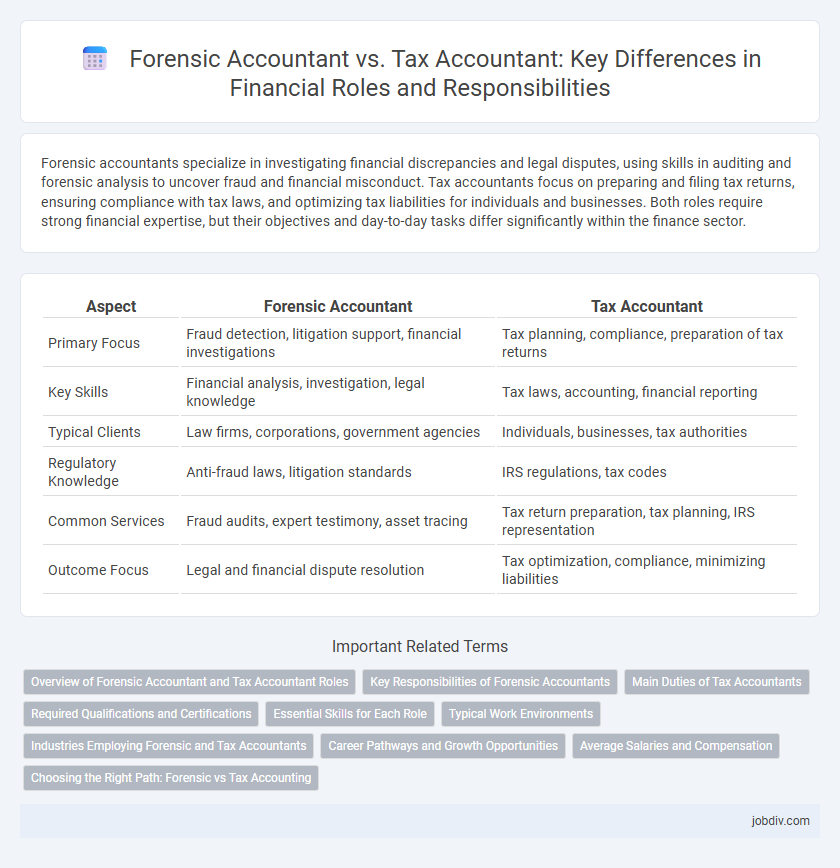

Forensic accountants specialize in investigating financial discrepancies and legal disputes, using skills in auditing and forensic analysis to uncover fraud and financial misconduct. Tax accountants focus on preparing and filing tax returns, ensuring compliance with tax laws, and optimizing tax liabilities for individuals and businesses. Both roles require strong financial expertise, but their objectives and day-to-day tasks differ significantly within the finance sector.

Table of Comparison

| Aspect | Forensic Accountant | Tax Accountant |

|---|---|---|

| Primary Focus | Fraud detection, litigation support, financial investigations | Tax planning, compliance, preparation of tax returns |

| Key Skills | Financial analysis, investigation, legal knowledge | Tax laws, accounting, financial reporting |

| Typical Clients | Law firms, corporations, government agencies | Individuals, businesses, tax authorities |

| Regulatory Knowledge | Anti-fraud laws, litigation standards | IRS regulations, tax codes |

| Common Services | Fraud audits, expert testimony, asset tracing | Tax return preparation, tax planning, IRS representation |

| Outcome Focus | Legal and financial dispute resolution | Tax optimization, compliance, minimizing liabilities |

Overview of Forensic Accountant and Tax Accountant Roles

Forensic accountants specialize in examining financial records to detect fraud, embezzlement, and other financial crimes, often collaborating with law enforcement during legal investigations. Tax accountants focus on preparing tax returns, ensuring compliance with tax laws, and optimizing tax liabilities for individuals or businesses. Both roles require strong analytical skills, but forensic accountants emphasize investigative techniques while tax accountants prioritize tax regulations and planning.

Key Responsibilities of Forensic Accountants

Forensic accountants specialize in investigating financial fraud, analyzing complex transactions, and preparing detailed reports for legal proceedings. They utilize forensic accounting techniques to detect embezzlement, money laundering, and other financial crimes, often collaborating with law enforcement and attorneys. Their key responsibilities also include reconstructing financial data to support litigation and dispute resolution.

Main Duties of Tax Accountants

Tax accountants specialize in preparing tax returns, ensuring compliance with tax laws, and advising clients on tax strategies to minimize liabilities. They analyze financial records to identify eligible deductions and credits while keeping up-to-date with changes in tax codes and regulations. Their main duties also include auditing tax documents and helping clients plan for future tax obligations efficiently.

Required Qualifications and Certifications

Forensic accountants require specialized certifications such as Certified Fraud Examiner (CFE) or Certified Forensic Accountant (Cr.FA) alongside a CPA license to investigate financial discrepancies and fraud. Tax accountants primarily need a Certified Public Accountant (CPA) designation with expertise in tax laws, regulations, and IRS compliance. Both roles demand strong analytical skills and relevant experience, but forensic accounting specializes in legal investigations while tax accounting focuses on tax preparation and planning.

Essential Skills for Each Role

Forensic accountants require strong analytical skills, expertise in fraud detection, and proficiency in legal procedures to investigate financial discrepancies and support litigation. Tax accountants must possess deep knowledge of tax laws, excellent numerical accuracy, and the ability to prepare and file tax returns efficiently for individuals and businesses. Both roles demand attention to detail and advanced accounting software proficiency, but forensic accountants emphasize investigative techniques, while tax accountants focus on regulatory compliance.

Typical Work Environments

Forensic accountants commonly work in law firms, government agencies, and accounting firms specializing in fraud detection and legal disputes, often collaborating with legal teams and law enforcement. Tax accountants typically operate within corporate finance departments, accounting firms, or tax consultancy agencies, focusing on tax preparation, compliance, and planning for individuals or businesses. Both professions may also serve clients independently, but forensic accountants engage more frequently in investigative and litigation settings, whereas tax accountants concentrate on regulatory adherence and tax strategy development.

Industries Employing Forensic and Tax Accountants

Forensic accountants are predominantly employed in legal firms, insurance companies, government agencies, and financial institutions where fraud detection and litigation support are critical. Tax accountants find extensive opportunities in public accounting firms, corporate finance departments, and government tax authorities, specializing in compliance and tax planning. Both roles are essential in sectors such as banking, healthcare, and manufacturing, where financial accuracy and regulatory adherence are paramount.

Career Pathways and Growth Opportunities

Forensic accountants specialize in investigating financial fraud, analyzing complex transactions, and collaborating with legal teams, offering career growth in law enforcement agencies, consulting firms, and litigation support. Tax accountants focus on tax preparation, compliance, and planning for individuals and businesses, with advancement opportunities in public accounting firms, corporate tax departments, and advisory roles. Both fields require strong analytical skills, but forensic accounting offers diverse pathways into criminology and legal consulting, while tax accounting provides steady growth through certifications like CPA and specialization in tax law.

Average Salaries and Compensation

Forensic accountants typically earn an average salary ranging from $70,000 to $100,000 annually, driven by their expertise in fraud detection and legal investigations. Tax accountants have a median salary around $60,000 to $85,000, influenced by their role in tax preparation and compliance. Compensation for forensic accountants often includes bonuses linked to case outcomes, while tax accountants may receive performance-based incentives during tax seasons.

Choosing the Right Path: Forensic vs Tax Accounting

Forensic accountants specialize in investigating financial fraud, analyzing complex data, and providing expert testimony in legal cases, making them ideal for careers in litigation support or fraud detection. Tax accountants focus on tax planning, compliance, and preparation for individuals and businesses to optimize tax liabilities and ensure adherence to tax regulations. Choosing between forensic and tax accounting depends on your interest in investigative work versus tax code expertise and the type of clients or industries you prefer to serve.

Forensic Accountant vs Tax Accountant Infographic

jobdiv.com

jobdiv.com