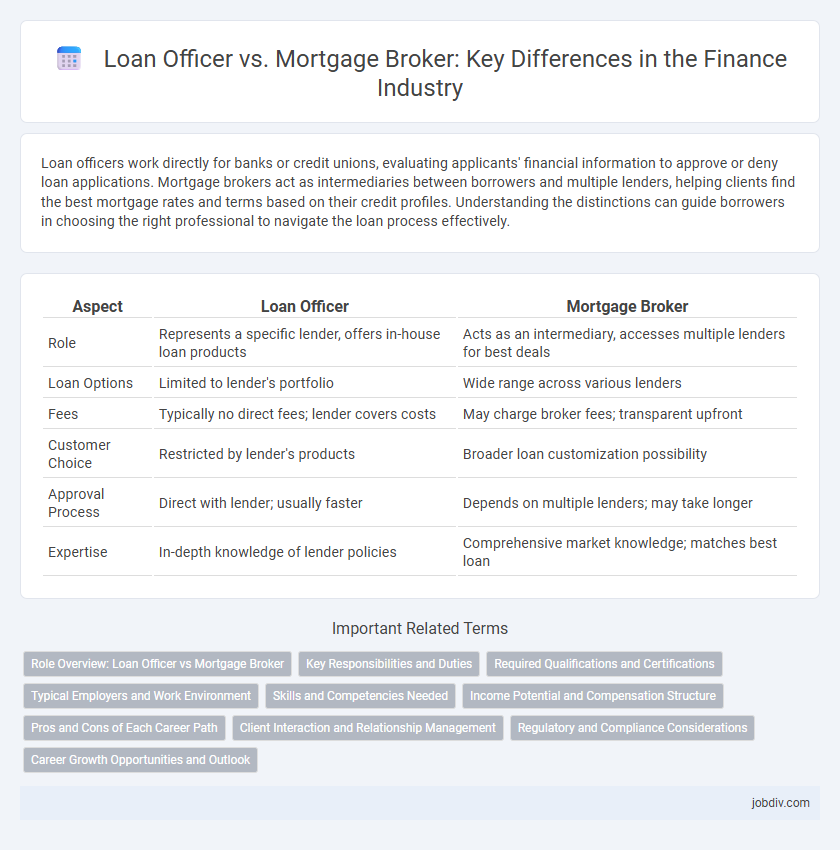

Loan officers work directly for banks or credit unions, evaluating applicants' financial information to approve or deny loan applications. Mortgage brokers act as intermediaries between borrowers and multiple lenders, helping clients find the best mortgage rates and terms based on their credit profiles. Understanding the distinctions can guide borrowers in choosing the right professional to navigate the loan process effectively.

Table of Comparison

| Aspect | Loan Officer | Mortgage Broker |

|---|---|---|

| Role | Represents a specific lender, offers in-house loan products | Acts as an intermediary, accesses multiple lenders for best deals |

| Loan Options | Limited to lender's portfolio | Wide range across various lenders |

| Fees | Typically no direct fees; lender covers costs | May charge broker fees; transparent upfront |

| Customer Choice | Restricted by lender's products | Broader loan customization possibility |

| Approval Process | Direct with lender; usually faster | Depends on multiple lenders; may take longer |

| Expertise | In-depth knowledge of lender policies | Comprehensive market knowledge; matches best loan |

Role Overview: Loan Officer vs Mortgage Broker

Loan officers originate and process loan applications while working directly for banks or credit unions, ensuring compliance with lending regulations and evaluating borrower creditworthiness. Mortgage brokers act as intermediaries between borrowers and multiple lenders, offering a wider range of loan options by sourcing competitive mortgage products from various financial institutions. Both roles require strong knowledge of financial products, client assessment, and adherence to federal and state lending laws.

Key Responsibilities and Duties

A Loan Officer evaluates loan applications, verifies financial information, and determines creditworthiness to approve or deny loans. A Mortgage Broker acts as an intermediary between borrowers and multiple lenders, securing the best loan terms tailored to clients' needs. Both roles require deep knowledge of financial products, regulatory compliance, and direct client interaction to facilitate smooth loan processing.

Required Qualifications and Certifications

Loan officers typically require a high school diploma, though many hold a bachelor's degree in finance, business, or economics, and must obtain a Nationwide Multistate Licensing System (NMLS) certification to originate loans legally. Mortgage brokers also need an NMLS license and often pursue additional certifications like the Certified Mortgage Consultant (CMC) designation to demonstrate expertise in mortgage products and regulatory compliance. Both roles require a strong understanding of lending laws, credit analysis, and financial documentation to effectively serve borrowers and lenders.

Typical Employers and Work Environment

Loan officers typically find employment with banks, credit unions, and mortgage companies, working in office settings that emphasize client interaction and financial analysis. Mortgage brokers operate independently or within brokerage firms, often managing multiple lender relationships and working in both office environments and remotely. Both roles require strong communication skills and a focus on regulatory compliance within fast-paced financial sectors.

Skills and Competencies Needed

Loan officers require strong analytical skills, in-depth knowledge of credit analysis, and proficiency in regulatory compliance to evaluate loan applications accurately. Mortgage brokers demand exceptional negotiation abilities, deep market insights, and extensive networking skills to secure favorable mortgage terms from multiple lending sources. Both roles benefit from excellent communication skills and customer service expertise to guide clients through complex financial processes effectively.

Income Potential and Compensation Structure

Loan officers typically earn a base salary combined with commissions, resulting in a more stable income but with capped bonuses tied to loan volume. Mortgage brokers operate on commission-only compensation, earning a percentage of the loan amount, which can lead to higher income potential driven by market demand and client acquisitions. Understanding the compensation structures is crucial for professionals assessing long-term earning prospects in loan origination roles.

Pros and Cons of Each Career Path

Loan officers offer direct access to lending institutions and typically enjoy stable salaries with benefits, but they may face rigid sales targets and limited product variety. Mortgage brokers provide a broader range of loan options from multiple lenders, enhancing client choice and potential earnings through commissions, although they often encounter income instability and must manage compliance across various institutions. Both career paths require strong interpersonal skills and financial knowledge, with mortgage brokers needing greater independence and regulatory agility compared to the more structured environment of loan officers.

Client Interaction and Relationship Management

Loan officers typically work directly for banks or credit unions, providing clients with personalized guidance through the loan approval process and maintaining ongoing relationships to support future financing needs. Mortgage brokers act as intermediaries between clients and multiple lenders, offering a broader range of loan options while managing communication and negotiations on behalf of the client. Effective client interaction and relationship management in both roles drive trust, repeat business, and tailored financial solutions.

Regulatory and Compliance Considerations

Loan officers are typically employed by banks or financial institutions and must adhere to specific institutional guidelines and federal regulations such as the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). Mortgage brokers, acting as intermediaries between borrowers and multiple lenders, are subject to both state licensing requirements and regulatory oversight by entities like the Nationwide Multistate Licensing System (NMLS). Both roles require strict compliance with anti-discrimination laws under the Equal Credit Opportunity Act (ECOA) to ensure fair lending practices.

Career Growth Opportunities and Outlook

Loan officers typically advance within banks or lending institutions, gaining expertise in credit analysis and underwriting to qualify for senior roles, whereas mortgage brokers expand their client networks and collaborate with multiple lenders, enhancing their market reach and potential earnings. The career growth outlook for loan officers is steady, driven by consistent demand for consumer and commercial loans, while mortgage brokers experience fluctuating opportunities tied to real estate market cycles and interest rate trends. Both roles require strong sales skills and regulatory knowledge, but mortgage brokers often have greater independence and the potential for higher commissions during housing booms.

Loan Officer vs Mortgage Broker Infographic

jobdiv.com

jobdiv.com