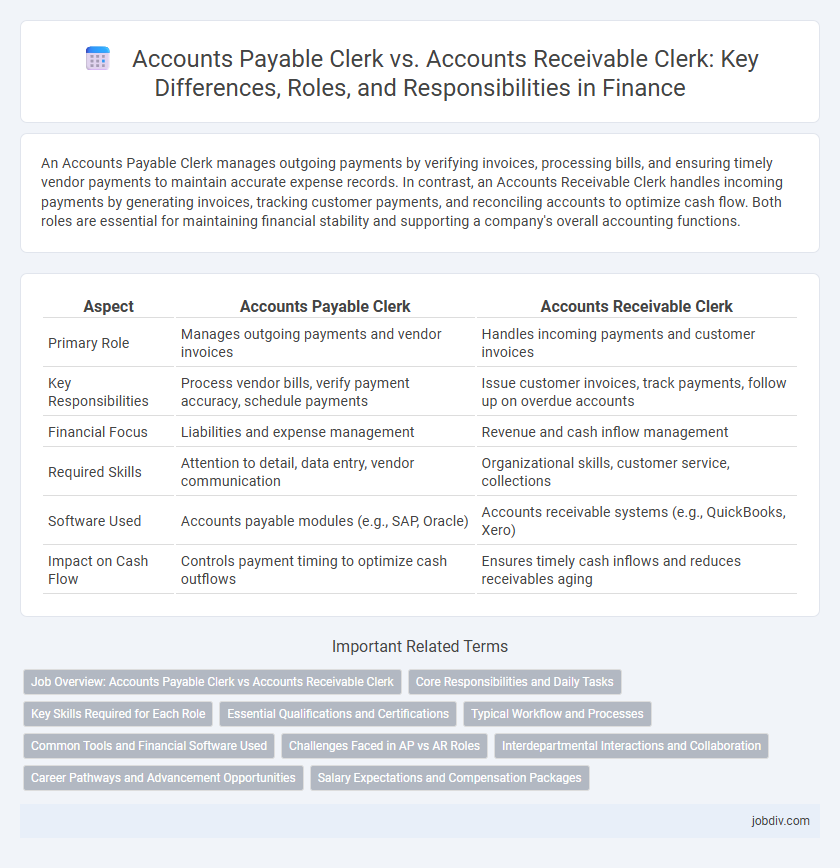

An Accounts Payable Clerk manages outgoing payments by verifying invoices, processing bills, and ensuring timely vendor payments to maintain accurate expense records. In contrast, an Accounts Receivable Clerk handles incoming payments by generating invoices, tracking customer payments, and reconciling accounts to optimize cash flow. Both roles are essential for maintaining financial stability and supporting a company's overall accounting functions.

Table of Comparison

| Aspect | Accounts Payable Clerk | Accounts Receivable Clerk |

|---|---|---|

| Primary Role | Manages outgoing payments and vendor invoices | Handles incoming payments and customer invoices |

| Key Responsibilities | Process vendor bills, verify payment accuracy, schedule payments | Issue customer invoices, track payments, follow up on overdue accounts |

| Financial Focus | Liabilities and expense management | Revenue and cash inflow management |

| Required Skills | Attention to detail, data entry, vendor communication | Organizational skills, customer service, collections |

| Software Used | Accounts payable modules (e.g., SAP, Oracle) | Accounts receivable systems (e.g., QuickBooks, Xero) |

| Impact on Cash Flow | Controls payment timing to optimize cash outflows | Ensures timely cash inflows and reduces receivables aging |

Job Overview: Accounts Payable Clerk vs Accounts Receivable Clerk

Accounts Payable Clerks specialize in managing a company's outgoing payments, verifying invoices, and ensuring timely disbursement to vendors to maintain positive supplier relationships. Accounts Receivable Clerks focus on tracking incoming payments, invoicing customers, and reconciling accounts to optimize cash flow and reduce overdue balances. Both roles require strong attention to detail and proficiency in accounting software, but they differ in managing payables versus receivables within the finance department.

Core Responsibilities and Daily Tasks

An Accounts Payable Clerk manages outgoing payments, processes invoices, and ensures timely vendor payments to maintain accurate financial records and avoid overdue liabilities. An Accounts Receivable Clerk handles incoming payments, generates invoices, monitors customer accounts, and follows up on outstanding balances to optimize cash flow. Both roles require meticulous attention to detail, proficiency in accounting software, and collaboration with finance teams to ensure transactional accuracy and financial reporting compliance.

Key Skills Required for Each Role

Accounts Payable Clerks require strong attention to detail, proficiency in invoice processing, and expertise in financial software such as SAP or QuickBooks to manage vendor payments accurately. Accounts Receivable Clerks need excellent communication skills, knowledge of billing procedures, and the ability to reconcile payments and maintain accurate customer account records. Both roles demand organizational skills and a solid understanding of accounting principles to ensure seamless transaction processing and financial record accuracy.

Essential Qualifications and Certifications

Accounts Payable Clerks typically require strong organizational skills and proficiency in accounting software such as QuickBooks or SAP, with essential certifications including the Certified Accounts Payable Professional (CAPP) credential. Accounts Receivable Clerks must demonstrate expertise in collections management and customer account reconciliation, often supported by certifications like the Certified Credit and Collection Professional (CCCP). Both roles benefit from a solid understanding of Generally Accepted Accounting Principles (GAAP) and experience with financial reporting tools.

Typical Workflow and Processes

An Accounts Payable Clerk manages the workflow of processing vendor invoices, verifying purchase orders, and scheduling timely payments to maintain positive supplier relationships and accurate financial records. In contrast, an Accounts Receivable Clerk oversees the invoicing process, monitors incoming payments, and reconciles customer accounts to ensure consistent cash flow and reduce outstanding receivables. Both roles require meticulous data entry, the use of accounting software like QuickBooks or SAP, and collaboration with finance teams to uphold organizational financial health.

Common Tools and Financial Software Used

Accounts Payable Clerks commonly use financial software such as SAP, Oracle Financials, and QuickBooks to manage vendor invoices, payment processing, and expense tracking. Accounts Receivable Clerks typically utilize tools like Microsoft Dynamics 365, FreshBooks, and NetSuite to handle invoicing, customer payments, and collections management. Both roles often rely on Excel for data analysis and reporting, enhancing workflow efficiency and accuracy in transaction records.

Challenges Faced in AP vs AR Roles

Accounts Payable Clerks face challenges such as managing invoice discrepancies, ensuring timely vendor payments, and maintaining accurate records to prevent duplicate payments or fraud. Accounts Receivable Clerks often struggle with tracking outstanding customer balances, resolving payment disputes, and accelerating cash flow to optimize liquidity. Both roles require meticulous attention to detail and effective communication skills to handle financial discrepancies and maintain strong stakeholder relationships.

Interdepartmental Interactions and Collaboration

Accounts Payable Clerks coordinate closely with procurement and finance departments to ensure timely vendor payments and accurate invoice processing, fostering seamless cash flow management. Accounts Receivable Clerks collaborate extensively with sales and customer service teams to track incoming payments, resolve billing disputes, and maintain accurate customer account records. Both roles require consistent communication and data sharing to reconcile financial records and support the organization's overall financial health.

Career Pathways and Advancement Opportunities

Accounts Payable Clerks typically advance into roles such as Accounting Technicians, Finance Analysts, or Accounts Payable Supervisors by gaining expertise in invoice processing and vendor relationship management. Accounts Receivable Clerks often progress to positions like Credit Analysts, Accounts Receivable Managers, or Billing Coordinators by developing skills in cash flow analysis and customer account reconciliation. Both career pathways offer opportunities for upward mobility into broader finance and accounting roles, including Financial Controller or Accounting Manager positions with experience and professional certification.

Salary Expectations and Compensation Packages

Accounts Payable Clerks typically earn an average salary ranging from $40,000 to $55,000 annually, with compensation packages often including health benefits, retirement plans, and performance bonuses. Accounts Receivable Clerks generally have a salary range of $38,000 to $53,000 per year, with compensation packages similarly incorporating health insurance, paid time off, and sometimes commission-based incentives. Salary variations depend on factors such as industry, company size, location, and level of experience within finance roles.

Accounts Payable Clerk vs Accounts Receivable Clerk Infographic

jobdiv.com

jobdiv.com