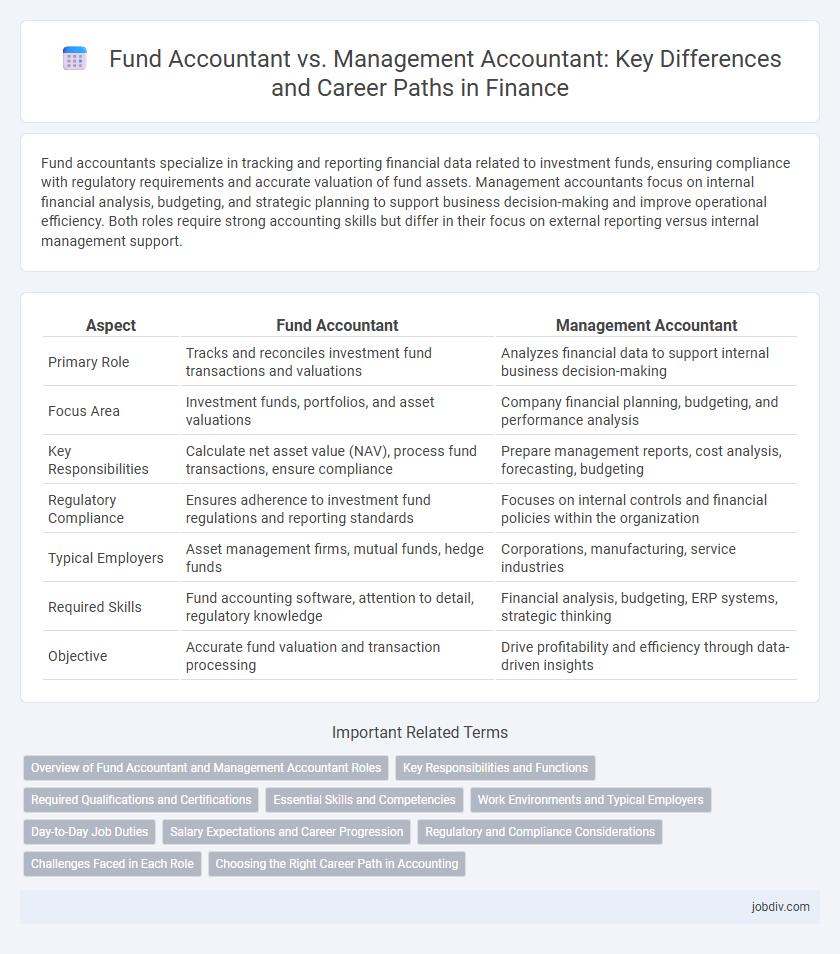

Fund accountants specialize in tracking and reporting financial data related to investment funds, ensuring compliance with regulatory requirements and accurate valuation of fund assets. Management accountants focus on internal financial analysis, budgeting, and strategic planning to support business decision-making and improve operational efficiency. Both roles require strong accounting skills but differ in their focus on external reporting versus internal management support.

Table of Comparison

| Aspect | Fund Accountant | Management Accountant |

|---|---|---|

| Primary Role | Tracks and reconciles investment fund transactions and valuations | Analyzes financial data to support internal business decision-making |

| Focus Area | Investment funds, portfolios, and asset valuations | Company financial planning, budgeting, and performance analysis |

| Key Responsibilities | Calculate net asset value (NAV), process fund transactions, ensure compliance | Prepare management reports, cost analysis, forecasting, budgeting |

| Regulatory Compliance | Ensures adherence to investment fund regulations and reporting standards | Focuses on internal controls and financial policies within the organization |

| Typical Employers | Asset management firms, mutual funds, hedge funds | Corporations, manufacturing, service industries |

| Required Skills | Fund accounting software, attention to detail, regulatory knowledge | Financial analysis, budgeting, ERP systems, strategic thinking |

| Objective | Accurate fund valuation and transaction processing | Drive profitability and efficiency through data-driven insights |

Overview of Fund Accountant and Management Accountant Roles

Fund accountants specialize in managing financial records and ensuring compliance for investment funds, focusing primarily on asset valuation, NAV calculation, and investor reporting. Management accountants support internal business operations by analyzing financial data, budgeting, forecasting, and providing insights to aid strategic decision-making within organizations. Both roles require strong accounting expertise but differ in scope, with fund accountants concentrating on external reporting and regulatory adherence, while management accountants emphasize internal financial management.

Key Responsibilities and Functions

Fund accountants specialize in maintaining accurate records of investment portfolios, calculating net asset value (NAV), and ensuring compliance with financial regulations specific to funds. Management accountants focus on internal financial analysis, budgeting, cost control, and performance evaluation to support strategic business decisions. Both roles require expertise in financial reporting, but fund accountants emphasize investor-related accounting, while management accountants drive organizational financial planning.

Required Qualifications and Certifications

Fund accountants typically require a bachelor's degree in finance, accounting, or economics, complemented by certifications such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) to ensure expertise in investment fund management and regulatory compliance. Management accountants often hold a bachelor's degree in accounting or business administration and pursue certifications like the Certified Management Accountant (CMA) to demonstrate proficiency in budgeting, cost analysis, and strategic financial planning. Both roles demand strong analytical skills and knowledge of financial reporting standards, but fund accountants emphasize investment-focused qualifications while management accountants prioritize internal financial control credentials.

Essential Skills and Competencies

Fund Accountants require strong expertise in financial reporting, portfolio valuation, and reconciliation to ensure accurate fund performance tracking. Management Accountants excel in budgeting, cost analysis, and strategic financial planning to support business decision-making and operational efficiency. Both roles demand proficiency in accounting software, attention to detail, and compliance with regulatory standards, but Fund Accountants prioritize investment-specific knowledge while Management Accountants emphasize managerial and operational insights.

Work Environments and Typical Employers

Fund accountants primarily operate within investment firms, mutual funds, hedge funds, and banks, handling daily financial reporting and reconciliation specific to investment portfolios. Management accountants typically work in a broader range of industries, including manufacturing, retail, and corporate sectors, focusing on budgeting, performance evaluation, and strategic financial planning. The work environment for fund accountants is highly regulated and deadline-driven, whereas management accountants often engage in cross-departmental collaboration to support internal decision-making.

Day-to-Day Job Duties

Fund accountants primarily handle the daily valuation of investment portfolios, manage capital transactions, and prepare financial statements to ensure compliance with regulatory standards. Management accountants focus on budgeting, cost analysis, and financial planning to support strategic decision-making within an organization. Both roles require strong analytical skills but differ in their emphasis on external reporting versus internal financial management.

Salary Expectations and Career Progression

Fund accountants typically earn higher salaries, ranging from $60,000 to $90,000 annually, due to their specialization in investment funds and regulatory compliance. Management accountants have salary expectations between $55,000 and $85,000, with career progression often leading to roles such as financial controller or CFO. Fund accountants may advance into roles in fund administration or portfolio management, while management accountants generally progress toward strategic financial planning and corporate decision-making positions.

Regulatory and Compliance Considerations

Fund accountants ensure compliance with stringent regulatory frameworks such as the Investment Company Act of 1940 and SEC reporting requirements, focusing on accurate valuation and financial reporting for investment funds. Management accountants concentrate on internal controls, budget adherence, and compliance with corporate governance standards like Sarbanes-Oxley (SOX) to support strategic decision-making within the organization. Both roles require expertise in financial regulations, but fund accountants emphasize external regulatory filings, while management accountants prioritize internal compliance and risk management.

Challenges Faced in Each Role

Fund accountants face challenges in maintaining precise and timely reconciliation of complex investment portfolios while ensuring compliance with regulatory frameworks and reporting standards like GAAP or IFRS. Management accountants grapple with accurately forecasting budgets, analyzing variances, and providing actionable insights to support strategic decision-making amidst volatile market conditions and fluctuating operational costs. Both roles require advanced proficiency in accounting software and strong analytical skills to navigate evolving financial regulations and stakeholder demands.

Choosing the Right Career Path in Accounting

Fund accountants specialize in managing and reporting on investment portfolios, ensuring accuracy in fund valuations, compliance with regulatory standards, and detailed financial disclosures for investors. Management accountants focus on internal financial analysis, budgeting, and strategic planning to support business decisions and improve organizational efficiency. Choosing the right career path depends on your interest in investment-focused accounting versus broader financial management and decision support within a company.

Fund Accountant vs Management Accountant Infographic

jobdiv.com

jobdiv.com